GBP/USD: plan for the European session on Nov 4, 2019

To open long positions on GBP/USD, you need:

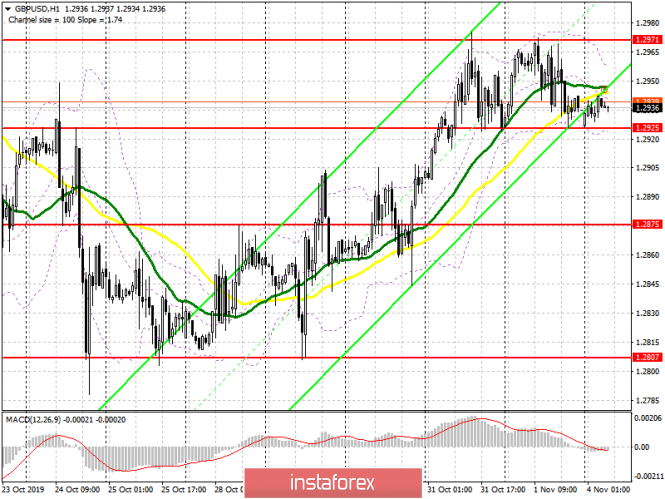

Friday’s data on the US labor market and a weak report on manufacturing activity on the background of a weakening US dollar did not cause buyers’ interest in the British pound, which indicates a possible downward correction of the pair at the beginning of this month. The lack of Brexit news continues to hold back bulls on the pound. The first signal to buy today will be a breakdown and consolidation above the resistance of 1.2971, which will lead to the demolition of stop orders of sellers and further growth of the pair on the trend. A breakthrough of the maximum of 1.3017 opens a direct path to new resistance in the area of 1.3074 and 1.3125, where I recommend taking the profits. In the case of a decline in the pound, the hope for growth is still left by the support of 1.2925, but it is best to open long positions from there only after the formation of a false breakdown. I recommend buying GBP/USD immediately on the rebound only from the support of 1.2875.

To open short positions on GBP/USD, you need:

Important fundamental data are not expected to be released today, so it will be possible to talk about a clear continuation of the bull market only after the breakout of monthly highs, which the bears will try to prevent. The formation of a false breakdown in the resistance area of 1.2971 will be the first signal to open short positions, and the main task of sellers will be to return the pair to the support of 1.2925. Only in this scenario can we expect a larger downward correction in the area of lows 1.2875 and 1.2807, where I recommend taking the profit. Any positive news on Brexit could lead to a rise in GBP/USD above the resistance of 1.2971. In this case, it is best to look at short positions after updating the last month’s high around 1.3017 or sell for a rebound from the resistance of 1.3074.

Indicator signals:

Moving Averages

Trading is below the 30 and 50 moving averages, which indicates a possible decline in the pound in the short term.

Bollinger Bands

A break of the lower border of the indicator at 1.2925 will increase pressure on the pound.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20

The material has been provided by InstaForex Company – www.instaforex.com