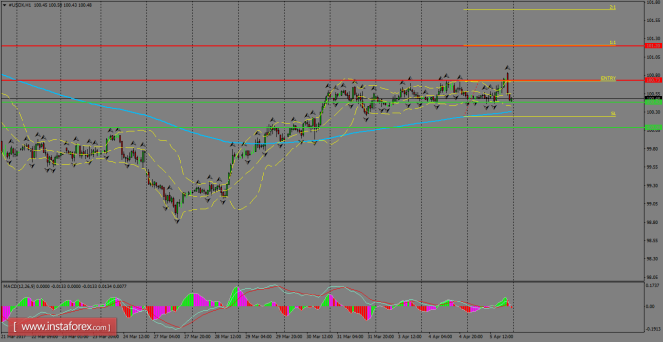

Daily analysis of USDX for April 06, 2017

The index quickly erased Wednesday’s gains after FOMC minutes and

now it’s being supported by the 100.43 zone. However, the overall

picture remains bullish and if the US Dollar index succeeds to break

above 100.73, then it can test the 101.20 hurdle. By the other hand,

if USDX does a consolidation below the 200 SMA at H1 chart, then the

next target would be the 100.00 handle.

H1 chart’s resistance

levels: 100.73 / 101.20

H1 chart’s support levels:

100.43 / 100.08

Trading recommendations for today:

Based on the H1 chart, place

buy (long)

orders only if the USD Index

breaks with

a bullish

candlestick;

the resistance

level is at

100.73,

take profit is at

101.20

and stop loss is at 100.24.

The material has been provided by InstaForex Company – www.instaforex.com