Previous Story

EURUSD Daily Technical Outlook and Review. Friday 20th June

Posted On 20 Jun 2014

Comment: 0

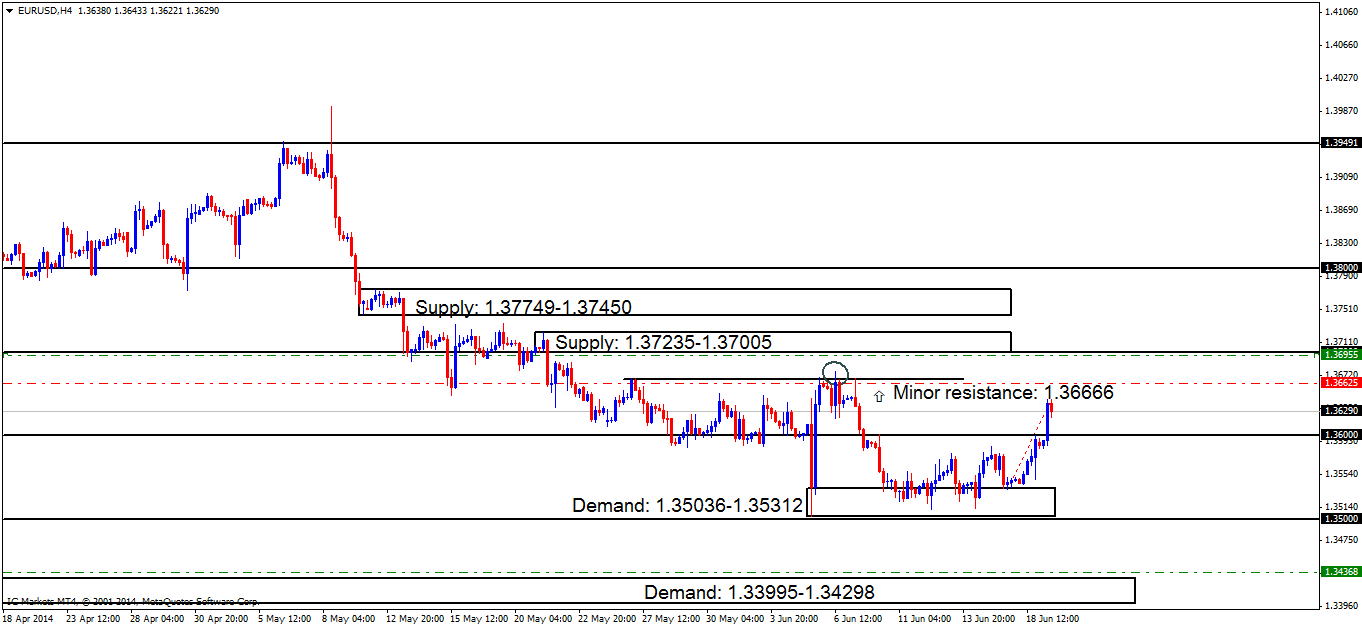

We can clearly see that on the daily timeframe, demand at 1.34770-1.35557 had active buyers within this area with the next trouble point for the buyers being seen at supply above (1.37342-1.36890).

4hr TF.

The buyers were taking no prisoners yesterday! There was little to no reaction seen, even at the round number 1.36000, which was our first target as we were long from demand below at 1.35378. Price came within 20 pips of our second target at 1.36666, and with the sellers seen showing interest around this area, it may be best to take what profit we have, and close the position, so all in all, a great trade on this pair, with a tidy profit locked in.

Pending/P.A confirmation orders:

- Pending buy orders (Green line) are seen around demand (1.33995-1.34298) at 1.34368. This demand area will more than likely see some sort of reaction due to its location seen to the left.

- The pending buy order (Green line) set at 1.35378 just above demand at 1.35036-1.35312 has now been closed. The second target at 1.36666 was nearly hit, so we decided to close our position very near its target.

- No P.A confirmation buy orders (Red line) are seen in the current market environment.

- Pending sell orders (Green line) seen at 1.36955 just below supply at 1.37235-1.37005 are set here since this level remains untouched, meaning unfilled orders are likely still set around this area.

- P.A confirmation sell orders (Red line) are visible below the minor resistance 1.36666 at 1.36625, this level has proved valid in the past, but still needs to be confirmed due to a spike/wick (circled) seen above resistance, which may have consumed most of the sellers originally there.Do be on your guard with these sell orders; the higher-timeframes are currently indicating that higher prices may be seen this week (Weekly demand: 1.34770-1.36771 Daily demand: 1.34770-1.35557).

- Areas to watch for buy orders: P.O: 1.34368 (SL: 1.33926 TP: Dependent on how price action approaches the zone) 1.35378 (Closed in profit) (SL: 1.34971 TP: [1] 1.36000 [2] 1.36666 [may be subject to change depending on approaching price action]). P.A.C: No P.A confirmation orders seen in the current market environment.

- Areas to watch for sell orders: P.O: 1.36955 (SL: 1.37270 TP: [1] 1.36666 [2] 1.36000) P.A.C:1.36625 (SL: 1.36810 TP: Dependent on where price ‘confirms’ the level).

- Most likely scenario: With the daily chart above showing room for price to move north, a fake out at the minor resistance level on the 4hr chart at 1.36666 up to supply at 1.37235-1.37005 may be seen, before any lower prices are visible.