EUR Appears to Shine More than Sterling

EUR Appears to Shine More than Sterling

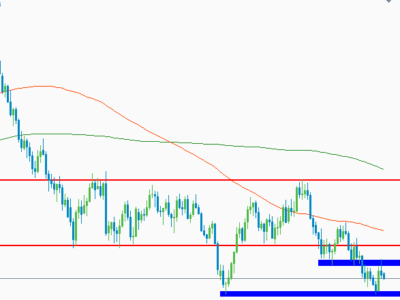

FX:EURGBP

The technical pattern on the EURGBP suggests the EUR may out perform GBP over the coming days. While many traders are fearful of trading EUR due to the Grexit risk, EURGBP may be one vehicle to participate while stripping out USD exposure.

From a techincal perspective, the EURGBP has appeared to carve out a 5-3 bullish pattern. This is an Elliott Wave pattern where you get 5 waves up followed by a 3 wave counter trend move. This suggests the near term trend is pointed higher.

If we look to the left, the March 2015 low to the May 2015 high is clearly an equal wave pattern. Therefore, the wave count options become more focused (see the notes in the chart for the top 3 options I’m following).

Either way, there are several counts that point towards a retest of .74. At that point, the bullish potential dissipates and the risk to reward ratio is extinguished.

An aggressive trader can look for a stop loss near 7120. A conservative trader can look to the May low near 7050.

Your counts are welcome. I’m always interested in where my counts are wrong.