Dollar broadly weaker as June Fed rate hike priced out

The US dollar has been hurt by fading expectations that the Federal Reserve will raise interest rates anytime soon, especially after a dismal nonfarm payrolls report last Friday.

A June hike has now been pretty much priced out and chances that the Fed will move in July have been lowered.

Federal Reserve Chair Janet Yellen, who spoke earlier this week in Philadelphia, did not specify whether the Fed will raise rates over the summer months.

Investors do not expect the Fed to raise rates unless incoming economic data beat expectations. Stronger US jobs data and signs of inflation picking up would help.

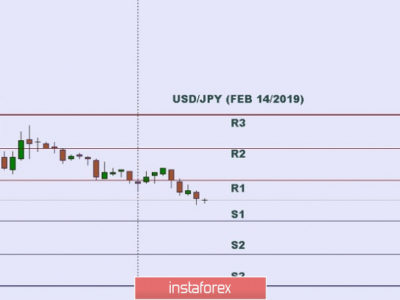

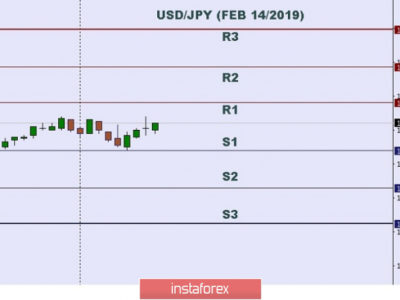

The dollar index, which is a gauge of the U.S. currency against a basket of six currencies, has fallen to a five-week low. It reached 93.68 on Wednesday. USDJPY has fallen below the key 107 yen level.

The dollar is expected to remain broadly weaker ahead of the Federal Reserve’s June 14-15 policy meeting.

The post Dollar broadly weaker as June Fed rate hike priced out appeared first on FXTM Blog.

Source:: Dollar broadly weaker as June Fed rate hike priced out