Fractal analysis of the main currency pairs on May 7, 2020

Forecast for May 7:

Analytical review of currency pairs on the scale of H1:

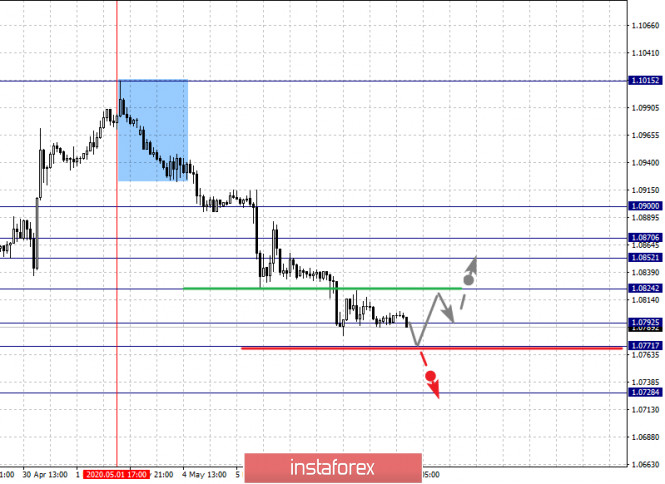

For the euro / dollar pair, the key levels on the H1 scale are: 1.0900, 1.0870, 1.0852, 1.0818, 1.0792, 1.0771 and 1.0728. Here, we are following the development of the downward cycle of May 1. The continuation of the downward movement is expected after the breakdown of the level of 1.0818. In this case, the target is 1.0792. Price consolidation is in the range of 1.0792 – 1.0771. For the potential value for the bottom, we consider the level of 1.0728. Upon reaching which, we expect an upward pullback.

Correction can be avoided after the breakdown of the level of 1.0824. Here, the first goal is 1.0852. The range of 1.0852 – 1.0870 is the key support for the downward cycle and the price passing this range will lead to the formation of initial conditions for the upward cycle. In this case, the potential target is 1.0900.

The main trend is the downward cycle of May 1.

Trading recommendations:

Buy: 1.0824 Take profit: 1.0850

Buy: 1.0872 Take profit: 1.0900

Sell: 1.0790 Take profit: 1.0772

Sell: 1.0768 Take profit: 1.0730

For the pound / dollar pair, the key levels on the H1 scale are: 1.2452, 1.2394, 1.2359, 1.2312, 1.2264, 1.2226 and 1.2153. Here, we are following the development of the descending structure of April 30. The continuation of the downward movement is expected after the breakdown of the level of 1.2312. In this case, the target is 1.2264. Price consolidation is in the range of 1.2264 – 1.2226. For the potential value for the bottom, we consider the level of 1.2153. Upon reaching which, we expect an upward pullback.

A short-term upward movement is possible in the range of 1.2359 – 1.2394. The breakdown of the last level will lead to in-depth correction. Here, the target is 1.2452. This level is a key support for the downward structure.

The main trend is the downward cycle of April 30

Trading recommendations:

Buy: 1.2360 Take profit: 1.2392

Buy: 1.2396 Take profit: 1.2450

Sell: 1.2310 Take profit: 1.2265

Sell: 1.2262 Take profit: 1.2228

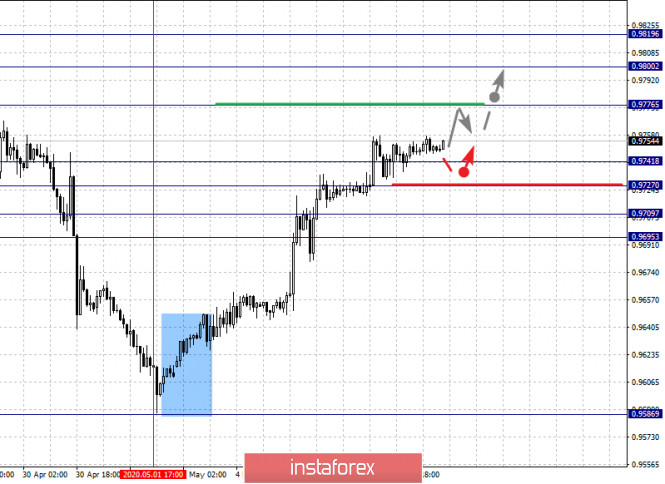

For the dollar / franc pair, the key levels on the H1 scale are: 0.9819, 0.9800, 0.9776, 0.9741, 0.9727, 0.9709 and 0.9695. Here, we are following the development of the upward cycle of May 1. The continuation of the upward movement is expected after the breakdown of the level of 0.9776. In this case, the target is 0.9800. Price consolidation is near this level and hence there is a high probability of a correction. For the potential value for the top, we consider the level of 0.9819.

