EUR/USD: plan for the US session on Jan 8, 2020

To open long positions on EURUSD, you need:

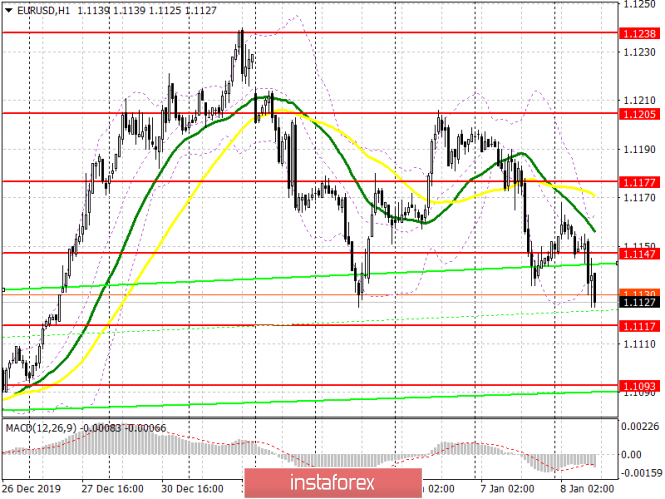

The report on the reduction of orders in the German industry, which was much worse than economists’ forecasts, led to a sell-off of the European currency in the first half of the day, the pressure on which remains at the time of writing the article. The bulls need to think carefully now about protecting the support of 1.1117. It is best to open long positions from there only after the formation of a false breakout, as well as subject to the release of weak statistics on the American labor market. In the scenario of no demand for the euro around the level of 1.1117, I recommend buying immediately on the rebound only after updating the minimum of 1.1093. An equally important task for buyers will be to return the resistance of 1.1147, since only in this scenario can we talk about maintaining the upward potential. The goal will be the highs of 1.1177 and 1.1205, where I recommend fixing the profit.

To open short positions on EURUSD you need:

Good statistics from ADP on the number of people employed in the private sector can continue the strong growth of the US dollar against the European currency. An unsuccessful return to the resistance level of 1.1147 in the second half of the day will be a signal to open short positions in the euro, and the main task of the bears will be to break through and consolidate below the support of 1.1117. In this scenario, EUR/USD can quickly return to the lows of 1.093 and 1.1069, where I recommend fixing the profits. If the sellers of the euro do not show activity when the bulls try to return the resistance of 1.1117, it is best to count on short positions for a rebound from the highs of 1.1177 and 1.1205.

Indicator signals:

Moving Averages

Trading continues below the 30 and 50 moving averages, indicating continued pressure.

Bollinger Bands

Bears broke through the lower border of the indicator, which indicates that they keep the market under control. In the case of an upward correction, short positions can be viewed from the average border of the indicator in the area of 1.1147.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence – Convergence / Divergence moving average) Fast EMA Period 12. Slow EMA Period 26. SMA Period 9

- Bollinger Bands (Bollinger Bands). Period 20

The material has been provided by InstaForex Company – www.instaforex.com