Fractal analysis of main currency pairs on June 29, 2020

For the euro/dollar pair, the price is close to the cancellation of the downward structure of June 23, for which a breakdown of 1.1290 is necessary. For the pound/dollar pair, we are watching the descending structure of June 24. The level of 1.2475 is the key support for the bottom. For the dollar/franc pair, monitor the formation of initial conditions for the top of June 23. The level of 0.9508 is the key resistance. For the dollar/yen pair, the development of the upward trend of June 23 is expected to continue after the price passes the noise range 107.23 – 107.37. For the euro/yen pair, the range of 119.91 – 119.67 is a key support for the top of June 22. For the pound/yen pair, the next goals were determined from the descending structure on June 23. The level of 132.03 is the key resistance, while the level of 133.08 is the key support.

Forecast for June 29:

Analytical review of currency pairs on the scale of H1:

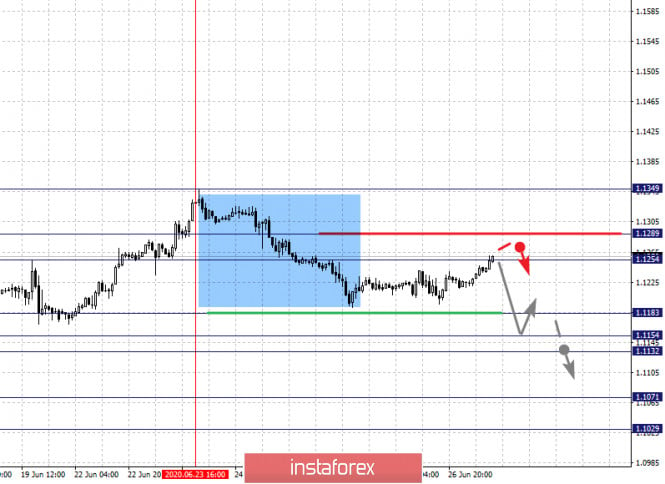

The key levels for the euro / dollar pair on the H1 scale are: 1.1289, 1.1254, 1.1232, 1.1183, 1.1154, 1.1132, 1.1071 and 1.1029. Here, we are following the formation of the descending structure of June 23. At the moment, the price is in correction. Whe continuation of the downward movement is expected after the breakdown of the level of 1.1183. In this case, the goal is 1.1154. The price passing the noise range 1.1154 – 1.1132 will lead to the development of a pronounced downward movement. Here, the goal is 1.1071. For the potential value for the bottom, we consider the level of 1.1029. We expect an upward pullback upon reaching which.

A short-term upward movement is possible in the range of 1.1254 – 1.1289. The breakdown of the last level will lead to the formation of an ascending structure. In this case, the potential target is 1.1349. We expect the initial conditions for the top to be formed to this level.

The main trend is the formation of the downward structure of June 23, the correction stage

Trading recommendations:

Buy: 1.1255 Take profit: 1.1287

Buy: 1.1292 Take profit: 1.1346

Sell: 1.1183 Take profit: 1.1155

Sell: 1.1130 Take profit: 1.1080

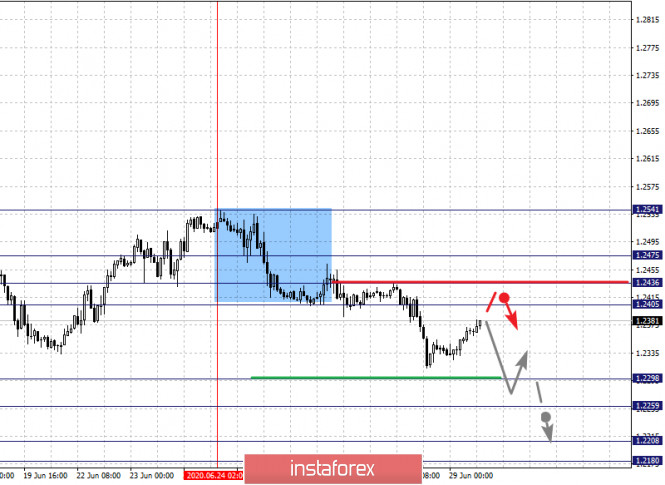

The key levels for the pound / dollar pair on the H1 scale are: 1.2541, 1.2475, 1.2436, 1.2405, 1.2298, 1.2259, 1.2208 and 1.2180. Here, we follow the descending structure of June 24. A short-term downward movement is expected in the range 1.2298 – 1.2259. The breakdown of the last level should be accompanied by a pronounced downward movement. In this case, the target is 1.2208. Price consolidation is in the range of 1.2208 – 1.2180.

