GBP/USD. Mar 24, 2020

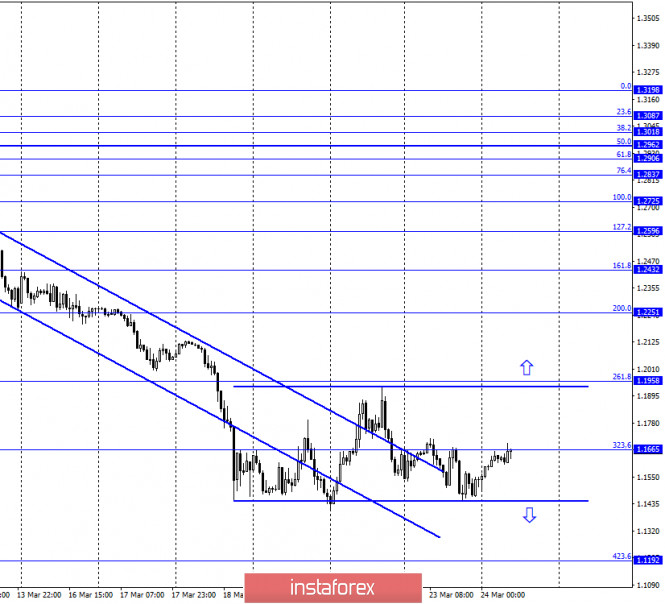

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the strong drop in quotes has stopped, but the growth of the pair’s quotes does not begin. Yesterday, I built a weak upward trend line, hoping that it would be the starting point for a new upward trend. However, yesterday, the pound/dollar pair performed a consolidation under it, which showed a lack of desire for serious growth. Today, a sideways trend corridor was built, which seems to better reflect the current mood of most traders. It is neither bearish nor bullish. Traders are wondering where to go next? The actions of the Fed and the US Treasury Department do not seem to allow us to buy the US dollar as zealously as before. Measures to ease monetary policy and stimulate the economy are unprecedented. At the same time, traders firmly believe that it is the dollar that will allow them to survive the crisis that the whole world is in.

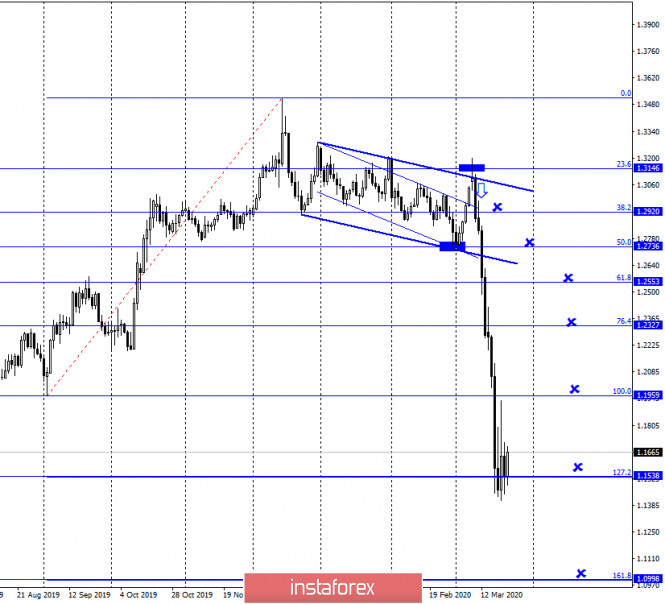

GBP/USD – 4H.

As seen on the 4-hour chart, I removed the grid of Fibo levels, since it is identical to the grid on the hourly chart. There are no new trading ideas on this chart, as there are no special changes in the pair’s movement. The British dollar’s quotes seem to have performed an upward turn, which allows traders to expect some growth. No indicator shows any new emerging divergences on March 24.

GBP/USD – Daily.

