The Dow Jones Does Its Best Bitcoin Impression, Europe Follows Suit

James Hughes, Chief Market Analyst, AxiTrader, comments:

Yesterday…

“It’s more records for the Dow Jones, but this time on the other side. Shares on Wall Street have plunged lower during the US session with the Dow Jones falling by 1,175 points, a record one day fall for the index.”

“It was the biggest fall ever beating the previous record set back in 2008 in the midst of global financial crisis.”

“The collapse in stock indices today has followed on from heavy falls on Thursday and Friday, and it seems now that we are in the midst of a huge correction for US stocks. Although however tempting it may be to call this the start of the much needed correction many analysts have been calling for, those look to short the indices must be cautious going into tomorrow’s session in case of bounce.”

“There does seem to be an obsession with blaming this fall in the increased rhetoric around inflation and rate hikes, however very little has actually changed on this front, and for me, certainly not enough to cause mass selling across the board. We know that inflation is a key battle ground for the Fed, so questions about when we will see that higher print are always likely to cause a stir. However as previously stated that hadn’t changed the outlook for rate hikes, that before today’s moves was looking like at least four in 2018.”

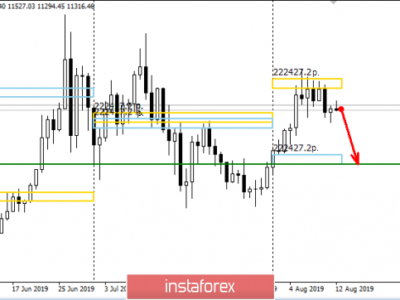

“The falls in stocks have also coincided with an aggressive fall in Bitcoin, and in fact for while during the trading session is looked like the Dow was trying to do its best Bitcoin impression. Bitcoin itself has plunged from 11,500 to below 7,000 stoking the fears that we could be in line for further downside in the next few days. Instead of these moves being blamed on hints on inflation it looks more to me like a snowball effect of a number of traders unwinding long term long positions and taking profit after seeing such amazing upside for the last 18 months.”

This Morning…

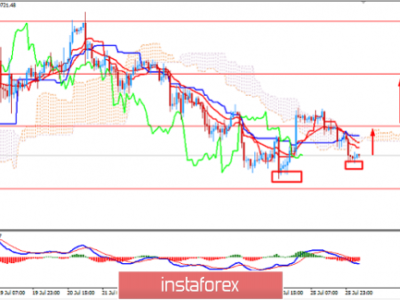

“This morning we have seen Europe follow suit by posting big downside losses with the FTSE and Dax both down over 3%.”

“Dow futures are also showing signs that this downside is likely to continue into Tuesday’s session with the Dow already down another 400 points. There is very little due out on a macroeconomic front today, which is actually bad news. In situations like this we would want to find something to take the attention away from the downside, and maybe see a positive number.”

“One thing to remember about the recent falls is that the economy is in a good place in the US, with Christine Lagarde only raising the outlook for global GDP two weeks ago in Davos. The question will be asked whether this is a market correction or a something more sinister for the global economy?”

“A 1000+ fall will give people flash backs of 2007-2008, however economically we are not in the same position so I do not think that is a fear. So far this is just a long awaited stock market correction, one that could have a lot further to go. When an asset flies higher in value so aggressively, the fall is always equally as quick.

“For me the Bitcoin and stock correlation is not a thing, but we are talking about a similar investor demographic, as well as the fact that if you’re long stock markets other investments have to be unraveled for margin. This morning margin calls a rife across the world, as long term bulls have a big decision to make, this is no longer buy the dips territory.”

For further information, visit www.axitrader.com