Fractal analysis of the main currency pairs for Apr 17, 2020

Forecast for April 17:

Analytical review of currency pairs on the scale of H1:

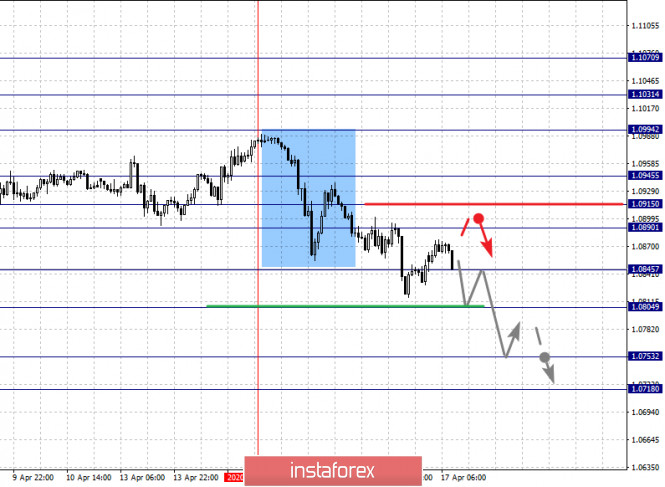

For the euro / dollar pair, the key levels on the H1 scale are: 1.0994, 1.0945, 1.0915, 1.0890, 1.0845, 1.0804, 1.0753 and 1.0718. Here, we are following the development of the initial conditions for the downward cycle of April 14. The continuation of the movement to the bottom is expected after the price breaks through the level of 1.0845. In this case, the target is 1.0804 and consolidation is near this level. The breakdown of the level of 1.0804 should be accompanied by a pronounced downward movement. Here, the target is 1.0753. We consider the level of 1.0718 to be a potential value for the downward trend. Upon reaching which, we expect consolidation as well as an upward pullback.

A short-term upward movement is possible in the range 1.0890 – 1.0915. Breaking through the last value will lead to an in-depth correction. Here, the target is 1.0945. This level is a key support for the downward structure. Its passage in price will lead to the formation of initial conditions for the top, where the potential target is 1.0994.

The main trend is the initial conditions for the downward cycle of April 14.

Trading recommendations:

Buy: 1.0890 Take profit: 1.0913

Buy: 1.0920 Take profit: 1.0945

Sell: 1.0845 Take profit: 1.0808

Sell: 1.0800 Take profit: 1.0755

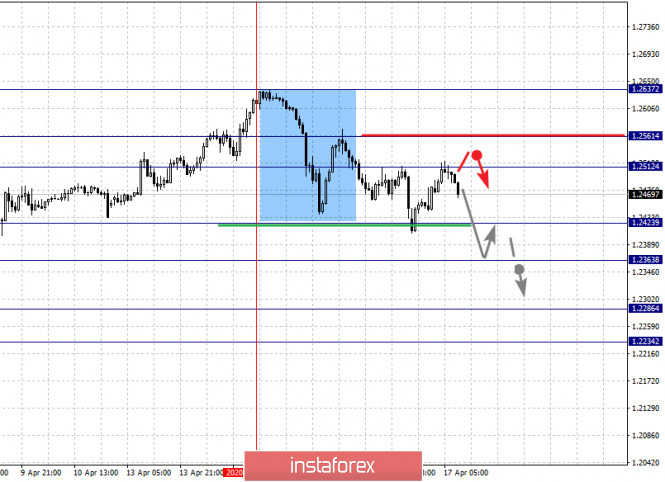

For the pound / dollar pair, the key levels on the H1 scale are: 1.2637, 1.2561, 1.2512, 1.2423, 1.2363, 1.2286 and 1.2234. Here, we are following the formation of the initial conditions for the downward cycle of April 14. The continuation of the downward movement is expected after the breakdown of the level of 1.2423. In this case, the target is 1.2363 and price consolidation is near this level. Breaking through the level of 1.2363 will lead to the development of pronounced movement. Here, the goal is 1.2286. For the potential value for the downward trend, we consider the level of 1.2234. Upon reaching this level, we expect consolidation, as well as an upward pullback.

A short-term upward movement is possible in the range of 1.2512 – 1.2561. Breaking through the latter value will lead to the formation of initial conditions for the top. In this case, the potential target is 1.2637.

The main trend is the initial conditions for the downward cycle of April 14.

