GBP/USD: plan for the European session on August 1, 2019

To open long positions on GBP/USD you need:

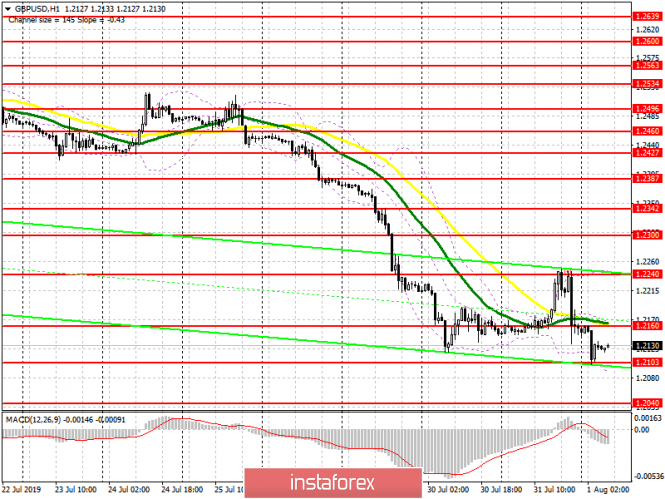

The fall of the pound continued, and the Bank of England’s decision on interest rates today is unlikely to appeal to buyers, since the regulator will not speak so actively on the subject of a possible tightening of monetary policy, when many central banks around the world are going to cut rates. Brexit remains a problem, which puts even more pressure on the Bank of England. Buyers of GBP/USD can only count on a false breakout in the support area of 1.2103, as only it can form a larger upward correction to the resistance area of 1.2160 and allow it to return to a high of 1.2240, where I recommend to take profits. In a scenario of a further bearish trend, it is best to consider new long positions in GBP/USD on the test of support at 1.2040 or on the rebound from a larger low of 1.1985.

To open short positions on GBP/USD you need:

Bears have actively returned to the market after the Fed’s decision yesterday, but until today’s announcement of the course of the Bank of England’s monetary policy, they are unlikely to take any active steps. A break of support at 1.2103 will lead to increased pressure on the pound and a further decrease in the area of 1.2040 and 1.1985 lows, where I recommend taking profits. If GBP/USD buyers become active after the decision of the Bank of England, then it is best to rely on new short positions after forming a false breakdown in the resistance area of 1.2160 or sell for a rebound from a high of 1.2240.

Indicator signals:

Moving averages

Trading is below 30 and 50 moving averages, which indicates the prevalence of pound sellers in the market.

Bollinger bands

A break of the lower boundary of the indicator around 1.2095 will lead to a further decrease in the pound. In case of an upward correction, the average border in the area of 1.2160 will act as resistance, and you can sell directly to rebound from the upper limit, which now passes in the area of 1.2240.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20

The material has been provided by InstaForex Company – www.instaforex.com