Fractal analysis of the main currency pairs on June 25, 2020

Outlook for June 25:

Analytical review of currency pairs on the scale of H1:

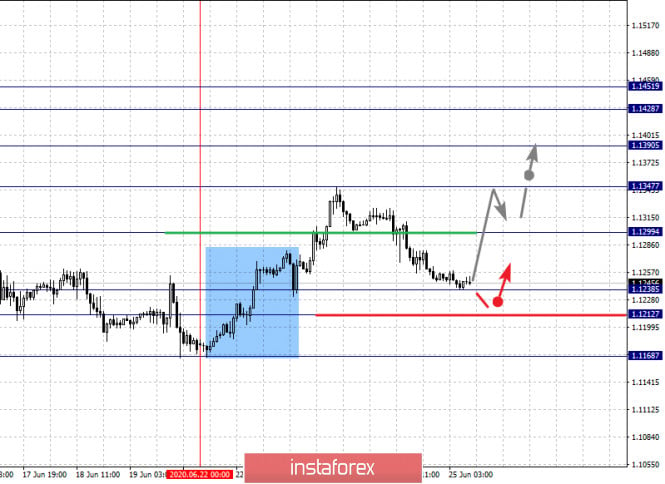

The key levels for the euro / dollar pair on the H1 scale are: 1.1451, 1.1428, 1.1390, 1.1347, 1.1299, 1.1238, 1.1212 and 1.1168. Here, the price is close to the cancellation of the upward structure from June 22, which requires passing the noise range 1.1238 – 1.1212. In this case, the potential target is 1.1168. The continuation of the upward movement is expected after the breakdown of the level of 1.1299. In this case, the first target is 1.1347. The breakdown of which, in turn, will allow you to count on movement to the level of 1.1390. Price consolidation is near this level. The breakdown of the level of 1.1390 will lead to movement to a potential target – 1.1451. Upon reaching which, we expect consolidation in the range 1.1428 – 1.1451.

The main trend is the ascending structure of June 22, the stage of deep correction

Trading recommendations:

Buy: 1.1300 Take profit: 1.1345

Buy: 1.1348 Take profit: 1.1390

Sell: 1.1238 Take profit: 1.1213

Sell: 1.1210 Take profit: 1.1168

The key levels for the pound / dollar pair on the H1 scale are: 1.2745, 1.2684, 1.2638, 1.2572, 1.2488, 1.2419, 1.2388 and 1.2334. Here, the price is close to the cancellation of the upward structure from June 22nd, which requires passage of the noise range 1.2419 – 1.2388, in this case, the potential target is 1.2334. The continuation of the upward movement is expected after the breakdown of the level of 1.2488. In this case, the target is 1.2572. Price consolidation is near this level. The breakdown of the level of 1.2572 will lead to a pronounced upward movement. In this case, the target is 1.2638. Price consolidation is in the range of 1.2638 – 1.2684. For the potential value for the top, we consider the level of 1.2745. Upon reaching which, we expect a downward pullback.

The main trend is the formation of initial conditions for the top of June 22, the stage of deep correction

Trading recommendations:

Buy: 1.2574 Take profit: 1.2638

Buy: 1.2488 Take profit: 1.2570

Sell: 1.2386 Take profit: 1.2335

Sell: Take profit:

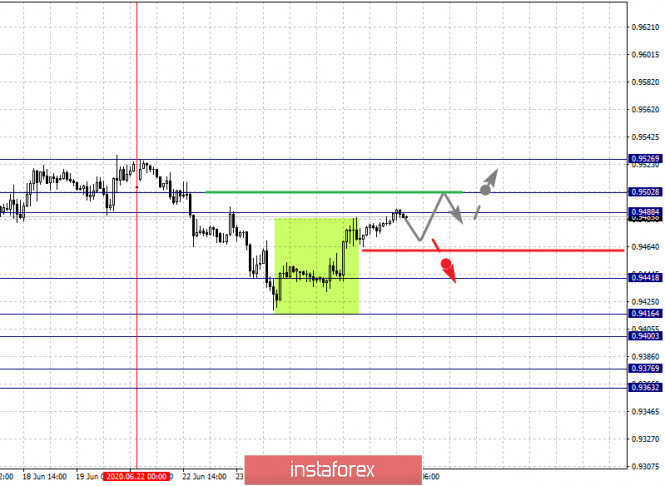

The key levels for the dollar / franc pair on the H1 scale are: 0.9526, 0.9502, 0.9488, 0.9441, 0.9416, 0.9400, 0.9376 and 0.9363. Here, the price is close to the cancellation of the downward structure of June 22, which requires a breakdown of the noise range of 0.9488 – 0.9502. In this case, the potential target is 0.9526. The continuation of the downward movement is expected after the breakdown of the level of 0.9441. In this case, the first target is 0.9416. Price consolidation is in the range of 0.9416 – 0.9400. The breakdown of the last level will lead to a pronounced downward movement. Here, the target is 0.9376. We consider the level of 0.9363 to be a potential value for the bottom. Upon reaching which, we expect consolidation in the range of 0.9363 – 0.9376, as well as an upward pullback.