Trading recommendations:

Buy: 1.2512 Take profit: 1.2560

Buy: 1.2566 Take profit: 1.2630

Sell: 1.2423 Take profit: 1.2370

Sell: 1.2360 Take profit: 1.2290

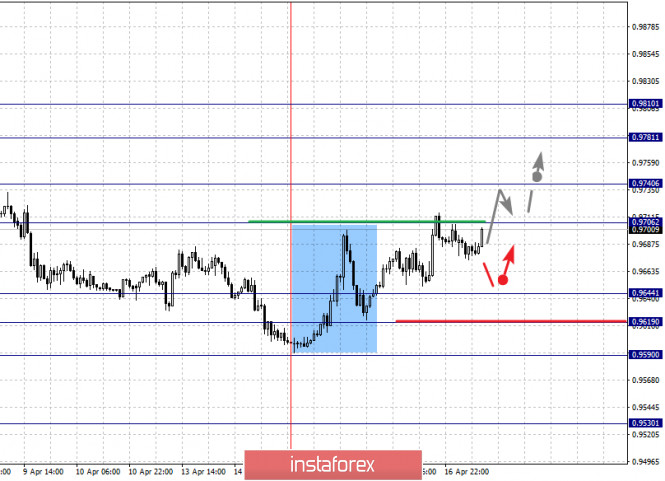

For the dollar / franc pair, the key levels on the H1 scale are: 0.9810, 0.9781, 0.9740, 0.9706, 0.9644, 0.9619, 0.9590 and 0.9530. Here, we are following the formation of the initial conditions for the upward cycle of April 14. The continuation of the upward movement is expected after the break through of the level of 0.9706. In this case, the target is 0.9740, where consolidation is near this level. After the price overcomes this level, it will lead to the development of a pronounced upward movement. In this case, the target is 0.9781. For the potential value for the top, we consider the level of 0.9810. Upon reaching which, we expect consolidation, as well as a downward pullback.

A short-term downward movement is possibly in the range of 0.9644 – 0.9619. Breaking through the latter value will favor the development of a downward movement. Here, the first goal is 0.9590. For the potential value for the downward movement, we consider the level of 0.9530.

The main trend is the formation of initial conditions for the upward cycle of April 14.

Trading recommendations:

Buy : 0.9706 Take profit: 0.9735

Buy : 0.9742 Take profit: 0.9780

Sell: 0.9644 Take profit: 0.9622

Sell: 0.9618 Take profit: 0.9590

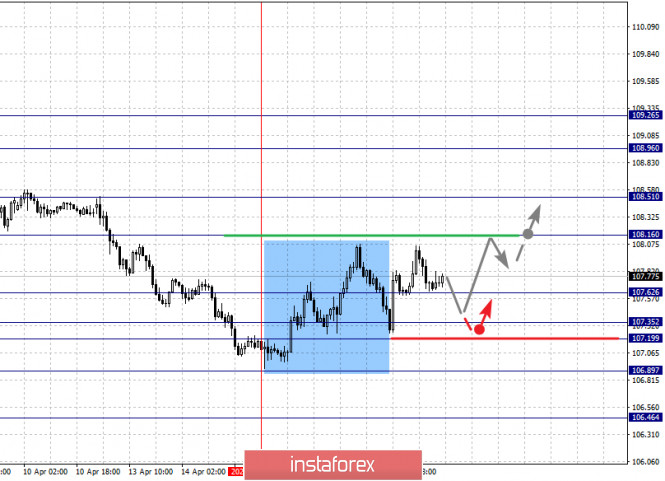

For the dollar / yen pair, the key levels on the scale are : 109.26, 108.96, 108.51, 108.16, 107.62, 107.35, 107.19 and 106.89. Here, we are following the initial conditions for the top of April 15. The continuation of the movement to the top is expected after the breakdown of the level of 108.16. In this case, the target is 108.51 and price consolidation is near this level. The breakdown of the level of 108.51 will lead to a pronounced upward movement. In this case, the target is 108.96. For the potential value for the bottom, we consider the level of 109.26. Upon reaching this level, we expect a downward pullback.

A short-term downward movement is possibly in the range of 107.62 – 107.35. The range between 107.35 – 107.19 is a key support for the top and price overcoming it will lead to the development of a downward structure. In this case, the potential target is 106.89.

The main trend: initial conditions for the top of April 15.