A short-term downward movement is possible in the range of 0.9741 – 0.9727. The breakdown of the last level will lead to an in-depth correction. Here, the target is 0.9709. The range of 0.9709 – 0.9695 is the key support for the upward structure.

The main trend is the upward cycle of May 1

Trading recommendations:

Buy : 0.9776 Take profit: 0.9800

Buy : 0.9802 Take profit: 0.9817

Sell: 0.9740 Take profit: 0.9728

Sell: 0.9725 Take profit: 0.9710

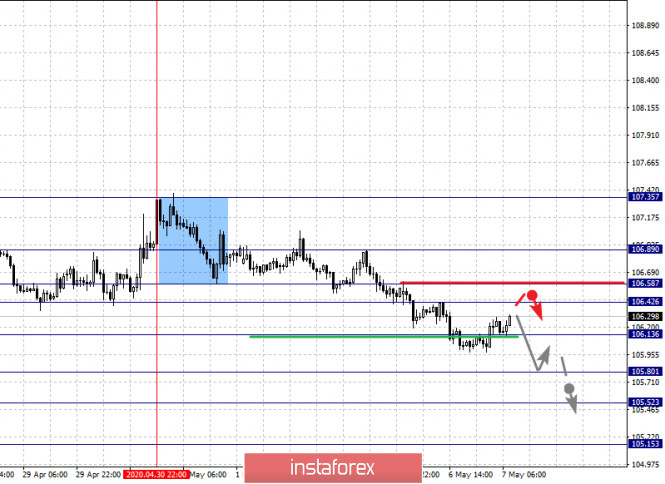

For the dollar / yen pair, the key levels on the scale are : 106.89, 106.58, 106.42, 106.13, 105.80 and 105.52. Here, we are following the formation of the descending structure of April 30. The continuation of the downward movement is expected after the breakdown of the level of 106.13. In this case, the target is 105.80. Price consolidation is near this level. For the potential value for the bottom, we consider the level of 105.52. Upon reaching which, we expect an upward pullback.

A short-term upward movement is possible in the range of 106.42 – 106.58. The breakdown of the last level will lead to an in-depth correction. Here, the target is 106.89. This level is a key support for the bottom.

The main trend is the downward cycle of April 30

Trading recommendations:

Buy: 106.42 Take profit: 106.57

Buy : 106.60 Take profit: 106.87

Sell: 106.11 Take profit: 105.82

Sell: 105.78 Take profit: 105.54

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.4299, 1.4259, 1.4209, 1.4171, 1.4101, 1.4071, 1.4047, 1.3997 and 1.3949. Here, we specified the subsequent goals from the local ascending structure on May 5 (this allows you to most accurately manage short-term operations). Short-term upward movement is expected in the range of 1.4171 – 1.4209. The breakdown of the last level will lead to a pronounced movement. Here, the target is 1.4259. For the potential value for the top, we consider the level of 1.4299. Upon reaching which, we expect consolidation, as well as a downward pullback.

A short-term downward movement is possible in the range of 1.41.01 – 1.4071. The range of 1.4071 – 1.4047 is the key support for the top and the price passing this range will lead to the development of the downward structure. In this case, the first potential target is 1.3997.

The main trend is the local upward structure of May 5

Trading recommendations:

Buy: 1.4171 Take profit: 1.4207

Buy : 1.4211 Take profit: 1.4257

Sell: 1.4100 Take profit: 1.4073

Sell: 1.4045 Take profit: 1.3998

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6487, 0.6446, 0.6413, 0.6368, 0.6337, 0.6299, 0.6254 and 0.6224. Here, we are following the development of the descending structure of April 30. Short-term downward movement is expected in the range of 0.6368 – 0.6337. The breakdown of the last level will lead to a movement to the level of 0.6299. We expect consolidation near this level. The breakdown of the level of 0.6297 should be accompanied by a pronounced downward movement. Here, the target is 0.6254. For the potential value for the bottom, we consider the level of 0.6224. Upon reaching which, we expect consolidation, as well as an upward pullback.

