EUR/USD: plan for the European session on Aug 29, 2019

To open long positions on EURUSD you need:

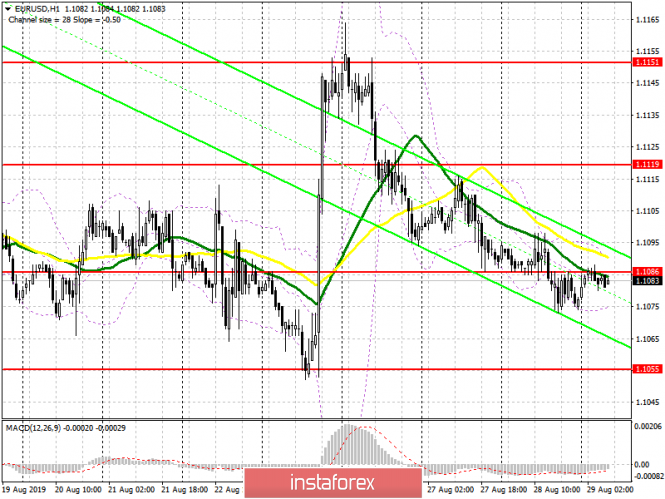

Yesterday, buyers missed the support of 1.1086, which coped with its function for almost three trading sessions. However, there was no major decline due to the lack of news. At the moment, it is best to open long positions after the release of a series of reports on the countries of the eurozone, ranging from consumer confidence and ending with inflation in Germany. Good news background will help the bulls regain the level of 1.1086, which will be the first signal to open long positions in the hope of updating the resistance of 1.1115, from which sellers will return to the market. However, a further target will still be a high of 1.1151, where I recommend taking profits. If eurozone reports put pressure on the euro, which is to be expected, then it is best to consider long positions after updating the low of the month in the region of 1.1055, or on the rebound from the new support of 1.1028.

To open short positions on EURUSD you need:

As long as trading is below a resistance of 1.1086, the market remains on the side of euro sellers. As I noted above, the entire emphasis will be shifted to data on the eurozone, and weak reports with the formation of a false breakdown in the region of 1.1086 will be the first signal to open short positions in order to continue a downward correction to the last week’s support area of 1.1055, where I recommend taking profit in the first half a day. However, the main goal of sellers will be a low of 1.1028. If the pair grows after the reports, you can consider new short positions after the formation of a false breakdown in the resistance area of 1.1115, or you can sell immediately for a rebound from a high of 1.1151.

Signals of indicators:

Moving averages

Trading below 30 and 50 moving averages, which indicates the return of euro sellers to the market.

Bollinger bands

A break of the lower boundary of the indicator in the region of 1.1075 will only increase pressure on the euro.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: Fast EMA 12, Slow EMA 26, SMA 9

- Bollinger Bands 20

The material has been provided by InstaForex Company – www.instaforex.com