Trading recommendations:

Buy: 108.16 Take profit: 108.50

Buy : 108.56 Take profit: 108.96

Sell: 107.58 Take profit: 107.38

Sell: 107.19 Take profit: 106.90

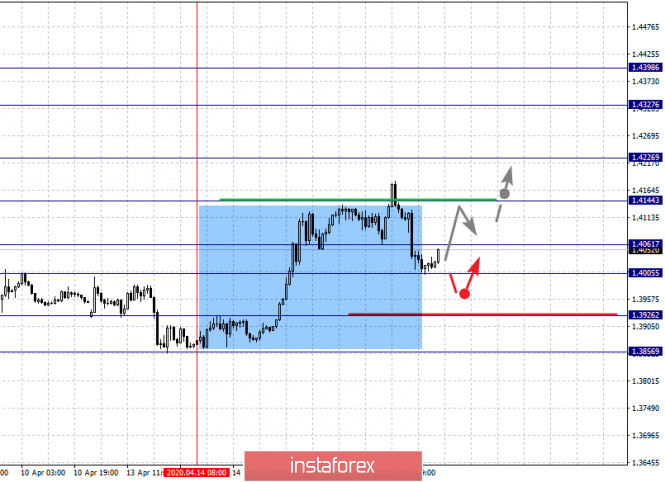

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.4398, 1.4327, 1.4226, 1.4144, 1.4061, 1.4005, 1.3926 and 1.3856. Here, we are following the formation of a medium-term ascendant structure of April 14. The continuation of the upward movement is expected after the breakdown of the level of 1.4144. In this case, the target is 1.4226 and price consolidation is near this level. The breakdown of the level of 1.4226 will lead to the development of a pronounced upward movement. In this case, the target is 1.4327. For the potential value for the top, we consider the level of 1.4398. Upon reaching which, we expect consolidation, as well as a downward pullback.

A short-term downward movement is possible in the range of 1.4061 – 1.4005. The breakdown of the latter value will lead to a long correction. In this case, the target is 1.3926. This level is a key support for the top.

The main trend is the formation of medium-term initial conditions for the upward movement of April 14.

Trading recommendations:

Buy: 1.4145 Take profit: 1.4220

Buy : 1.4230 Take profit: 1.4325

Sell: 1.4060 Take profit: 1.4010

Sell: 1.4000 Take profit: 1.3940

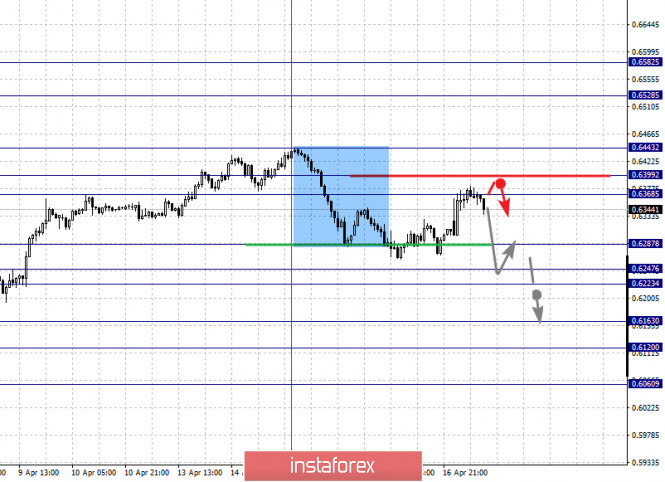

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6443, 0.6368, 0.6328, 0.6296, 0.6247, 0.6223, 0.6163, 0.6120 and 0.6060. Here, we are following the formation of the initial conditions for the downward cycle of April 14. The continuation of the downward movement is expected after the price passes the noise range 0.6247 – 0.6223. In this case, the target is 0.6163. A short-term downward movement, as well as consolidation is in the range of 0.6163 – 0.6120. For the potential value for the bottom, we consider the level 0.6060. Upon reaching which, we expect a pullback to the top.

A short-term upward movement is possible in the range of 0.6296 – 0.6328. The breakdown of the last value will lead to an in-depth correction. Here, the target is 0.6368. This level is a key support for the downward structure and its breakdown will lead to the formation of initial conditions for the upward cycle. Here, the first goal is 0.6443.

The main trend is the formation of initial conditions for the downward cycle of April 14.