A short-term upward movement is expected in the range of 1.2405 – 1.2436. The breakdown of the last level will lead to a deeper movement. Here, the target is 1.2475. This level is a key support for the bottom and the price passing this level will lead to the formation of initial conditions for the top. In this case, the potential target is 1.2541 .

The main trend is the descending structure of June 24

Trading recommendations:

Buy: 1.2405 Take profit: 1.2434

Buy: 1.2437 Take profit: 1.2475

Sell: 1.2298 Take profit: 1.2260

Sell: 1.2257 Take profit: 1.2208

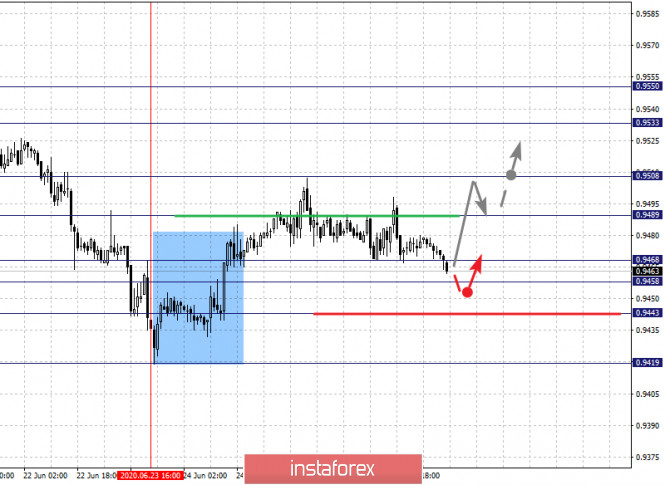

The key levels for the dollar / franc pair on the H1 scale are: 0.9550, 0.9533, 0.9508, 0.9489, 0.9468, 0.9458 and 0.9443. Here, we are following the formation of the initial conditions for the top of June 23. A short-term upward movement is expected in the range of 0.9489 – 0.9508. The breakdown of the last level will lead to a pronounced upward movement. Here, the target is 0.9533. For the potential value for the top, we consider the level of 0.9550. Upon reaching which, we expect consolidation, as well as a downward pullback.

A consolidated movement is possible in the range of 0.9468 – 0.9458. The breakdown of the latter value will lead to a deeper correction. In this case, the target is 0.9443. This is the key support level for the top.

The main trend is the formation of initial conditions for the top of June 23

Trading recommendations:

Buy : 0.9490 Take profit: 0.9505

Buy : 0.9510 Take profit: 0.9533

Sell: 0.9457 Take profit: 0.9445

Sell: 0.9440 Take profit: 0.9422

The key levels for the dollar / yen pair on the scale are : 108.28, 107.95, 107.70, 107.37, 107.23, 106.94, 106.79 and 106.56. Here, we are following the construction of potential for the top of June 23. The continuation of the upward movement is expected after the price passes the noise range 107.23 – 107.37. In this case, the target is 107.70. A short-term upward movement, as well as consolidation are in the range of 107.70 – 107.95. We consider the level of 108.28 to be a potential value for the top. Upon reaching which, we expect a downward pullback.

A short-term downward movement is possible in the range of 106.94 – 106.79. The breakdown of the last level will lead to a deeper correction. Here, the target is 106.56. This is a key support level for the top.

