Fractal analysis of Gold, Silver, and Oil on Apr 14, 2020

Forecast for April 14:

Analytical review in H1 scale:

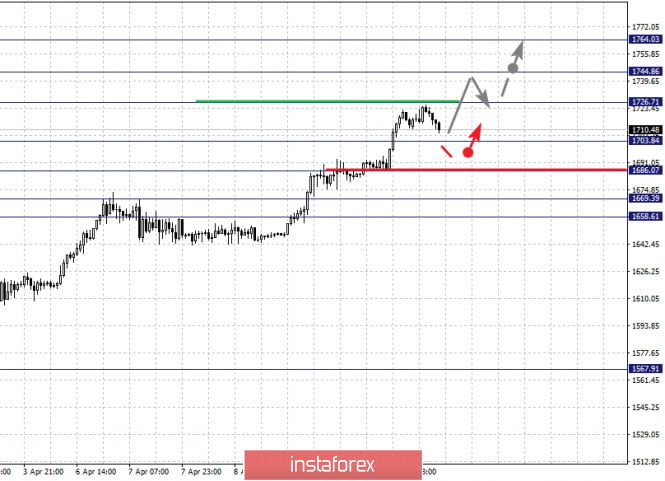

For Gold, the main key levels on the H1 scale are: 1764.03, 1744.86, 1726.71, 1703.84, 1686.07, 1669.39 and 1658.61. Here, we are following the development of the local ascending structure of March 31. The continuation of the movement to the top is expected after the breakdown of the level of 1726.71. In this case, the target is 1744.86. Price consolidation is near this level. For the potential value for the top, we consider the level of 1764.03. Upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is possibly in the range of 1703.84 – 1686.07. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1669.39. The range of 1669.39 – 1658.61 is a key support for the entire upward trend.

The main trend is the local structure for the top of March 31.

Trading recommendations:

Buy: 1727.00 Take profit: 1744.00

Buy: 1746.00 Take profit: 1764.00

Sell: 1703.00 Take profit: 1787.00

Sell: 1784.00 Take profit: 1670.00

For Oil, the main key levels on the H1 scale are: 34.46, 32.48, 29.64, 27.37, 25.26, 23.46, 21.90 and 19.14. Here, we are following the formation of medium-term initial conditions for the top of March 30. At the moment, the price is in deep correction. The continuation of the movement to the top is expected after the breakdown of the level of 25.26. In this case, the first goal is 27.37. The breakdown of which, in turn, will allow us to count on the development of the main cycle. Here, the goal is 29.64. For the potential value for the top, we consider the level of 34.46.

On the other hand, consolidated movement is possibly in the range of 23.46 – 21.90, hence, there is a high probability of a reversal to the top. The breakdown of the level of 21.90 will lead to the development of a downward structure. In this case, the first goal is 19.14.

The main trend is the formation of a medium-term upward structure from March 30, the stage of deep correction

Trading recommendations:

Buy: 25.30 Take profit: 27.30

Buy: 27.40 Take profit: 29.60

Sell: Take profit:

Sell: 21.70 Take profit: 19.75

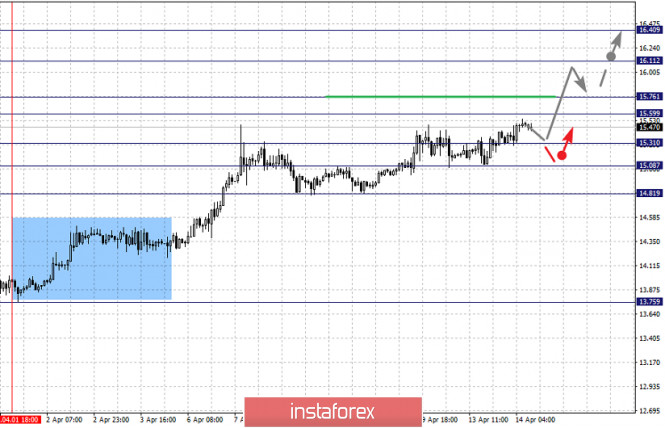

For Silver, the main key levels on the H1 scale are: 16.40, 16.11, 15.76, 15.59, 15.31, 15.08 and 14.81. Here, we are following the development of the local ascendant structure from April 1. The continuation of the movement to the top is expected after the price passes the noise range of 15.59 – 15.76. In this case, the target is 16.11. For the potential value for the top, we consider the level of 16.40. Upon reaching which, we expect consolidation, as well as a pullback to the bottom.

Short-term downward movement is possibly in the range of 15.31 – 15.08. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 14.81. This level is a key support for the top.

The main trend is the local structure for the top of April 1.

Trading recommendations:

Buy: 15.77 Take profit: 16.10

Buy: 16.13 Take profit: 16.40

Sell: 15.31 Take profit: 15.10

Sell: 15.06 Take profit: 14.81

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Fractal analysis of Gold, Silver, and Oil on April 14