Dollar Faces Headwinds as Yields Continue to Fall

The USD/JPY has been oscillating around 120.00. Japanese markets are closed for a public holiday Monday, which has thinned out the yen market, and directional impetus is limited in early-week trade. The rally in U.S. yields have reduced the demand for dollar assets as the interest rate differential moves in favor of the yen. Interest rate differentials measure the divergence between similar sovereign debts.

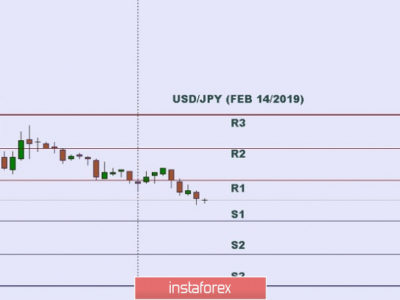

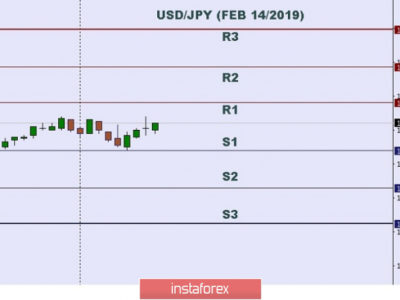

The USD/JPY has technically established a bearish bias. The 20-, 50-, 100- and 200-day moving averages have been breached over the last three weeks, and big-picture momentum is shifting lower on the weekly chart. The two-year rally inspired by “Abenomics” policies now looks to be in jeopardy, though the BoJ is likely to respond at its October meeting with an expansion in QQE. Resistance is marked at 120.31 which coincides with the 20-day moving average. Support on the currency pair is seen near an upward sloping trend line that comes in near 118.75.

The post Dollar Faces Headwinds as Yields Continue to Fall appeared first on Forex Circles.