EUR/USD. Apr 23, 2020

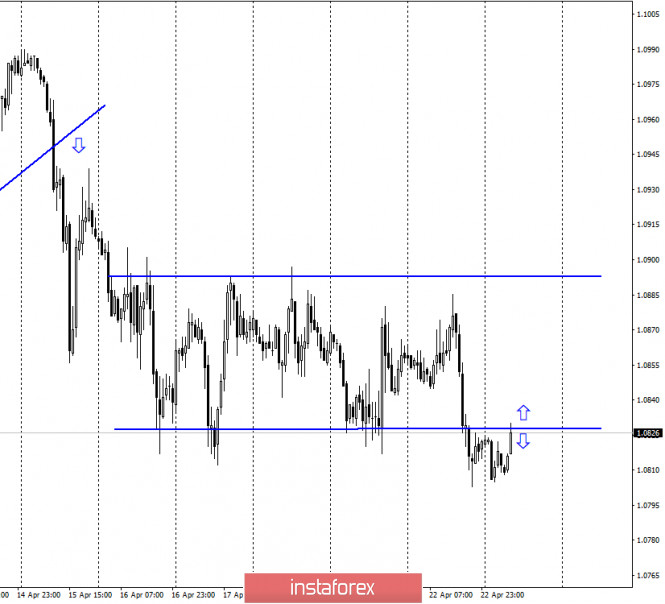

EUR/USD – 1H.

Hello, traders! On April 22, the euro/dollar pair secured under the lower line of the side corridor. Thus, I believe that now the euro/dollar pair can continue falling. At the same time, this morning, the pair’s quotes performed a reversal in favor of the European currency and returned to the lower line of the corridor. The rebound of the pair’s rate from this line will again work in favor of the US currency and the resumption of the fall. Closing the pair above this line will work in favor of the EU currency and will finally confuse the whole picture since an upward trend may begin or a sideways trend may resume. With trading today, you need to be careful. The most discussed topic in recent days is the topic of the EU summit, which will be held today and during which a decision should be made on the sources of funding for the EU economy as a program to counteract coronavirus. The source for the 2.2 trillion euros will be discussed at the summit. The problem is that countries do not have a common opinion on this issue. Therefore, there is a possibility that the aid package, without which the EU economy may collapse, may not be accepted.

EUR/USD – 4H.

On the 4-hour chart, the pair’s quotes made a consolidation under the Fibo level of 23.6% (1.0840), which increases the probability of a further fall in the quotes. In contrast to the hourly chart, the sales signal looks stronger. There is also a downward trend line on the 4-hour chart, which defines the current mood of traders as “bearish”. Thus, I would say that the chances of a fall in the European currency on April 23 are extremely high. However, today we should pay attention to the information background, as the EU summit may present a surprise, and in addition to the summit today there will be quite a lot of news in the European Union and the United States.

EUR/USD – Daily.

On the daily chart, the euro/dollar pair performed a consolidation under the Fibo level of 23.6% (1.0840), as well as under the “tapering triangle”. Thus, there are two sales signals on this chart at once, which significantly increases the chances of the pair falling.

EUR/USD – Weekly.

On the weekly chart, the euro/dollar pair continues to trade near the bottom line of the “narrowing triangle”. The rebound of quotes from this line still allows us to expect an increase in quotes in the long term in the direction of the level of 1.1600 (the upper line of the “triangle”). Closing the pair under the “triangle” will work in favor of the US currency and, possibly, a new long fall.

Overview of fundamentals:

On April 22, there was not a single important report or news in the European Union or in America. Thus, weak movements of the euro/dollar pair and the absence of a trend correspond to the information background.

News calendar for the US and the EU:

Germany – index of business activity in the manufacturing sector (09:30 GMT).

Germany – index of business activity in the services sector (09:30 GMT).

EU – manufacturing sector PMI (10:00 GMT).

EU – index of business activity in the sector of services (10:00 GMT).

US – number of initial applications for unemployment benefits (14:30 GMT).

US – index of business activity in the manufacturing sector (15:45 GMT).

US – PMI for the services sector (15:45 GMT).

On April 23, the calendars of economic events in the European Union and the United States contain a fairly large number of reports. Most attention should be paid to the report on initial applications for unemployment benefits in America, which may amount to more than 4 million new applications.

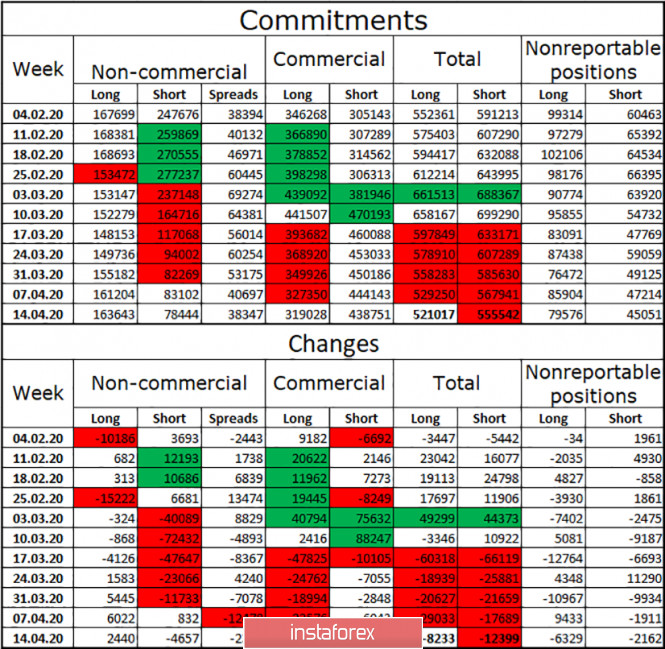

COT (Commitments of Traders) report:

The latest COT report showed no major changes in the mood of hedgers and speculators. Major market players were engaged in getting rid of long and short contracts. The first category lost 12,399 contracts during the week, while the second category lost 8,233. The increase was recorded only for long-term contracts of the “Non-commercial” group, that is, for speculators. However, these same speculators have been actively getting rid of short contracts in recent months, not believing that the dollar will become more expensive again. The overall advantage among major players remains on the side of short positions. Over the past week, the number of short-term contracts has decreased in absolute terms, so the probability of a fall in the euro currency is reduced. The euro/dollar pair does not show a high tendency to fall this week, so the trend of shorting short positions may continue among major players.

Forecast for EUR/USD and recommendations for traders:

At this time, I recommend selling the euro with the goal of 1.0638, since there are 4 signals on three charts at once. However, I still do not recommend trading without stop losses. I recommend buying euros after fixing quotes above the downtrend line on the 4-hour chart with the goals of 1.0964 and 1.1065.

Terms:

“Non-commercial” – major market players: banks, hedge funds, investment funds, private, large investors.

“Commercial” – commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

“Non-reportable positions” – small traders who do not have a significant impact on the price.

The material has been provided by InstaForex Company – www.instaforex.com