Expected Euro Correction to 1.1285 After Friday

Previous:

The euro/dollar was trading above the 112th degree on Friday before the American session. The rate was under pressure due to the dollar strengthening. This was caused by a weakening of the British pound after the publication of new Brexit survey results. According to data from the ORB for The Independent newspaper, 55% of respondents are ready to vote leave, with 45% to vote remain. The euro by US trading close was down to 1.1245.

The stats didn”t have much effect on the key currencies. The US consumer confidence index fell from 94.7 in May to 94.3 in June. It was forecasted to fall to 94. The index for consumer expectations fell from 84.9 to 83.2, with the index for current economic conditions rising from 109.9 to 111.7.

Market Expectations:

As you know, my Monday”s forecast always goes against Friday”s movements. The euro has updated its minimum in Asia. The dollar was being sold for 1.1250 euros at 7:14 EET. I expect a correctional movement to 1.1245 for the American session.

Market participant attention has drifted to the FOMC meeting on 15th June. The likelihood of a rate rise this month has fallen to 2%. The announcements made will be important for traders as they could hint at the date when rates will rise.

Day”s News (EET):

- 16:30, UK index for leading indicators from the CB.

Technical Analysis:

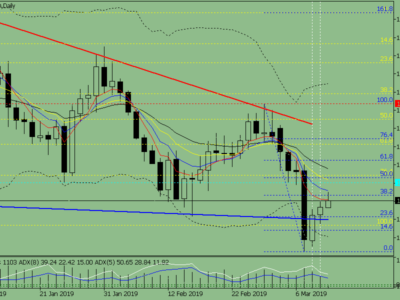

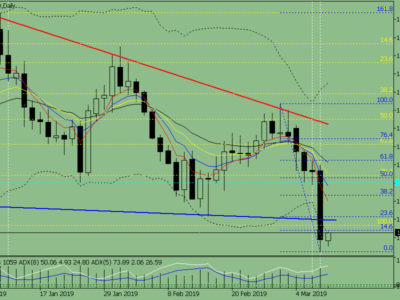

Intraday forecast: minimum: 1.1232 (current Asian), maximum: 1.1285, close: 1.1265.

Euro/dollar rate on the hourly. Source: TradingView

The fall in the euro from its 1.1415 maximum was 157 degrees. It isn”t an important support since the price could easily shift to 180 degrees or the D3 line. Since today is Monday and I”m always looking at movements against that of Friday, in my forecast I”ve gone for a revival of the euro to the 45th degree. This level will be further strengthened by the balance line in the evening, with the LB now at 1.1315 and the 112th degree from the 1.1415 maximum. The 112th and 45th degrees are forming a price knot at 1.1282-1.1285.

Earn from currency market fluctuations by investing in a Forex Investment Portfolio.