Fundamental Analysis of USD/JPY for February 20, 2018

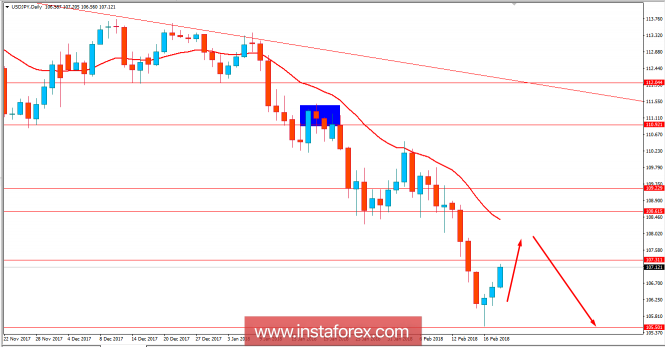

USD/JPY has been quite impulsive with the bullish gains after rejecting off the 105.50 support area with a daily close. The impulsive non-volatile bearish gains lead the price to fall drastically from 113.50 area which is currently expected to show some retracement towards 108 price area before proceeding much lower in the future. Recently JPY Trade Balance report was published with an increase to 0.37T from the previous figure of 0.09T which was expected to be at 0.14T. Despite having no high impactful economic reports or events recently USD gained momentum which does lead to an explanation of current market sentiment ahead of the FOMC on Wednesday. As of the recent news, FOMC Meeting is expected to discuss another rate hike in March 2018 which may lead to further gain on the USD side for the coming days. As of the current scenario, USD is expected to gain certain momentum over JPY which will lead to a certain decision after FOMC Meeting outcome on Wednesday. Though expectation is to see a further gain on the USD side recent JPY positive economic report lead to indecision for the upcoming momentum in the pair.

Now let us look at the technical view, the price is currently quite bullish with the gains which are expected to lead towards 108 price area before proceeding lower again in the future. The bearish trend has been quite non-volatile and impulsive earlier which is expected to continue further but with certain pullback along the way. As the price remains below 108.50 price area, the bearish bias is expected to continue further.

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Fundamental Analysis of USD/JPY for February 20, 2018