As seen on the daily chart, the picture remains the most interesting. The GBP/USD pair performed a fall to the corrective level of 127.2% (1.1538), but it was not possible to perform a clear closing under it. Thus, it is possible to interpret this attempt to overcome it as a retreat. The British currency has a certain chance of growth, but the lower charts show that there is no special desire among bull traders to move the British currency up. Thus, as long as the pair’s quotes are trading above the corrective level of 127.2% (1.1538), the probability of growth remains. Fixing the pair’s exchange rate under the Fibo level of 127.2% will work in favor of the US dollar and resume the fall in the direction of the corrective level of 161.8% (1.0998).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a fall to the lower line of the “narrowing triangle”, but the breakdown may be false. So far, it is difficult to say what exactly happened near the lower line of the triangle. A false breakout will give a high probability of growth to the first downward trend line.

Overview of fundamentals:

On Monday, no important economic reports were published in the UK and the US. Both America and Britain remain in strict quarantine, and now we can only wait for the growth rate of COVID-2019 virus infections among the population to go down.

The economic calendar for the US and the UK:

United Kingdom – index of business activity in the service sector (11:30 GMT).

United Kingdom – index of business activity in the manufacturing sector (11:30 GMT).

USA – index of business activity in the service sector (15:45 GMT).

US – index of business activity in the manufacturing sector (15:45 GMT).

Today, the US and UK business activity indices for March will show, how bad things are in these countries and what the consequences of the epidemic may be, whether traders are ready to start paying attention to economic reports again, or whether they will still be in a state of shock and track only news and data on COVID-2019.

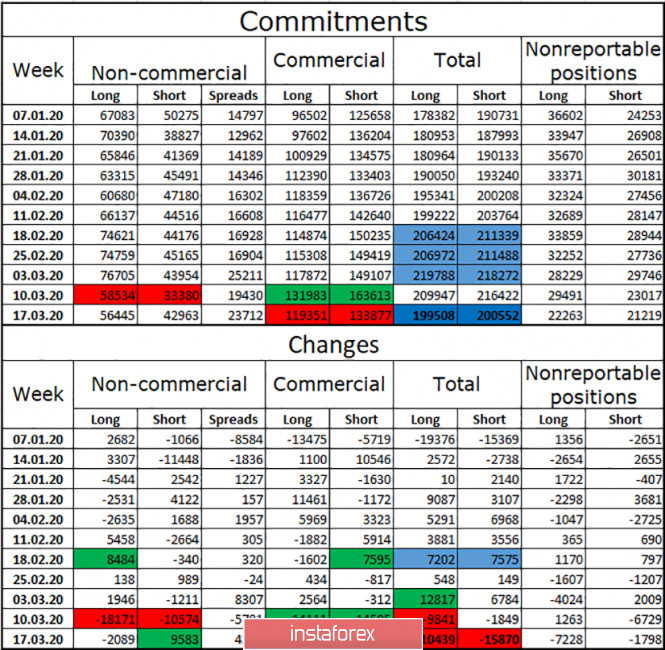

COT report (Commitments of Traders):

The new COT report, released on Friday, again showed no major changes in the number of contracts between groups of speculators and hedger companies. The total number of long and short contracts has decreased slightly but remains almost equal. The “Commercial” group immediately dropped 30,000 short contracts and 12,000 long contracts at once. A group of speculators has increased 9,000 short-contracts. Thus, speculators believe that the pound can resume the process of falling, but they have half as many contracts in their hands as in the hands of large companies that hedge their risks in the foreign exchange market.

Forecast for GBP/USD and recommendations to traders:

Major players do not like the GBP/USD pair too much, preferring the EUR/USD pair. Nevertheless, the COT report allows for the end of the “bearish” trend. We should start now from the corrective level of 127.2% on the daily chart. Closing the pair’s rate under the side corridor on the hourly chart or under the level of 127.2% on the daily chart will work in favor of the US currency and allow traders to sell the British again.

Terms:

“Non-commercial” – major market players: banks, hedge funds, investment funds, private, large investors.

“Commercial” – commercial enterprises, firms, banks, corporations, companies that buy currency to ensure current activities or export-import operations.

“Non-reportable positions” – small traders who do not have a significant impact on the price.

The material has been provided by InstaForex Company – www.instaforex.com