The main trend is building potential for the top of June 23

Trading recommendations:

Buy: 107.37 Take profit: 107.70

Buy : 107.72 Take profit: 107.92

Sell: 106.94 Take profit: 106.80

Sell: 106.75 Take profit: 106.56

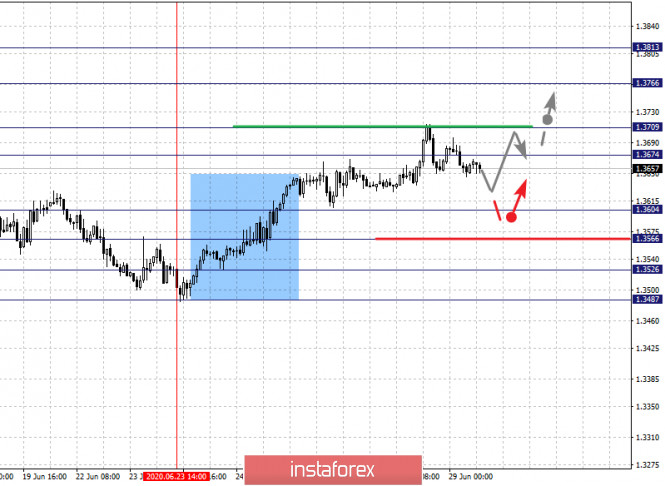

The key levels for the Canadian dollar / US dollar pair on the H1 scale are: 1.3813, 1.3766, 1.3709, 1.3674, 1.3604, 1.3566, 1.3526 and 1.3487. Here, the price forms the potential for the top of June 23. The continuation of the upward movement is expected after the breakdown of the level of 1.3674. In this case, the target is 1.3709. Price consolidation is near this level. The breakdown of the level of 1.3709 will lead to a pronounced upward movement. Here, the target is 1.3766. The potential value for the top is the level 1.3813. Upon reaching which, we expect consolidation, as well as a downward pullback.

A short-term downward movement is possible in the range of 1.3604 – 1.3566. The breakdown of the last level will lead to a deeper correction. Here, the target is 1.3526. This is a key support level for the top and the price passing this level will lead to the development of a downward structure. In this case, the first potential target is 1.3487.

The main trend is the formation of the upward potential of June 23

Trading recommendations:

Buy: 1.3674 Take profit: 1.3707

Buy : 1.3711 Take profit: 1.3765

Sell: 1.3604 Take profit: 1.3570

Sell: 1.3564 Take profit: 1.3526

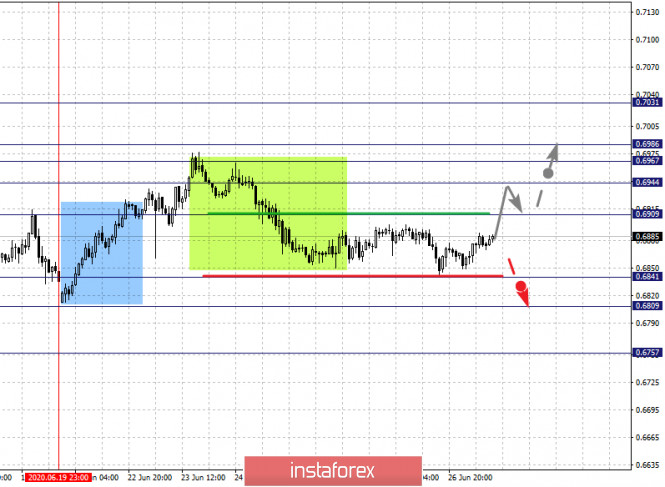

The key levels for the Australian dollar / US dollar pair on the H1 scale are : 0.7031, 0.6986, 0.6967, 0.6944, 0.6909, 0.6841, 0.6809 and 0.6757. Here, we follow the local rising structure of June 19th. The continuation of the upward movement is expected after the breakdown of the level of 0.6909. In this case, the first target is 0.6944. The breakdown of which will lead to a movement to the level of 0.6967. The price passing the noise range 0.6967 – 0.6986 should be accompanied by a pronounced upward movement. Here, the target is 0.7031. Price consolidation is near this level.

The resumption of the development of a downward trend is possible after a breakdown of the level of 0.6840. Here, the first goal is 0.6809. The breakdown of which should be accompanied by a pronounced downward movement. Here, the potential target is 0.6757.

