EUR Leading Diagonal Pattern Opens the Door for Longs

EUR Leading Diagonal Pattern Opens the Door for Longs

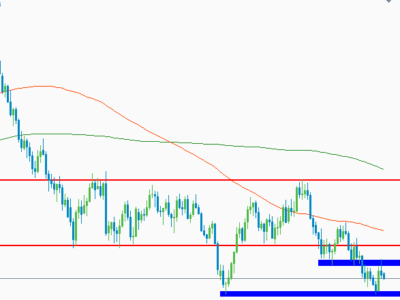

FX:EURUSD

Last night, we posted about the potential for a leading diagonal on the EURUSD (see the notes at the bottom of “EUR Analysis Prior to Greece Referendum Vote”). The pair has continued to play that tune which implies:

• A tradable low is in place at 1.0915 which coincides with scenario #2 in the “EUR Analysis Prior to Greece Referendum Vote” (see green notes on the original chart)

• The 1.0915 ended 4 degrees of trend and likely kicks off a green circle ‘c’ wave higher which subdivides into 5 waves

• Look for a 50-78% retracement on the diagonal to time a long entry (1.0960-1.1020)

• Target 1.1250 and 1.1470

• If prices break above 1.1125 BEFORE hitting the retracement zone of 1.0960-1.1020, then consider a breakout long trade

A print at 1.0914 means this analysis is incorrect so we have the opportunity for a good risk to reward ratio long trade.

Also, SSI continues to be weighed towards sellers at -1.69. Sentiment can be used as a contrarian signal which suggests prices may rise. These traders who are short become future supply of buyers as they are already committed to their position.

Additionally, with the analysis posted yesterday on the USDCAD (bullish), this may open the door to consider long EURCAD. EURJPY may have some bullish juice in it too. I’ll post those if any clean EW counts or RR ratio trades can be identified.

Though this post is written to the tune of the higher probability leading diagonal scenario. Other scenarios do exist. I have listed the top 4 as I see them.

For those Elliotticians, what other scenarios are you considering on EURUSD?

Source:: EUR Leading Diagonal Pattern Opens the Door for Longs