EUR/USD: plan for the European session on Oct 2, 2019

To open long positions on EURUSD you need:

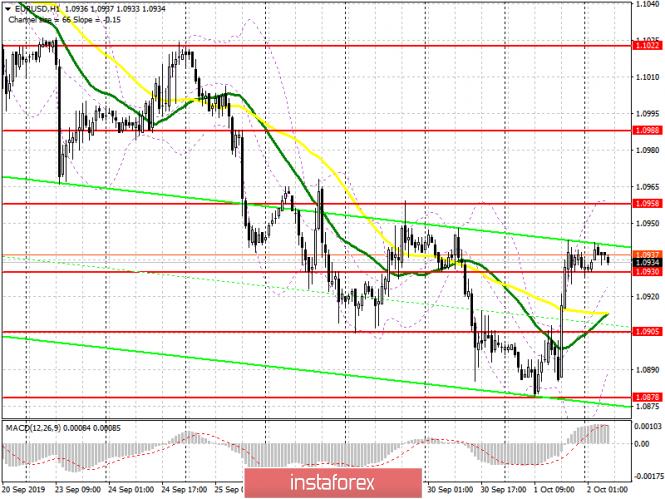

Yesterday’s weak report on manufacturing activity from ISM caused the US dollar to sharply fall against the euro, today pressure may continue after the release of data from ADP on the number of employees. However, in the morning, to maintain the upward trend, the bulls will need to protect the support of 1.0930, and the formation of a false breakdown there will be a signal for the further opening of long positions in the expectation of updating the highs of 1.0958 and 1.0988, where I recommend taking profit. If after a speech by representatives of the European Central Bank, the EUR/USD pair goes below the support of 1.0930, then it is best to count on long positions after testing the area of 1.0905, or on a rebound from a larger low of 1.0878.

To open short positions on EURUSD you need:

In the morning, the release of important fundamental statistics on the eurozone is not planned, so traders will wait for new benchmarks from representatives of the European Central Bank and data from the US ADP. An important task is to return to the support level of 1.0930, which may increase the pressure on the pair and lead to the update of yesterday’s lows 1.0905 and 1.0878, where I recommend taking profits. If the demand for the euro continues in the first half of the day, then only the formation of a false breakdown in the resistance area of 1.0958 will be a signal to open short positions. In a different scenario, selling EUR/USD is best done for a rebound from a high of 1.0988.

Signals of indicators:

Moving averages

Trading is conducted above 30 and 50 moving average, which indicates the likely completion of a downward trend in the short term.

Bollinger bands

In case EUR/USD declines in the morning, support will be provided by the lower boundary of the indicator in the region of 1.0890. A break of the upper boundary at 1.0958 will lead to a larger upward trend.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: Fast EMA 12, Slow EMA 26, SMA 9

- Bollinger Bands 20

The material has been provided by InstaForex Company – www.instaforex.com