Euro Technically Ready for Growth

The euro on Monday closed up against Friday”s close, but down from Asian market opening. The euro strengthened against the dollar to 1.1382 during the Asian session. The dollar weakened due to the Brexit fear factor dying down. The most recent surveys are indicating a rise in those wishing to remain in the EU.

The pound/dollar rose by 371 points to 1.4717 due to these surveys. The euro/dollar returned to 1.1300 after the morning”s rally. The euro”s weakening was caused by a fall in the euro/pound rate.

Market Expectations:

Yellen is set to speak today and tomorrow with a six month report before US congress. She will speak about the state of the economy and monetary policy. Investors will be waiting for her to give a hint about when rates will be put up by the Fed. Her task is to not to make the market nervous before the UK referendum this Thursday. Since the euro corrected on Monday against the dollar, by the end of the day it should strengthen to 1.1359.

Day”s News (EET):

- 11:30, UK public sector borrowing in May;

- 12:00, German June economic sentiment index from ZEW;

- 13:00, UK June industrial orders from the CBI;

- 16:00, ECB”s Draghi speaking;

- 17:00, Fed”s Yellen speaking.

Technical Analysis:

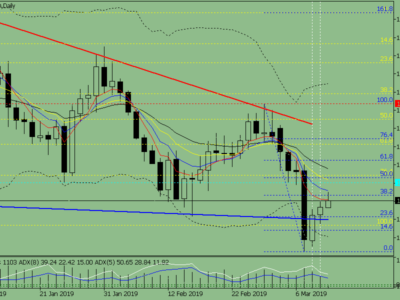

Intraday forecast: minimum: 1.1303, maximum: 1.1383, close: 1.1359.

Euro/dollar rate on the hourly. Source: TradingView

A fall in rate meant the euro stopped at the 45 and 67 degrees. The AO indicator has offloaded. We just need the oscillator stochastic to return to the buy zone and then we can start a new growth phase.

The rate is now at 1.1330. If we make a line along the minimums then we get a support. I don”t think it will hold and the rate will drop to 1.1303. I expect the euro to strengthen to 1.1383 from it. I”m putting more on a softly worded speech from Yellen at 17:00 EET. A weakening of the euro to 1.1276 will cancel my growth forecast. A pinbar has formed on the daily. I”m still not taking it into consideration while the pound hasn”t weakened.

Earn from currency market fluctuations by investing in a Forex Investment Portfolio.

Source:: Euro Technically Ready for Growth