GBPUSD Daily Technical Outlook and Review 25th June

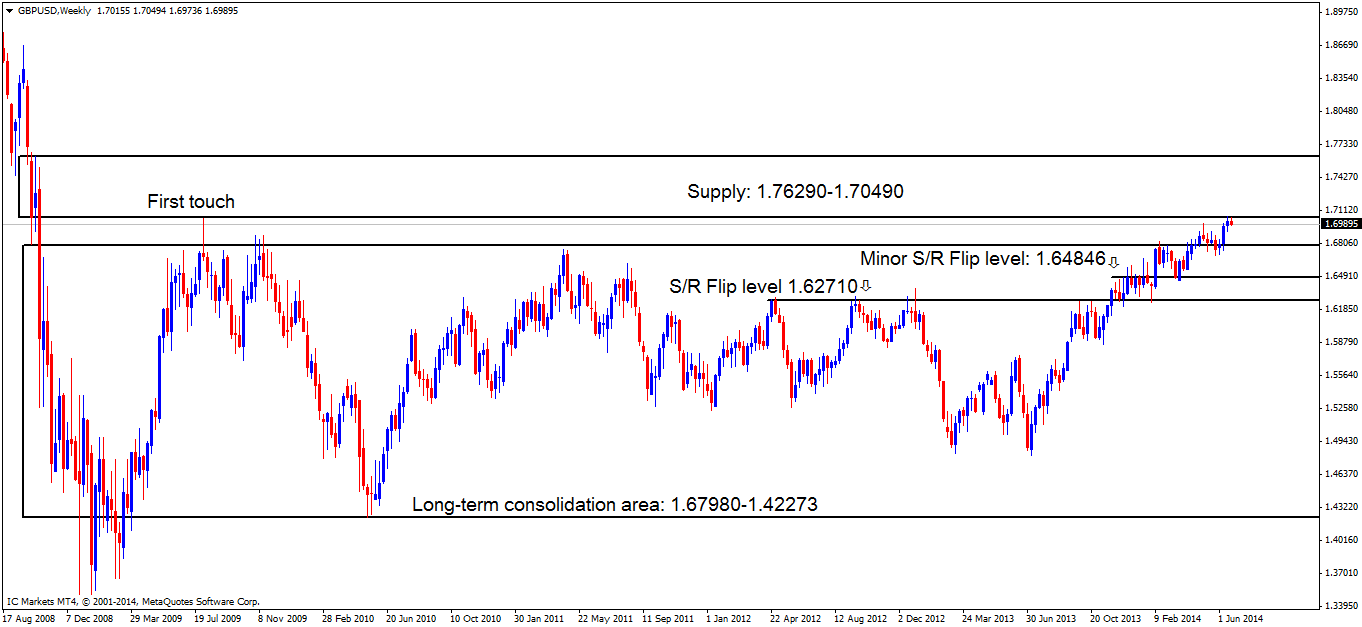

Below on the weekly timeframe, we are seeing the sellers beginning to show more interest around the weekly supply area at 1.76290-1.70490.

