EURUSD: Expected Bounce to Trend Line as Part of Correction

Yesterday”s Trading:

On Thursday the euro/dollar was trading up and down. In the first half of the day the euro dropped to 1.1179 (under pressure from cross pairs), in the second it returned to 1.1227.

The minutes from the last FOMC meeting showed that the US Fed could lift the interest rates in June if the data is there to back up such a decision. At the same time, according to the latest data from CME Group FedWatch, on Thursday the likelihood of an interest rate rise dropped from 38% to 30%. I reckon that this is to do with the fact what Fed reps Fischer and Dudley had to say. They announced that the Fed will raise rates on the basis of fundamental data. This is nothing new, but it stopped the dollar rally short.

The US index for leading indicators showed a 0.6% rise in April (forecasted: 0.6%, previous: 0.0%).

The number of initial unemployment benefit applications in the US fell from 278k against a previous 294k the week earlier (forecasted 275k).

The manufacturing activity index from the Philadelphia Fed fell by -1.8% against a 3.5% forecasted rise and a previous -1.6%.

Market Expectations:

Today isn”t really full of news. Traders will be taking trading decisions based on the US Fed minutes and the recent economic data. An inverted (V) pattern formed on Thursday.

It came off structurally weak, but if the cross switches into a correctional phase before the week”s end, the euro/dollar will correct to 1.1260. Whilst the euro hasn”t corrected to the trend, I”m not considering a weakening of the euro against the USD.

Day”s News (EET):

- 13:00, UK industrial orders index;

- 15:30, Canadian CPI and retail sales;

- 17:00, US sales housing on the secondary market in April;

- 20:05, drilling rigs from Baker Hughes.

Technical Analysis:

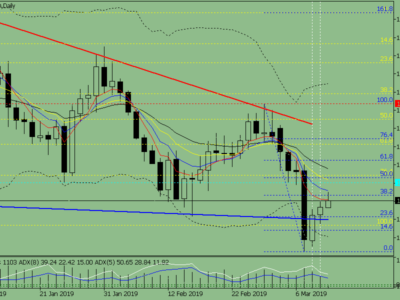

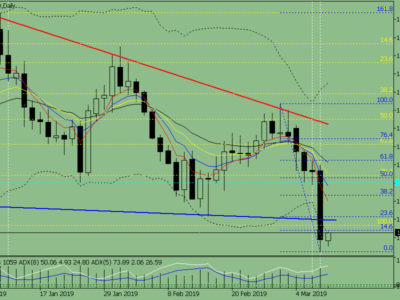

Intraday forecast: minimum: 1.1196 (current Asian), maximum: 1.1259, close: 1.1235.

Euro/dollar rate on the hourly. Source: TradingView

The technical picture in the euro/pound on the hourly is horrific. Such a fall of the euro against the pound leaves no chance for a correction. I”m saying that the cross will start its correction before the weekend and due to this the euro/dollar will correct to the 67th degree at 1.1259 or to the trend line which took its beginnings from 3rd May”s 1.1616 maximum. At the very least it ought to bounce to the 45th degree or the balance line.

Source:: EURUSD: Expected Bounce to Trend Line as Part of Correction