The main trend is the local descending structure of June 22, the stage of deep correction

Trading recommendations:

Buy : 0.9502 Take profit: 0.9526

Buy : Take profit:

Sell: 0.9440 Take profit: 0.9416

Sell: 0.9400 Take profit: 0.9377

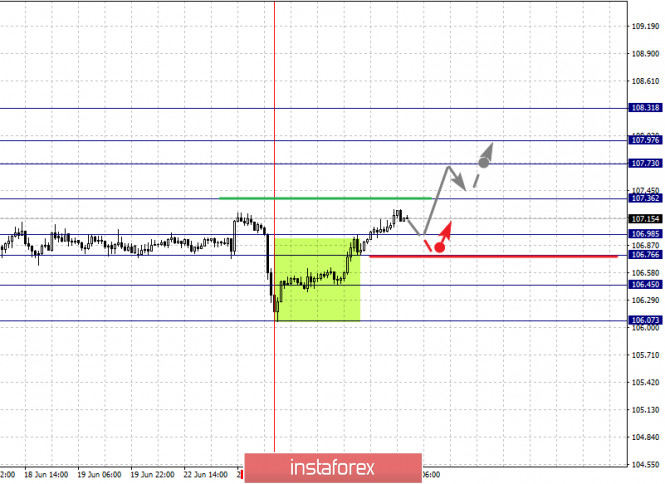

The key levels for the dollar / yen pair on the scale are: 108.31, 107.97, 107.73, 107.36, 106.98, 106.76, 106.45 and 106.07. Here, the price has canceled the formation of the downward structure and at the moment, we are following the formation of the potential for the top of June 23. The continuation of the upward movement is expected after the breakdown of the level of 107.36. In this case, the target is 107.73. Short-term upward movement, as well as consolidation are in the range of 107.73 – 107.97. For the potential value for the top, we consider the level of 108.31. Upon reaching which, we expect a downward pullback.

A short-term downward movement is possible in the range 106.98 – 106.76. The breakdown of the last level will lead to a deeper correction. Here, the target is 106.45. This is the key support level for the top.

Main trend: building potential for the top of June 23

Trading recommendations:

Buy: 107.36 Take profit: 107.71

Buy : 107.74 Take profit: 107.96

Sell: 106.98 Take profit: 106.77

Sell: 106.74 Take profit: 106.45

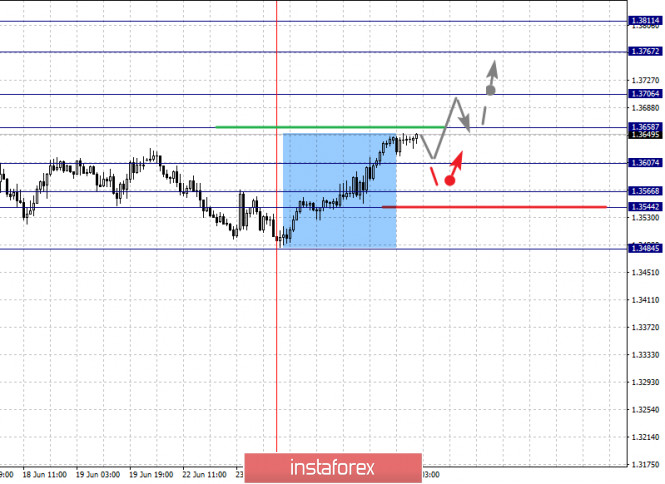

The key levels for the Canadian dollar / US dollar pair on the H1 scale are: 1.3811, 1.3767, 1.3706, 1.3658, 1.3607, 1.3566, 1.3544 and 1.3484. Here, the price forms the potential for the top of June 23. The continuation of the upward movement is expected after the breakdown of the level of 1.3658. In this case, the target is 1.3706. Price consolidation is near this level. The breakdown of the level of 1.3706 will lead to a pronounced upward movement. Here, the target is 1.3767. For the potential value for the top, we consider the level 1.3811. Upon reaching which, we expect consolidation, as well as a downward pullback.

A correction is possible after the breakdown of the level of 1.3607. In this case, the target is 1.3566. The range of 1.3566 – 1.3544 is the key support for the top and price passing this will lead to the development of a downward structure. In this case, the potential target is 1.3484.

The main trend is the formation of the upward potential of June 23

Trading recommendations:

Buy: 1.3658 Take profit: 1.3704

Buy : 1.3708 Take profit: 1.3765

Sell: 1.3605 Take profit: 1.3567

Sell: 1.3544 Take profit: 1.3486

The key levels for the Australian dollar / US dollar pair on the H1 scale are: 0.7052, 0.6990, 0.6941, 0.6849, 0.6789, 0.6741, 0.6705. 0.6613 and 0.6549. Here, we are following the local ascendant structure from June 19th. We expect a short-term upward movement in the range of 0.6941 – 0.6990. The breakdown of the level of 0.6990 will lead to the cancellation of the downward trend. In this case, the first target is 0.7052.

