Euro falls to fresh 6-month low

Daily Forex Market Preview, 29/05/2018

The U.S. and the UK markets were closed yesterday on account of their respective bank holidays. However, that didn’t stop investors from selling the euro currency. Ongoing developments from Italy on the political front push the euro lower on the day despite gapping higher on the open.

Looking ahead, the economic calendar for the day will see the release of the trade balance figures from Switzerland. Later in the day, the U.S. Conference Board’s consumer confidence index is expected to show a modest decline to 128.2 in May, down from 128.7 in April. Despite the anticipated lower reading on the index, consumer confidence in the U.S. is hovering near all-time highs.

The RBNZ will be releasing its financial stability report later in the day.

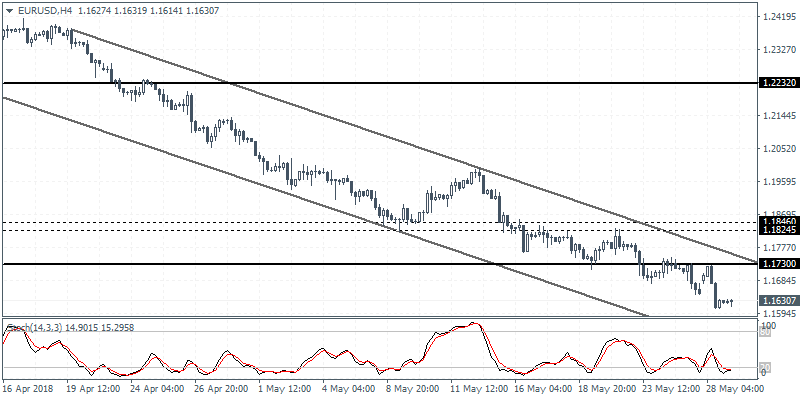

EURUSD intra-day analysis

EURUSD (1.1630): The euro currency fell to a fresh 6-month low on Monday at 1.1607 before slightly pulling back higher. The decline below the 1.1672 level of support is likely to pave way for further declines down to 1.1500. This comes following a brief rebound in prices close to the level of 1.1730 where resistance has been formed following the reversal on Monday. Any scope of a recovery in price action can be expected only on a close above 1.1730 level.

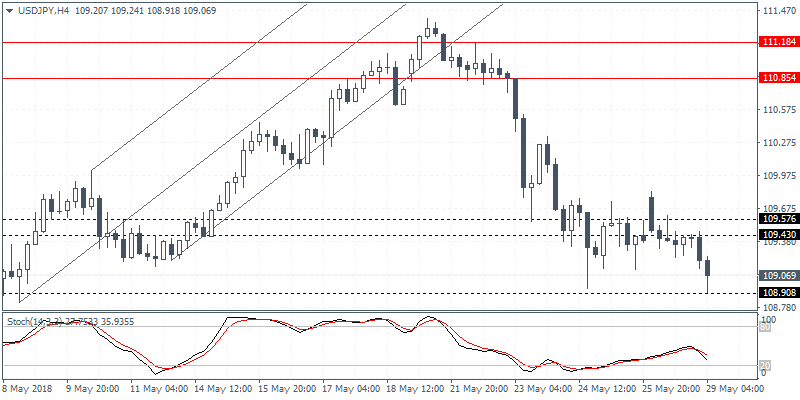

USDJPY intra-day analysis

USDJPY (109.06): The USDJPY currency pair was seen extending the declines earlier today with prices briefly testing lows of 108.91 before pulling back. A further retest of this support level is expected. A rebound off the support at 108.90 could potentially keep the USDJPY range bound within the resistance level of 109.43 and the mentioned support. An upside breakout above 109.57 could signal further gains in price toward 110.85. To the downside, a close below 108.90 could trigger declines to push price to test 108.00 level of support.

XAUUSD intra-day analysis

XAUUSD (1297.89): Gold prices were broadly muted on Monday with price action trading below the resistance level of 1304 – 1301 level. Failure to breakout above this level has kept price action muted with the potential to test the lower support at 1282 once again. To the upside, only a strong close above 1304 level could trigger an upside correction. The resistance level at 1325 is expected to be the next level of target.