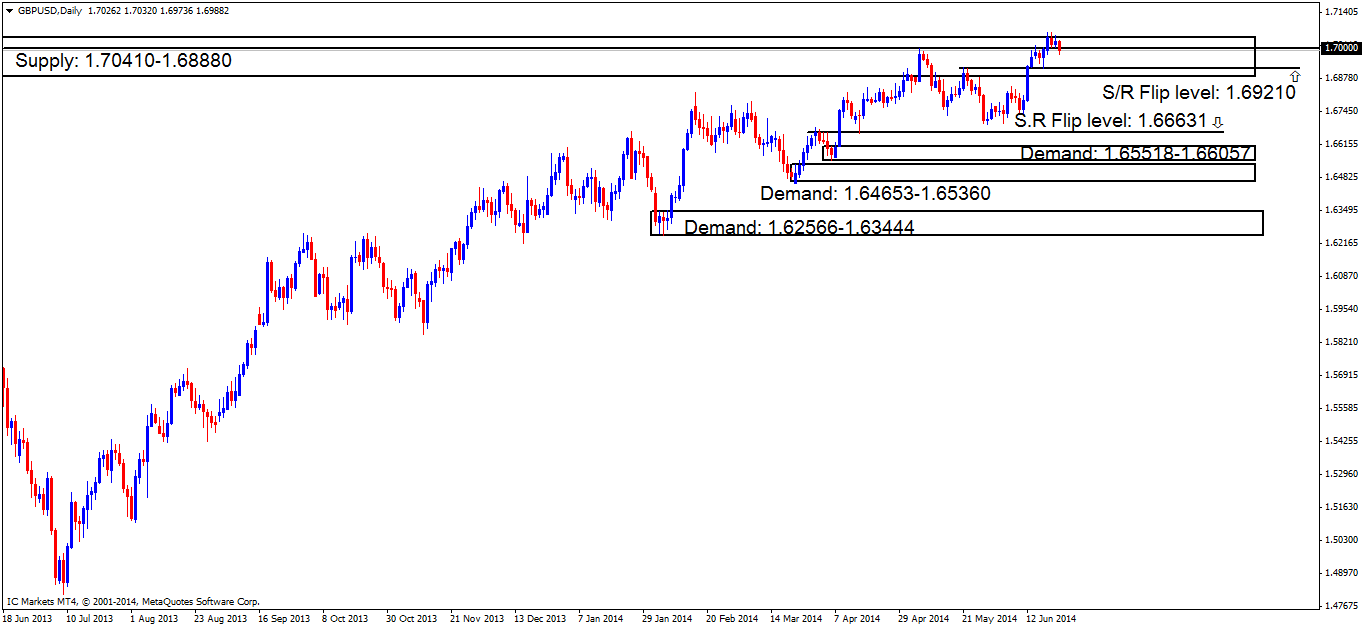

Daily TF.

Here on the daily timeframe, we are starting to see signs that the three wicks above daily supply at 1.70410-1.68880 may well have been fakeouts. The first trouble area for the sellers on this timeframe is the S/R flip level below at 1.69210.

