EUR Update – Forex Trading Tips

Euro remains weak medium term due to the quantitative easing program that is underway and expected to continue for at least another 12-18 months.

EUR Update

Interest Rate

Main Refinancing Operations (MRO) Rate: 0.05%

Last Change: September 4, 2014 (0.15%)

Expected Future Change: On hold

Quantitative Easing: €60 billion per month

Next Rate Decision: September 3

Inflation

Inflation Target: <2%

Period: Year ending August 31

Final CPI: 0.2%

Final Core CPI: 1%

Next Release: September 16 (Final)

Employment

Month: May

Unemployment Rate: 11.1% Expected: 11.0%

Next Release: September 1

Growth

Period: Year ending June 30

Flash GDP: 1.2% Expected: 1.3%

Next Release: September 4 (Revised GDP)

Summary

- Numerical economic data from the Eurozone is compiled and released by Eurostat.

- The EURUSD is the most actively traded currency pair.

- On January 22, 2015 the ECB officially announced a program of quantitative easing to tackle deflation in the Euro area. This program consists of buying €60 billion per month worth of bonds including government debt, asset-backed securities and covered bonds but not corporate bonds.

- The QE program was implemented on March 9, 2015.

- The EURUSD fell over 35 points in less than one year, from May 2014 – March 2015. This was attributed to both speculation of easing by the ECB and strength in the US economy. Substantial pullbacks are inevitable after such moves.

- HICP inflation is projected to average zero in 2015 but to rise to 1.5% in 2016 and further to 1.8% in 2017.

- Euro area annual inflation was 0.2% at the end of August, stable compared with June and July. The annual core reading for August was 1%, flat from July and up from 0.8% the year ending June.

Analysis

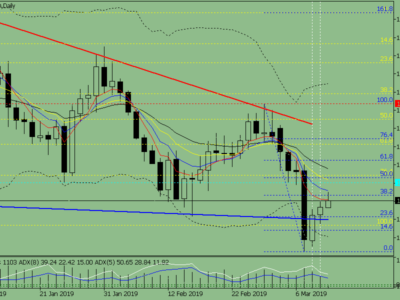

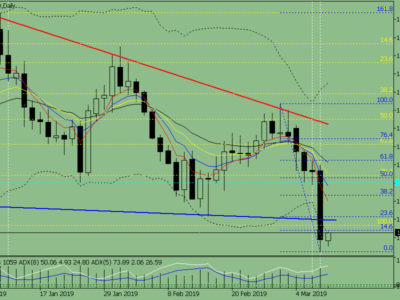

The euro has resumed its downward trend against the USD in recent sessions, in line with the longer term fundamentals. The EURUSD has fallen 500 pips from recent highs as of the start of September. The pair’s rapid decline follow’s an equally rapid rally which saw it poke above 1.17 on August 24. The reasons for the prior rally are outlined below.

1. USD weakness has caused a rally in EURUSD. This is on the back of the more dovish Fed minutes and slowing demand from China which is pressuring commodities and therefore inflation expectations. This means the market is pushing the probability of rate hikes back to December or possibly even 2016. The market has been massively short EURUSD for about 12 months; a slight unwind can cause aggressive upside.

2. Recent weakness in commodity-linked currencies has made euro appear comparatively more attractive.

3. The yuan devaluation caused short EURCNH carry trades to be unwound. Some traders had been using the euro as a funding currency, and with the CNH moving lower it prompted a mass exodus of these positions. Combined with this move we saw USD sell off as the market suspected that the PBOC’s move to lower the yuan exchange rate would send negative signals about global growth and decrease the chances of a Fed liftoff in September.

The EURUSD now approaches the 1.14 handle after rallying over 500 pips in two weeks. The euro has also rallied against commodity currencies in the last few months; up nearly 1,600 pips against the AUD and 3,000 against the NZD. Although still undertaking QE, and with near-zero interest rates, the currency has seen some neutral sentiment of late. This is primarily due to the suspicions that inflation bottomed during March and April, and a partial unwind of massive short positioning.

Eurozone flash CPI for August was released on August 31. It showed all-items inflation increased 0.2% for the 12 months ending August 31 – unchanged from the prior month’s reading. The core reading increased 1%. If core inflation exceeds this level it will be the highest since August 2013 when it printed 1.1%. We will be watching EZ inflation closely for further price changes in the context of falling oil. As Draghi said at a recent ECB press conference – “we still have a long, long way to go”.

August 14 saw Preliminary GDP y/y for Q2 come in below expectations at 1.2%. Yet this is up from the Q1 EZ growth of 1%. German GDP y/y for Q2 came in at 1.6%, up from 1.1% in Q1. These numbers indicate the Eurozone economy is expanding. However French GDP q/q for Q2 was flat.

The massive bond buying program and near-zero interest rates means that the euro is fundamentally a weak currency. However to what degree this weakness has already been priced in is a more complex question. We saw EURUSD fall over 3,500 pips between May 2014 and March 2015, a manifestation of policy divergence. CPI readings indicate inflation bottomed around March/April 2015 and since then we have seen euro rally against weaker currencies, however inflation still remains subdued. Recent strength in the currency has been driven by a re-pricing of Fed and BOE rate hike expectations and weaker commodity-linked currencies – it is a case of the euro simply being relatively neutral in terms of sentiment within an environment of stronger negative sentiment on counter currencies and large capacity for shorts to be unwound.

The post EUR Update – Forex Trading Tips appeared first on Jarratt Davis.

Source:: EUR Update – Forex Trading Tips