Trading recommendations:

Buy: 0.6368 Take profit: 0.6395

Buy: 0.6400 Take profit: 0.6440

Sell : 0.6287 Take profit : 0.6247

Sell: 0.6220 Take profit: 0.6165

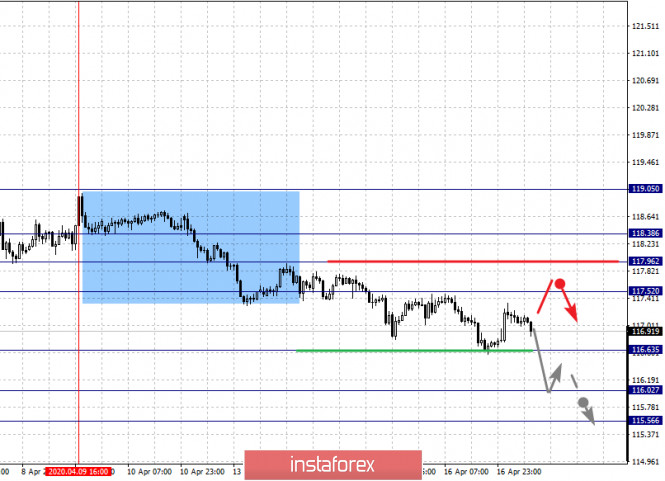

For the euro / yen pair, the key levels on the H1 scale are: 118.38, 117.96, 117.52, 116.63, 116.02 and 115.56. Here, we are following the formation of the descending structure of April 9. The continuation of the downward movement is expected after the breakdown of the level of 116.63. In this case, the goal is 116.02. For the potential value for the bottom, we consider the level of 115.56. Upon reaching which, we expect consolidation, as well as an upward pullback.

A short-term upward movement is possible in the range of 117.52 – 117.96. Breaking through the last value will lead to an in-depth correction. Here, the goal is 118.38. This level is a key support for the downward structure.

The main trend is the descending structure of April 9.

Trading recommendations:

Buy: 117.52 Take profit: 117.94

Buy: 117.98 Take profit: 118.36

Sell: 116.60 Take profit: 116.10

Sell: 116.00 Take profit: 115.60

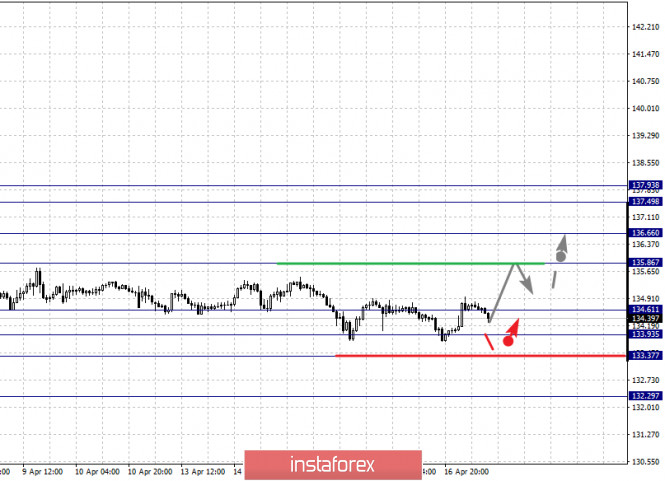

For the pound / yen pair, the key levels on the H1 scale are : 137.93, 137.49, 136.66, 135.86, 134.61, 133.93, 133.37 and 132.29. Here, we determine the subsequent goals for the top from the local ascending structure on April 3. The continuation of the development of the upward trend is expected after the breakdown of the level of 135.86. In this case, the target is 136.66 and price consolidation is near this level. Breaking through the level of 136.66 should be accompanied by a pronounced upward movement. Here, the target is 137.93. Price consolidation is in the range of 137.93 – 137.49 and from here, we expect a reversal in correction.

A short-term downward movement is possible in the range of 134.61 – 133.93. The range of 133.93 – 133.37 is the key support for the upward structure from April 3. Its passage at the price will lead to the formation of a downward structure. In this case, the potential target is 132.29.

The main trend is the equilibrium state.

Trading recommendations:

Buy: 135.86 Take profit: 136.60

Buy: 136.70 Take profit: 137.49

Sell: 134.60 Take profit: 134.00

Sell: 133.90 Take profit: 133.40

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Fractal analysis of the main currency pairs for April 17