Eurozone’s performance sabotaged by Paris attacks

Last Friday’s deadly attacks in Paris may undermine an already struggling Eurozone. According to the latest Gross Domestic Product (GDP) preliminary report, released on Friday by Eurostat, the Eurozone’s economic growth slowed down during the third quarter of the year. The Q3 2015 GDP data revealed growth by 0.3%, whereas the level of the previous quarter was at slightly stronger at 0.4%. The data released took analysts by surprise as most of them were expecting the rate to remain at the same level of 0.3%.

The largest contributor to the Eurozone economy’s failure to show additional growth is the parallel slowdown of the German economy, the Union’s largest state. However, the French economy managed to show positive progress for Q3 in comparison to the previous quarter’s zero growth. The discouraging economic result urged many investors to expect nothing but additional measures by the European Central Bank (ECB) to tackle low inflation levels and moderate growth.

The German economy matched the Eurozone as a whole, after the nation’s Federal Statistical Office’s preliminary growth data also revealed a Q3 2015 growth of 0.3% compared to 0.4% during the previous quarter even though analysts were expecting this result. The report addressed Germany’s growth as ‘moderate’, however it was stated that the ratio of imports versus exports increased, and therefore had a negative impact on the overall growth level of the economy. Higher cost of imports also weighed on the economic growth of France, however a boost of household spending and also the increase of goods and services produced were able to erase any negative effects and turn the economy back into growth mode.

While there is moderate evidence of economic recovery, the markets remain unconvinced. And this is why the possibility of the ECB introducing additional measures during its next meeting is still on the table. At the beginning of the year it started a Quantitative Easing (QE) programme that included the monthly purchase of €60 billion worth of bonds as the main part of its measures to boost inflation. Signs of improvement for Q3 2015 were shown by the Eurozone’s biggest economies, but smaller economies that are currently struggling, such as the Portuguese economy, had no growth and there was contraction by the Greek and Finnish economies by 0.5% and 0.6% respectively. Hints of the ECB taking further action have been provided by the policymakers themselves. Last month a statement by the Bank said that its measures would be re-examined, while its President Mario Draghi said that the ECB is ready to extend its policy if needed.

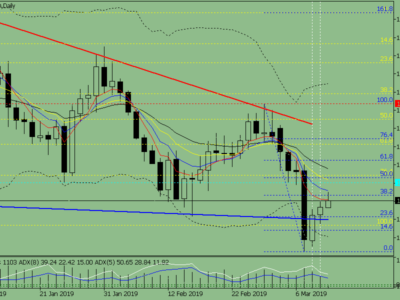

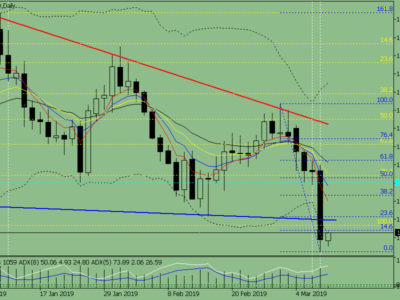

The EUR/USD is poised once again for an interesting week. Unless there will be a dramatic turnaround for the U.S. economy between now and its final meeting of the year, there is a solid possibility that the Federal Reserve might move with its first interest rate increase since 2006. And since there is only a limited amount of economic data coming up, the release of the U.S. Durable Goods Orders for October – expected on Wednesday 25 November at 13:30 GMT – is of increased importance. September’s data showed a drop by 1.2% and it will be interesting to see the markets’ reaction in case of a further slip. However, across the Atlantic, we may see some volatility with the euro on Monday morning after Friday’s devastating attacks in Paris.

The post Eurozone’s performance sabotaged by Paris attacks appeared first on Forex.Info.