Dollar still gains on Trump’s fiscal policy pledge

The US dollar extended its gains against the euro as increased expectations that the President-elect Donald Trump’s administration might introduce monetary stimulus with the aim to boost growth for the world’s largest economy.

Following the US presidential election result, Donald Trump gave his speech in which he vowed to be a President of all Americans. He also spoke highly of his rival Hilary Clinton and promised to deliver significant monetary stimulus spending towards infrastructure and tax reductions for the corporate sector and even the well-off individuals.

Because of the pledges he made, markets are giving him the benefit of the doubt but at the same time investors are keeping a close look to his administration as it is being structured and the details of his fiscal policy. During his campaign, he made comments against the Federal Reserve’s autonomy and in parallel criticised its current Chairwoman Janet Yellen. However, his pre-election comments can also be taken with a pinch of salt because for a large part of his campaign he was focused against the Republican party, members of which hold high positions within the Fed.

Trump might fill in the two currently vacant positions within the Fed and there is a large possibility that he could replace Janet Yellen when her term expires in 2018. However, it would not be straightforward for him to push her to resign because that scenario would cause the markets to react adversely to such a violation of the Fed’s independence. But even if and when Trump replaces the current Fed Chair woman, her successor would not be able to impose his/her views on monetary policy to the seven-member committee simply because each one of them can and will disagree when it becomes necessary.

In any case, the Fed can’t simply increase interest rates without the right economic conditions being in place. In case economic growth and inflation remain low, the increase of interest rates would be followed by punishment from the markets. That punishment would eventually reach Donald Trump. An aggressive monetary policy could strengthen the US dollar, but if it was premature then it would also have unwanted implications such as the widening of the trade deficit and hurt the employment sector.

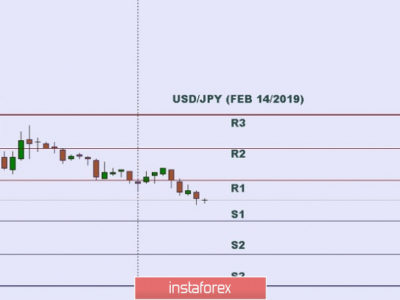

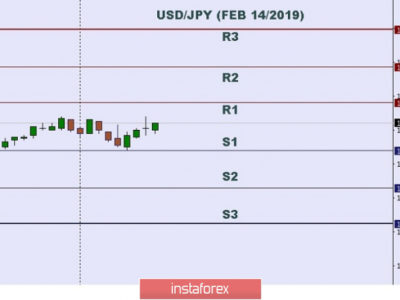

The USD/JPY posted significant gains through last week following continuous expectations that Donald Trump might introduce fiscal stimulus, the overall gains of which reached 3.8% as the currency pair ended trading at 110.887. An increasing number of traders are also expecting an interest rate increase during the next Federal Open Market Committee (FOMC) meeting in December which also boosts demand for the U.S. dollar.

Stock markets would most probably welcome fiscal policy loosening together with deregulation of the corporate sector, at least in the short term. But overall, investors will be monitoring other economic factors and therefore it is currently anybody’s guess as to whether Donald Trump will find the right balance.

The post Dollar still gains on Trump’s fiscal policy pledge appeared first on Forex.Info.