GBP/USD: Opponents of the rigid position of Boris Johnson becomes greater. The euro may continue to rise to 1.13

Yesterday’s data on the US economy did not greatly contribute to the strengthening of the US dollar and were generally ignored by markets amid the trade conflict, which continues to worsen between the US and China.

Retail sales data from The Retail Economist and Goldman Sachs indicated an increase in the index in US retailers. According to the report for the week from July 28 to August 3, the index grew by 2.4%, while compared to the same period in 2018, the growth was 3.3%.

A report from Redbook also pointed to the growth of retail sales. Thus, sales in July increased by 1.1% compared to June and by 4.8% compared to the same period of 2018. During the week from July 28 to August 3, retail sales of Redbook increased by 5.1%. Against the background of worsening trade conflicts and a decrease in the level of confidence of Americans, such good data will certainly support the economy in the 3rd quarter of this year. Let me remind you that at the end of last week, a report on the growth of wages of American households was released, which in the future will also have a positive impact on the increase in retail sales.

According to the US Department of Labor, the number of open vacancies in the US in June fell slightly to 7.348 million. However, the number of jobs exceeded the number of unemployed in the US in June by 1.373, and the rate of layoffs in June remained at 2.3%.

Such data once again prove just excellent performance of the American labor market, which will continue to support the economy.

During yesterday’s speeches, representatives of the Federal Reserve System once again touched on the future of interest rates.

Thus, the President of the Fed-St. Louis James Bullard said that it is too early to call for further cuts in rates, but did not rule out that there will be a need for such actions in the future. According to Bullard, it is now necessary to see how the recent changes will affect the economy, and only after that to continue further policy adjustments. However, given the fact that trade policy uncertainty remains high, a delay in monetary policy will increase uncertainty, which will have a negative impact on the economy in the future.

As for the technical picture of the EURUSD pair, the situation is still fully controlled by buyers. Yesterday’s downward correction ended at 1.1170, which I paid attention to several times in my reviews. At the moment, the task of buyers is to return to the resistance of 1.1220, the breakdown of which will return to the market players who put on strengthening risky assets and will lead to an update of the monthly highs in the area of 1.1290 and 1.1240.

GBPUSD

The British pound made an unsuccessful attempt to restore against the US dollar yesterday amid rumors that there are more and more opponents of the current position of British Prime Minister Boris Johnson. Obviously, there are far fewer people who want a tough Brexit than there are supporters of a milder solution to the problem and a compromise with the EU. However, as we can see on the chart, there are few who want to buy the pound even at current lows, which indicates a very likely continuation of the bearish trend, especially in the conditions of the technical formation that is now formed.

To resume the downward trend, the bears only need a breakout of the support of 1.2140, which will open a real prospect for a return to the area of the lows of the year 1.2080 and their renewal. The main target of the pound sellers at the end of the week will be the support areas of 1.2020 and 1.1960.

NZDUSD

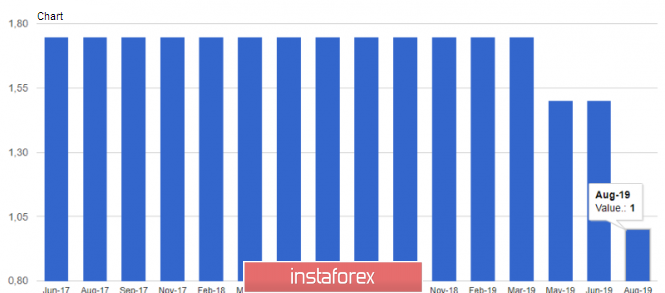

The New Zealand dollar collapsed against the US dollar after, contrary to all expectations, the Reserve Bank of New Zealand lowered the official interest rate by 50 bps to 1.0%.

The Central Bank said that the increased uncertainty around trade slowed growth in the trading partner countries, and the new lower rates will increase government spending and support demand. The RBNZ is also concerned that wage growth in the private sector is weak, hence the need for a strong initial monetary incentive for achieving target levels of inflation and employment.

The material has been provided by InstaForex Company – www.instaforex.com