A short-term upward movement is expected in the range of 0.6446 – 0.6487. The breakdown of the last level will lead to the formation of initial conditions for the upward cycle. In this case, the potential target is 0.6571.

The main trend is the downward structure of April 30

Trading recommendations:

Buy: 0.6450 Take profit: 0.6486

Buy: 0.6490 Take profit: 0.6530

Sell : 0.6368 Take profit : 0.6338

Sell: 0.6335 Take profit: 0.6300

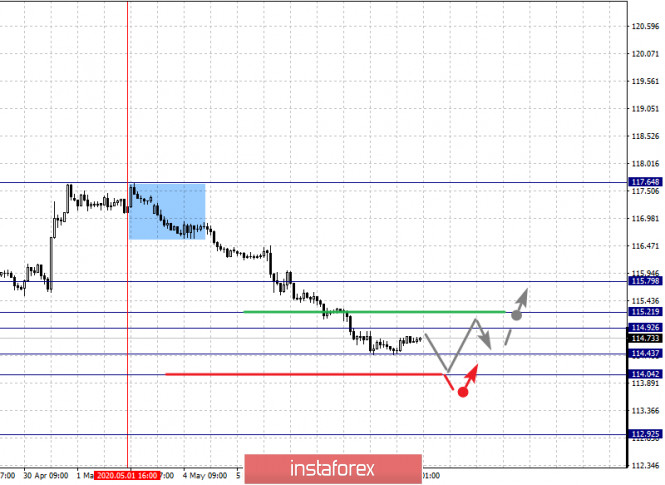

For the euro / yen pair, the key levels on the H1 scale are: 115.79, 115.21, 114.92, 114.43, 114.04 and 112.92. Here, we are following the development of the downward cycle of May 1. At the moment, the price is near the limit values, and therefore, there is a high probability of a correction. Short-term downward movement is possible in the range of 114.43 – 114.04, from here we expect a key reversal to the top. The breakdown of the level of 114.04 will be accompanied by an unstable development of the situation. Here, the potential target is 112.92.

A short-term upward movement is possible in the range of 114..92 – 115.21. The breakdown of the last level will lead to an in-depth correction. Here, the target is 115.79. This level is a key support for the downward structure.

The main trend is the downward cycle of May 1

Trading recommendations:

Buy: 114.92 Take profit: 115.20

Buy: 115.24 Take profit: 115.76

Sell: 114.40 Take profit: 114.06

Sell: 113.95 Take profit: 113.50

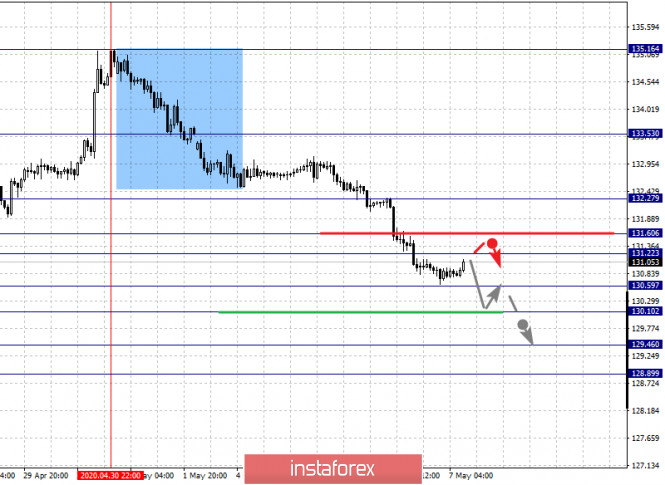

For the pound / yen pair, the key levels on the H1 scale are : 132.27, 131.60, 131.22, 130.59, 130.10, 129.46, 128.89. Here, we are following the development of the descending structure of April 30. Short-term downward movement is expected in the range of 130.59 – 130.10. The breakdown of the last level will lead to a pronounced downward movement. Here, the target is 129.46. For the potential value for the bottom, we consider the level of 128.89. Upon reaching which, we expect an upward pullback.

A short-term upward movement, as well as consolidation are possible in the range of 131.22 – 131.60. The breakdown of the last level will lead to in-depth movement. Here, the goal is 132.27. This level is a key support for the downward structure.

The main trend is the downward structure of April 30

Trading recommendations:

Buy: 131.66 Take profit: 132.25

Buy: Take profit:

Sell: 130.59 Take profit: 130.15

Sell: 130.05 Take profit: 129.46

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Fractal analysis of the main currency pairs on May 7