The resumption of the downward trend is possibly after the breakdown of the level of 0.6849. Here, the first goal is 0.6789. The breakdown of which, in turn, will allow us to rely on the movement to 0.6741. The price passing through the noise range 0.6741 – 0.6705 will lead to a pronounced downward movement. Here, the target is 0.6613. For the potential value for the downward trend, we consider the level of 0.6549. Upon reaching which, we expect an upward pullback.

The main trend is the local upward structure of June 19

Trading recommendations:

Buy: 0.6941 Take profit: 0.6988

Buy: 0.6992 Take profit: 0.7050

Sell : 0.6849 Take profit : 0.6790

Sell: 0.6787 Take profit: 0.6741

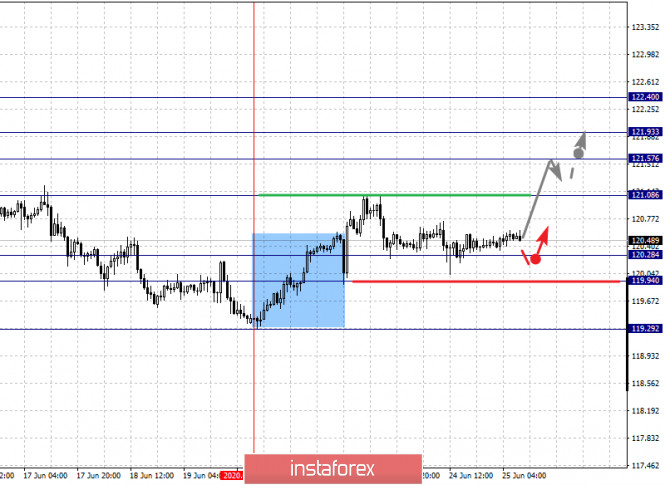

The key levels for the euro / yen pair on the H1 scale are: 122.40, 121.93, 121.57, 121.08, 120.28, 119.94 and 119.29. Here, the price forms expressed initial conditions for the top of June 22. The continuation of the upward movement is expected after the breakdown of the level of 121.08. In this case the target is 121.57. Short-term upward movement, as well as consolidation are in the range of 121.57 – 121.93. For the potential value for the top, we consider the level of 122.40. We expect a downward pullback upon reaching which.

A short-term downward movement is possible in the range of 120.28 – 119.94. The breakdown of the last level will lead to the development of a downward trend. In this case, the target is 119.29. Price consolidation is near this level.

The main trend is the formation of initial conditions for the top of June 22

Trading recommendations:

Buy: 121.08 Take profit: 121.57

Buy: 121.59 Take profit: 121.91

Sell: 120.28 Take profit: 119.95

Sell: 119.92 Take profit: 119.31

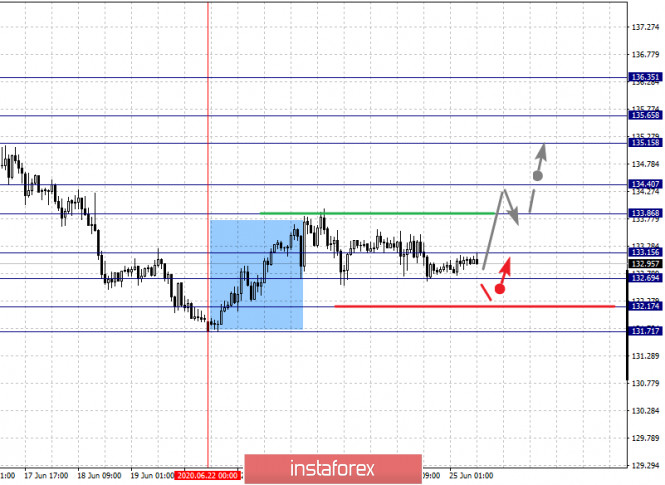

The key levels for the pound / yen pair on the H1 scale are : 136.35, 135.65, 135.15, 134.40, 133.86, 133.15, 132.69, 132.17 and 131.71. Here, the price forms the potential for the top of June 22. A short-term upward movement is expected in the range of 133.86 – 134.40. The breakdown of the last level will lead to a pronounced upward movement. Here, the target is 135.15. Price consolidation is in the range of 135.15 – 135.65. We consider the level 136.35 to be a potential value for the top. We expect a downward pullback upon reaching this level.

A consolidated movement is possible in the range of 133.15 – 132.69. The breakdown of the last level will lead to a deeper correction. Here, the goal is 132.17. This is the key level for the top.

The main trend is the formation of initial conditions for the upward cycle of June 22

Trading recommendations:

Buy: 133.86 Take profit: 134.40

Buy: 134.44 Take profit: 135.15

Sell: 132.66 Take profit: 132.17

Sell: 132.15 Take profit: 131.72

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Fractal analysis of the main currency pairs on June 25th