The main trend is the local upward structure of June 19

Trading recommendations:

Buy: 0.6910 Take profit: 0.6942

Buy: 0.6945 Take profit: 0.6967

Sell : 0.6840 Take profit : 0.6810

Sell: 0.6807 Take profit: 0.6760

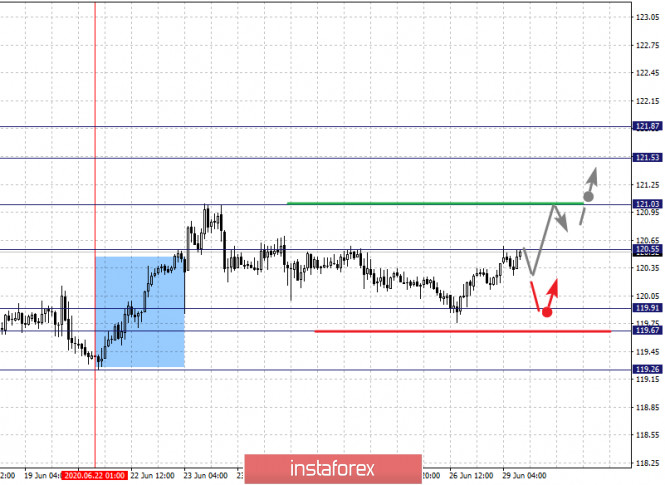

The key levels for the euro / yen pair on the H1 scale are: 121.87, 121.53, 121.03, 120.55, 119.91, 119.67 and 119.26. Here, we are following the ascending structure of June 22. The continuation of the upward movement is expected after the breakdown of the level of 120.55. In this case, the target is 121.03. Price consolidation is near this level and its breakdown should be accompanied by a pronounced upward movement. Here, the goal is 121.53. For the potential value for the top, we consider the level of 121.87. Upon reaching which, we expect a downward pullback.

A short-term downward movement is possible in the range of 119.91 – 119.67. This range is a key support for the top and the price passing this level will favor the development of a downward structure. In this case, the first potential target is 119.26.

The main trend is the formation of initial conditions for the top of June 22

Trading recommendations:

Buy: 120.55 Take profit: 121.00

Buy: 121.05 Take profit: 121.50

Sell: 119.90 Take profit: 119.70

Sell: 119.65 Take profit: 119.26

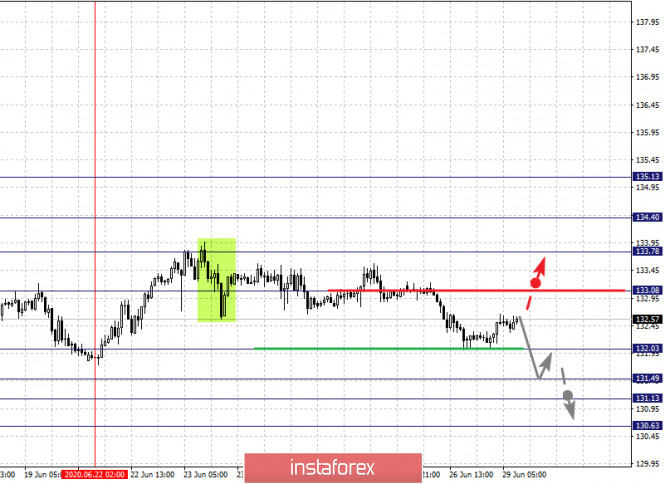

The key levels for the pound / yen pair on the H1 scale are: 135.13, 134.40, 133.78, 133.08, 132.02, 131.49, 131.13 and 130.63. Here, we expect the development of the downward structure from June 23 after the breakdown of the level of 132.03. In this case, the target is 131.49. Price consolidation is in the range of 131.49 – 131.13. We consider the level of 130.63 to be a potential value for the bottom. Upon reaching which, we expect consolidation, as well as an upward pullback.

The level of 133.08 is a key support for the downward movement and its breakdown will lead to the formation of local initial conditions for the top. In this case, the first goal is 133.78. Price consolidation is near this level. In general, a pronounced ascending structure is expected to the level of 134.40.

The main trend is the descending structure of June 23

Trading recommendations:

Buy: 133.10 Take profit: 133.75

Buy: 133.80 Take profit: 134.40

Sell: 132.00 Take profit: 131.50

Sell: 131.13 Take profit: 130.65

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Fractal analysis of main currency pairs on June 29th