EURUSD: Evening Target 1.1285

Yesterday”s Trading:

As I expected, the euro/dollar was in a correction phase throughout Monday. The euro regained against its US counterpart to 1.1342 after a reduction in New York manufacturing activity of -9.02 against a +6.50 expected rise. By trade close, the pair had returned to 1.1315. The movement fully coincided with forecasts.

Market Expectations:

Today trader attention is on UK and US inflation data. Three US Fed representatives will speak later. The day won”t be easy for the euro since the pound and Aussie are significantly up against all pairs in Asia.

The Aussie dollar strengthened 80 points following the publication of the RBAs minutes. The UK pound reacted up to the latest ORB survey for the Daily Telegraph regarding a possible Brexit.

The text of the minutes wasn”t as soft as had been expected. The regulator wanted to wait to receive additional data before dropping interest rates. The RBA took note of the improving labour market situation.

According to recent survey data, 55% of Brits want to remain in the EU. The pound/dollar rose 85 points to 1.4493, the euro/pound fell 50 points to 0.7810. Due to this the euro was under pressure in its pair with the US dollar.

With these swings the euro/dollar was able to return to 1.1338/45. During the US session I expect to see a fall to 1.1285. This is the only day when the sellers can update the minimum, afterwards traders will begin to set their positions before the US Fed”s minutes come out.

Day”s News (EET):

- 11:30, UK CPI and manufacturing inflation;

- 12:00, Eurozone balance of trade;

- 13:00, German monthly Bundesbank report;

- 15:30, Canadian changes in manufacturer sales in March;

- 15:30, US construction permits, CPI and foundations lain in April;

- 16:15, US industrial manufacturing in April;

- 19:00, FOMC members Lockhart and Williams to speak;

- 21:00, FOMC member Kaplan to speak.

Technical Analysis:

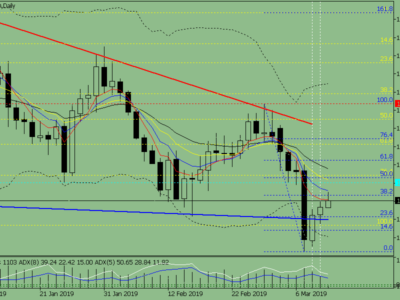

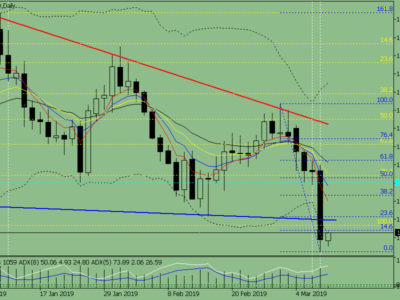

Intraday minimum: 1.1285, maximum: 1.1338, close: 1.1300.

Euro/dollar rate on the hourly. Source: tradingview

As of 6:50 EET, the market saw the euro/dollar trading at 1.1316. Taking the morning strengthening of the pound and Aussie dollar against the USD into account, I expect to see a restoral of the euro to 1.1338. I don”t write off a test of the trend line at 1.1345 either.

The pound and the Aussie have strengthened against the USD by 80 points apiece. Despite such a strengthening, I”ll take a risk for today in saying that the euro will fall to 1.1285. There”s no end to the bear trend with a 1.1616 maximum on the hourly.

Source:: EURUSD: Evening Target 1.1285