Fundamental Analysis of NZD/USD for June 22, 2018

NZD/USD has been quite bearish till yesterday before it bounced off the 0.68 support area with a daily close. NZD has been dominated by USD in several ways, but after the recent rate hike from 1.75% to 2.00%, the USD gains were quite massive.

This week, NZD has been quite weak with the recently published economic reports including GDP decreasing to 0.5%, as expected, from the previous value of 0.6%, Current Account showing an increase to 0.18B from the previous negative value of -2.75B which was expected to be at 0.05B, and Westpac Consumer Sentiment report, published with a decrease to 108.6 from the previous figure of 111.2.

On the other hand, USD has been a bit weaker due to worse economic results published recently, after the rate hike phenomenon persisted in the market earlier. Today, USD Flash Manufacturing PMI report is going to be published which is expected to decrease to 56.3 from the previous figure of 56.4 and Flash Services PMI report is expected to decrease to 56.4 from the previous figure of 56.8.

As of the current scenario, NZD is expected to gain certain momentum over USD which is struggling to get over the worse economic reports and gain momentum. Though the long-term trend is still bearish, certain bullish momentum of NZD gains are expected to last for a shorter period resulting as retracement in the process.

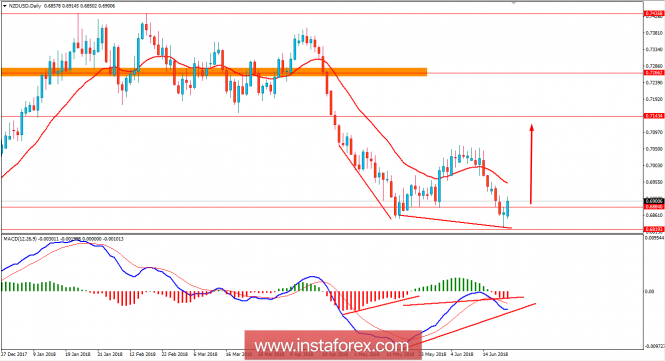

On the technical view, the price has been forming certain Bullish Divergences recently, which is currently expected to cause certain bullish momentum in the pair leading the price towards the resistance in the 0.7150 area in the coming days. As the price remains above 0.68 with a daily close, the bullish momentum is expected to continue further.

The material has been provided by InstaForex Company – www.instaforex.com