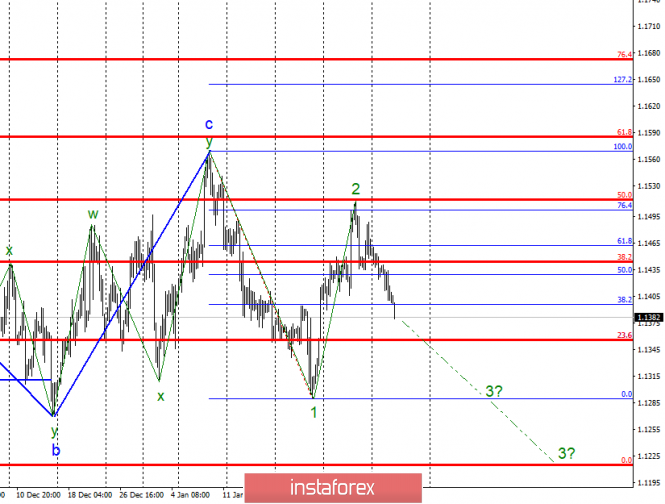

EUR/USD Wave analysis February 6,2019

Wave counting analysis:

On Tuesday, February 5, trading ended for EUR / USD by another 35 bp decline. Thus, the current wave counting retains its integrity and implies the continuation of the construction of the downward wave 3 with targets located near the level of 0.0% Fibonacci and below. Even with the fulfillment of the backup version, which involves building not a pulsed, but a three-wave section of the trend, a decline is still expected within wave c. With regard to the news background, yesterday’s reports showed a slight improvement in business activity in Europe and a deterioration in the United States. However, the dollar still continues to be in demand, which coincides with the prospects for the wave pattern.

Sales targets:

1,1289 – 0.0% Fibonacci

1.1215 – 0.0% Fibonacci

Shopping goals:

1.1502 – 76.4% Fibonacci

1.1569 – 100.0% Fibonacci

General conclusions and trading recommendations:

The pair continues to build a downward wave of 3. Thus, now I still recommend selling the instrument with targets located near the marks of 1.1289 and 1.1215, which equates to 0.0% and 0.0% Fibonacci. There are no prerequisites for changing the working version. It is needed to clarify the wave marking now.

The material has been provided by InstaForex Company – www.instaforex.com