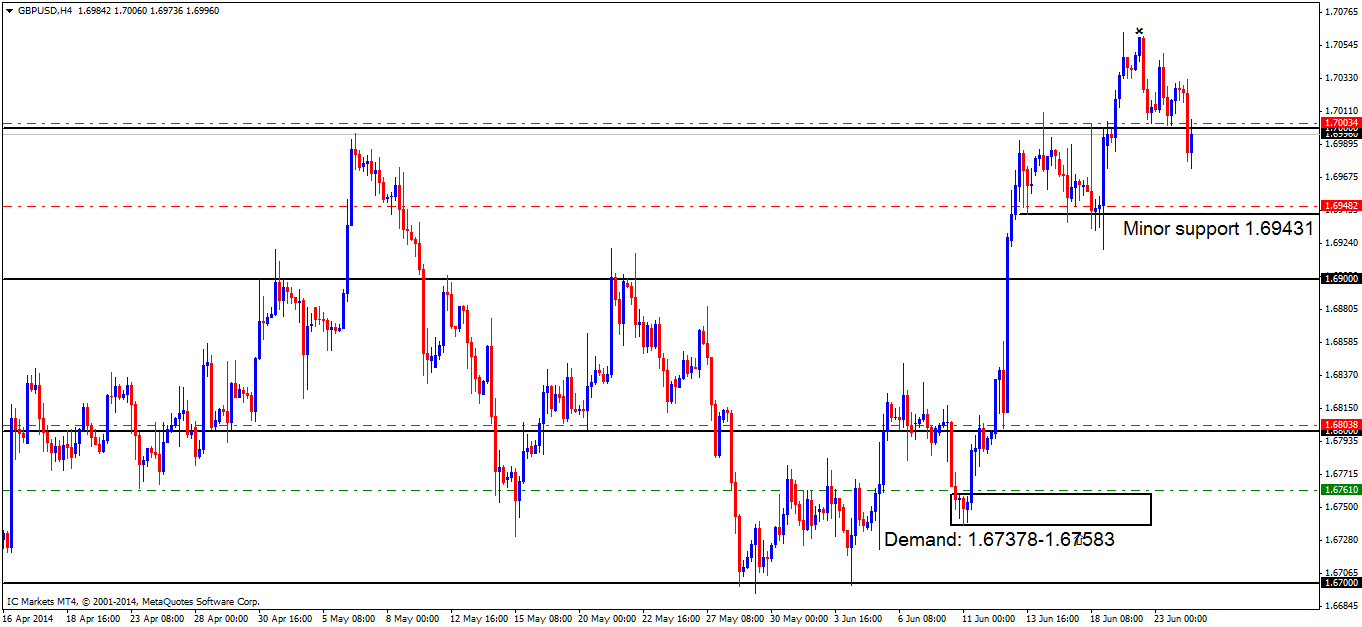

4hr TF.

Chart 1 below shows the reaction/bounce off of the round number 1.70000 was very short lived! A strong break to the downside of the round number was seen, leaving anyone who was initially long there little choice but to cover their positions. A small retest of the round number level is currently being seen at the time of writing, with sellers showing a little interest at the moment. None of the above should come as a big surprise though as we are in higher-timeframe supply as shown above.

Chart 1:

Pending/P.A confirmation orders:

- Pending buy orders (Green line) are seen at 1.67610 just above demand at 1.67378-1.67583. A pending order is valid here due to the momentum away from the demand area, indicating orders may be left unfilled here.

- P.A confirmation buy orders (Red line) are seen just above the round number 1.68000 at 1.68038. A reaction may be likely here because of the way pro money used this level to rally prices higher with force, a quick change in direction like this likely indicates pro money activity, thus, all of their orders may have not been filled at that time. The reason a pending order is not used here is because pro money, on a regular basis perform deep stop hunts around big figure levels (1.68000), and these tails/wicks can be huge sometimes, hence the need to wait for confirmation.

- P.A confirmation buy orders (Red line) are seen just above minor support (1.69431) at 1.69482. A reaction north is likely to be seen here, however we are currently seeing higher-timeframe supply being hit on the weekly timeframe at 1.76290-1.70490, hence the need for a confirmation buy order, rather than a pending buy order.

- The P.A confirmation buy order (Red line) set just above the round number 1.70000 at 1.70034has now been cancelled, price dropped too far from the entry level at 1.70034, with the buyers also being unable to consume any sellers at the high marked with an x at 1.70597 seen on chart 1 above.

