Daily Market Report – USD/CHF Upside Paused October 31, 2017

USD/CHF Still In the Buyer’s Territory

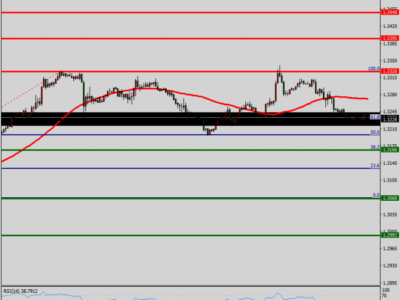

The currency pair has increased sharply in the previous week and has reached fresh new highs. The minor drop is somehow understandable after the impressive rally. Price dropped significantly in the yesterday’s trading session, but now is trading in the green again. We’ll see what will really happen in the upcoming period because is trading above some important support levels (resistance turned into support).

The retreat could be only temporary and the rate could resume the upside movement in the upcoming period. Price dropped in the yesterday’s session as the USDX plunged after the last week’s impressive rally. USDX is trading right above the 94.55 static and is pressuring a minor dynamic support level, technically it should climb much higher in the upcoming period.

The rate increased again and tries to recover after the yesterday’s drop, technically it should climb much higher as long as is trading above the 0.9955 level and above the 250% Fibonacci line (ascending dotted line). Could also retest the median line (ml) of the minor ascending pitchfork before will try to increase towards the 1.0036 previous high. The next major upside target will be at the 1.0091 level.

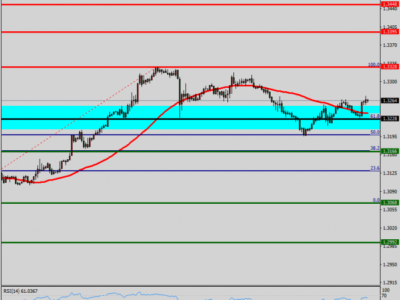

USD/CAD Further Increase Expected

The USD/CAD increased and looks determined to resume the upside movement in the upcoming period after the failure to retest the upper median line of the blue ascending pitchfork. Price can consolidate the latest gains on the short term because it could try to recapture more directional energy before will climb towards the major upside target from the upper median line (UML) of the major red descending pitchfork.

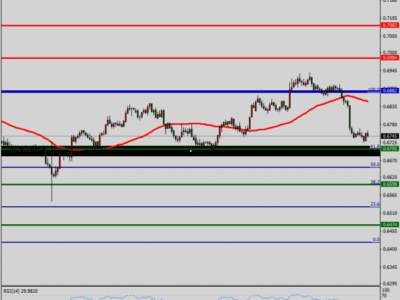

NZD/USD Could The Price Resume The Massive Drop?

The currency pair dropped today and erased the yesterday’s minor gains. Price failed to reach and retest the 0.6885 former static support (support turned into resistance) and now approaches the 0.6817 previous low. A false breakout above the WL2 will force the rate to drop much below the 100% Fibonacci level.

By Olimpiu Tuns – Market Analyst