Forecast for USD/JPY on Jan 30, 2020

USD/JPY

Yesterday’s Fed meeting had a neutral effect on stock indices: Dow Jones added 0.04% while the S&P 500 fell 0.09%. Today in the Asian session, the Japanese Nikkei 225 lost 1.02%, the Australian S&P/ASX200 shed 0.19%, and the South Korean Kospi SEU index was down 0.45%. The yen is trading in the range of January 27-28 with a falling mood: on the daily chart, the price returned below the balance line, the signal line of the oscillator turned down in the bearish trend zone.

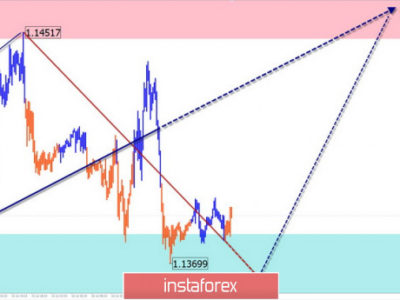

The purpose of the movement is the level of 108.50 – the peak of September 18, 2019. Consolidation under the level opens the more significant goal of 107.87 – the point of intersection of two trend lines of price channels: declining red and rising green.

On the H4 chart, the price reversed yesterday from the red indicator line of the balance, the price returned to the range of January 27-28. The Marlin oscillator is also returning to the bears zone. We are waiting for the price to fall to the magnetic point of 107.87.

In an alternative scenario, after the price goes above yesterday’s peak, growth may continue to the MACD line in the 109.70/85 range – here the resistance of this line is close on the charts of both scales.

The material has been provided by InstaForex Company – www.instaforex.com