EURUSD in sideways

Previous:

Investor activity during the American session was low. Due to the lack of catalysers for movement, the EURUSD dropped to 1.1072 and then restored to 1.1088 by trade opening in Asia. The euro spent the day in a 33 point corridor range.

Market Expectations:

On Tuesday I am sticking with a bullish mood for the pair and reckon that, with support from the euro/pound, the euro/dollar will rise to 1.1128. The news is little, too little for it to rock the market. Due to this, the euro”s strengthening has a ceiling of 1.1150.

Day”s News (EET):

- 08:45, Swiss July unemployment level;

- 09:00, German June balance of trade;

- 11:30, UK production in manufacturing industries and industrial production in June. UK balance of trade for June;

- 15:15, Canadian foundations lain for new homes in June;

- 15:30, US productivity in the non-farm sector and labour force expenses in Q2 of 2016;

- 17:00, UK Q2 GDP assessment from NIESR and US index for economic optimism amongst consumers in August from IBD/TIPP.

Technical Analysis:

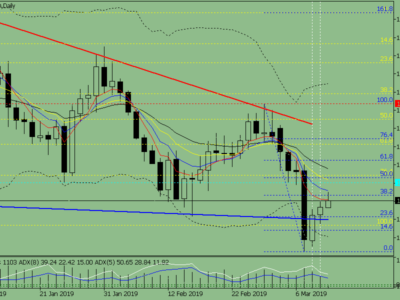

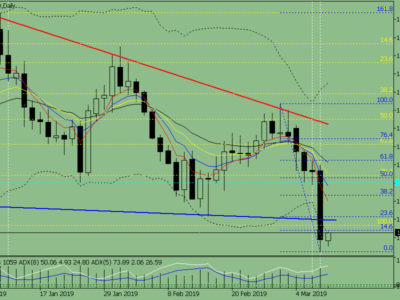

Intraday forecast: minimum: 1.1071 (current Asian), maximum: 1.1128, close: 1.1101.

Euro/dollar rate on the hourly. Source: TradingView

The euro dollar is still trading below the 45th degree and LB. Whilst traders within the price are banking on a rate drop from the BoE, the euro/pound will offer support to the euro/dollar.

When a cross rises with a weakening dollar, the euro/dollar rate sees a sharp rise. When a cross rises with a rising dollar, the euro/dollar consolidates in a sideways. The stronger the EUR/USD growth from its current level, the higher the likeliness of us seeing a test of 1.12.

Source:: EURUSD in sideways