EURUSD: Minimum Could Update Before FOMC Minutes

Yesterday”s Trading:

On Tuesday the euro/dollar closed slightly down, leaving the shade at a 1.1348 maximum. I can”t explain what caused the turnaround for the euro after the inflation report came out up. Perhaps it was because of rising oil prices.

When it became clear that the US April CPI came out better than expected, the euro/dollar fell to 1.1301.

We didn”t see any dollar rally for due to the positive manufacturing production data. The US manufacturing production index in April was 0.7% (forecasted: 0.2%, previous: -0.9%). Construction of new housing was also up, but that also couldn”t bring the dollar up with it. Yesterday”s statistical data started to be reflected in the Asian markets.

Market Expectations:

Today”s key event for the dollar is the FOMC minutes. On my forecast I expect to see a test of 1.1255/60 in the first half of the day, with a subsequent bounce to 1.1304 after the publication of the minutes.

Day”s News (EET):

- 11:30, UK labour market data: average wage changes, changes in applications for unemployment benefit, unemployment level;

- 12:00, Eurozone definitive April CPI;

- 16:30, UK March index of leading indicators from Conference Board.

- 17:30, US oil reserve changes 9-15th May;

- 21:00, US FOMC minutes.

Technical Analysis:

Intraday forecast: minimum: 1.1258, maximum: 1.1304, close: 1.1304.

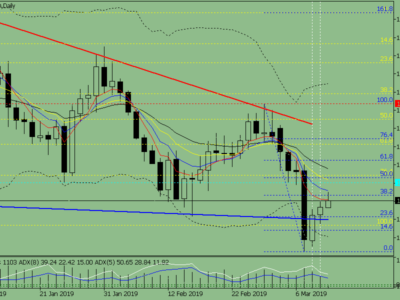

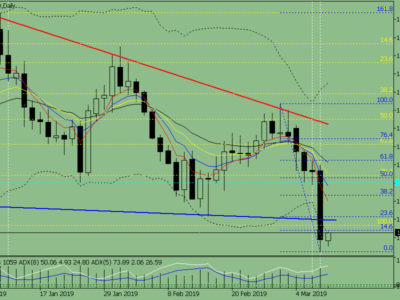

Euro/dollar rate on the hourly. Source: tradingview

I wrote above that I don”t know why the euro/dollar flipped from 1.1301. By the evening the sellers had closed off all of the growth and in Asia they chased the buyers back to 1.1284. In my forecast I”m waiting for a test of 1.1260. The correctional pattern from 1.1282 indicates a continuation of the bear trend. We need to get past the 1.1282 minimum from 13th May.

From the 67th degree I reckon there”ll be a euro bounce to 1.13. Why? Well, who would want to leave short positions open before the publication of the FOMC minute. Pretty much no one expects there to be a rise in US interest rates in June. If the euro doesn”t return to 1.13 by the close of the day, ready yourself for a weakening of the euro to 1.1080.