Euro Tests Resistance as Bund Yields Reach 1%

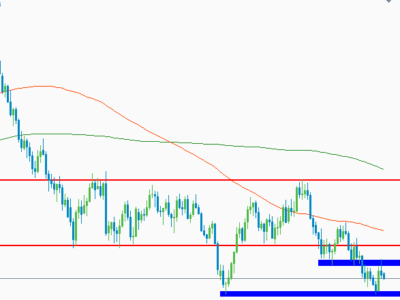

EUR/USD has reversed back to the 1.1300 area after rallying to a five-day peak of 1.1374. The move higher coincided with a spike in the 10-year Bund yield, which reached 1.0% for the first time since last September. Recent firm data and perky May inflation have enabled the euro to generally hold up well to the dollar, but the rekindled Fed rate hike narrative following last Friday’s solid U.S. payrolls report and ongoing gridlock in Greece’s bailout negotiations are curtailing EUR/USD’s upside potential. Support on the currency pair is seen near the 10-day moving average at 1.1145. Momentum has turned positive as the MACD recently generated a buy signal.

In economic news, Italian production dropped in April. Italian production data disappointed, as did the French number earlier. Still, at least Italian PMI readings are looking promising and with the ECB giving a helping hand, the Italian economy is still set to stabilize and start to improve gradually, even though fundamental weaknesses, which can only be addressed through further reforms, remain.

French industrial production disappoints, with overall output down 1.0% month over month, against expectations for a modest rise. The correction may do some extent be a one off due to the closure of a major refinery in April, but PMI readings, while improving also continue to disappoint and indicate ongoing contraction. France is hoping strengthening German domestic demand will also help to lift the French economy, but in the medium to long term France still needs structural reforms to boost competitiveness, especially once the ECB’s very supportive monetary policy comes to an end.

The post Euro Tests Resistance as Bund Yields Reach 1% appeared first on Forex Circles.