Fractal analysis of Gold, Silver, and Oil on Apr 10, 2020

Forecast for April 10:

Analytical review in H1 scale:

For Gold, the main key levels on the H1 scale are: 1744.86, 1726.71, 1703.84, 1692.46, 1670.84, 1657.09 and 1638.66. Here, we are following the development of the local ascending structure of March 31. The continuation of the movement to the top is expected after the price passes the noise range 1692.46 – 1703.84. In this case, the target is 1726.71. For the potential value for the top, the level of 1744.86 can be considered, and near which, a consolidation and a possible rollback to correction can be expected.

Short-term downward movement is possible in the range of 1670.84 – 1657.09. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 1638.66. This level is a key support for the entire upward trend.

The main trend is the local structure for the top of March 31.

Trading recommendations:

Buy: 1704.00 Take profit: 1724.00

Buy: 1727.00 Take profit: 1744.00

Sell: 1670.00 Take profit: 1658.00

Sell: 1656.00 Take profit: 1640.00

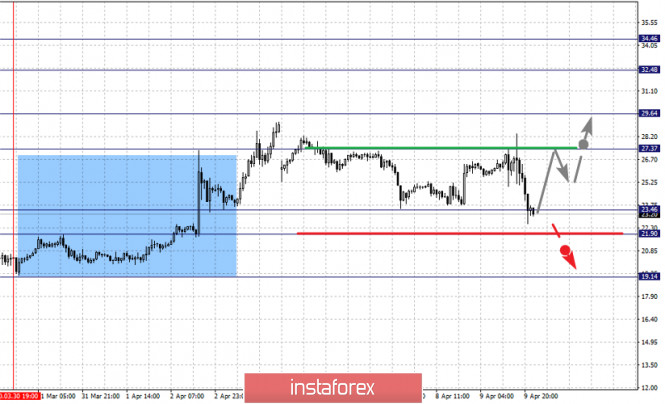

For Oil, the main key levels on the H1 scale are: 34.46, 32.48, 29.64, 27.37, 23.46, 21.90, and 19.14. Here, we are following the formation of medium-term initial conditions for the top of March 30. At the moment, the price is in deep correction. The continuation of the upward movement is expected after the breakdown of the level of 27.37. In this case, the first goal is 29.64. The breakdown of this level will lead to the development of an upward cycle in the scale of H1 and H4. For the potential value for the top, it is still considered at the level of 34.46.

Short-term downward movement is possible in the range of 23.46 – 21.90, hence, there is a high probability of an upward reversal. The breakdown of the level of 21.90 will lead to the development of a downward structure. In this case, the first goal is 19.14.

The main trend is the formation of a medium-term upward structure from March 30, the stage of deep correction.

Trading recommendations:

Buy: 27.40 Take profit: 29.60

Buy: 29.70 Take profit: 32.40

Sell: 23.46 Take profit: 22.00

Sell: 21.70 Take profit: 19.75

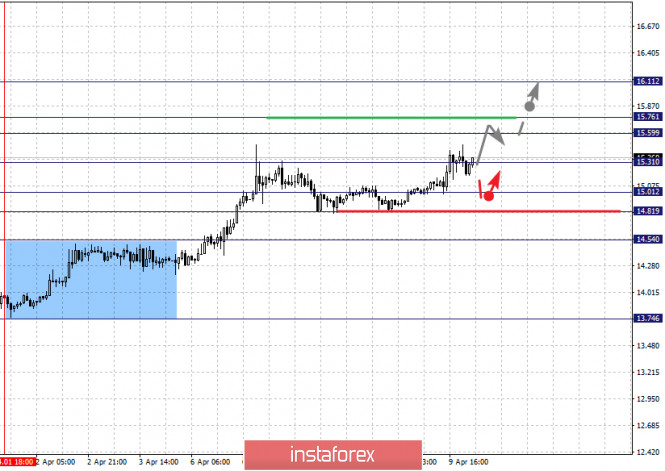

For Silver, the main key levels on the H1 scale are: 16.11, 15.76, 15.59, 15.31, 15.01, 14.81 and 14.54. Here, we are following the development of the local ascendant structure from April 1. The continuation of the movement to the top is expected after the breakdown of the level of 15.31. In this case, the target is 15.59. On the other hand, price consolidation is in the range of 15.59 – 15.76. For the potential value for the top, we consider the level of 16.11. The movement to which is expected after the breakdown of the level of 15.76.

Short-term downward movement is possible in the range of 15.01 – 14.81. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 14.54. This level is a key support for the top.

The main trend is the local structure for the top of April 1.

Trading recommendations:

Buy: 15.33 Take profit: 15.59

Buy: 15.77 Take profit: 16.10

Sell: 15.01 Take profit: 14.81

Sell: 14.78 Take profit: 14.55

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Fractal analysis of Gold, Silver, and Oil on April 10