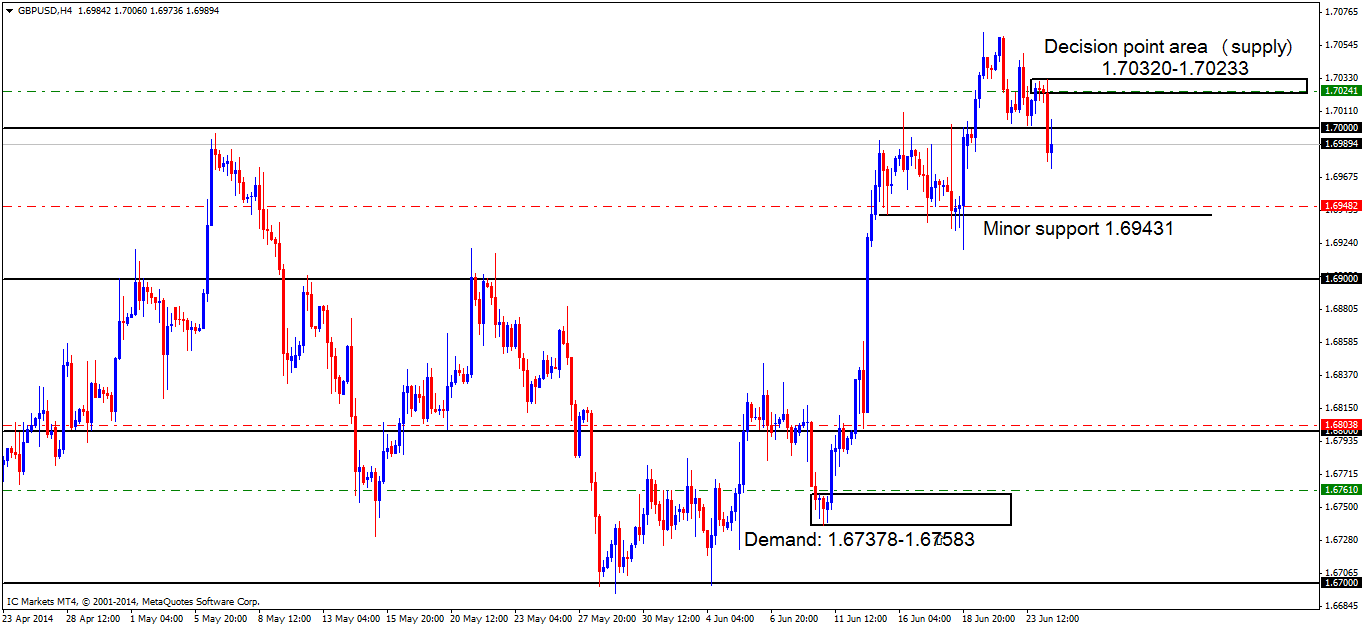

- Pending sell orders (Green line) are seen just within supply (1.70320-1.70233) at 1.70241. A pending sell order is valid here due this being the last decision point seen before pro money broke the round number 1.70000 to the downside meaning unfilled order may be left there.

- No P.A confirmation sell orders (Red line) are seen in the current market environment.

Chart 2 below shows some of the alterations made regarding our current buy orders. Price has formed a new (supply) decision point area at 1.70320-1.70233 with price now seen being capped between the supply area just mentioned and demand (minor support) below at 1.69431.

There is very little stopping price from hitting minor support below at 1.69431, however pro money may require more liquidity (buy orders) to sell into before this push to the down side is seen, a prefect levelwould more than likely be the last decision point area above at 1.70241.

Chart 2:

Quick Recap:

Sellers really took control of the market recently as a clean break south of the round number 1.70000 was seen, which was reported may happen in the last analysis. Our P.A confirmation buy order set at 1.70034 has now been removed due to price dropping too far from the entry level. A new pending sell order is seen just above the round number (level above) within supply (decision point area 1.70320-1.70233) at 1.70241. Price will likely push higher to the last decision point level just mentioned before any lower prices are seen.

- Areas to watch for buy orders: P.O: 1.67610 (SL: 1.67345 TP: [1] 1.68000 [2] 1.69000 [likely to be changed, depending on price approach]). P.A.C: 1.68038 (SL: Dependent on approaching price action after the level has been confirmed TP: Dependent on approaching price action after the level has been confirmed). 1.69482 (likely to be set at 1.69176 TP: Dependent on approaching price action after the level has been confirmed).

- Areas to watch for sell orders: P.O: 1.70241 (SL: 1.70352 TP: [1] 1.70000, subject to change depending on how future price action unfolds) P.A.C: No P.A confirmation sell orders seen in the current market environment.

Price action confirmation: simply means traders will likely wait for price action to confirm a level by consuming the opposing supply or demand area, then entering a trade on a possible retracement, this may occur on the lower timeframes also.

Pending orders: means pending orders are likely seen.

Source: IC Markets Trading Desk