Ichimoku indicator analysis of USDX for September 12, 2017

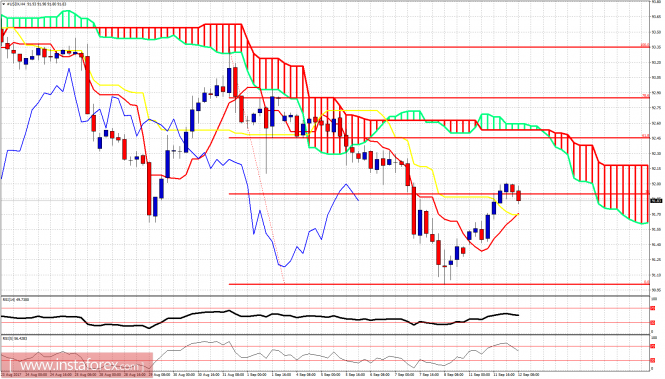

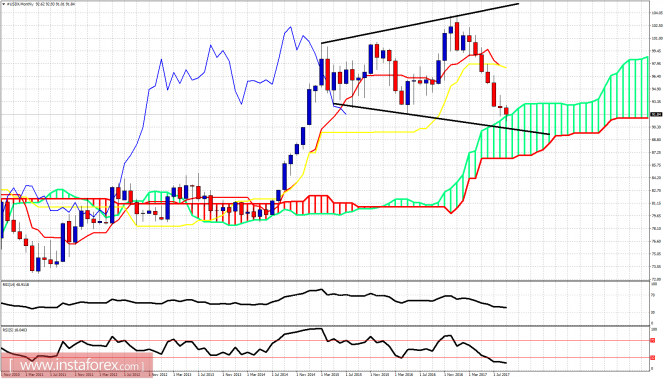

The Dollar index has bounced towards the 38% Fibonacci retracement, but short-term trend remains bearish as long as price is below the 4-hour Kumo at 92.50. The Dollar index has reached important monthly support and we could see a very strong bounce from around the 90 level.

The Dollar index is trading below the 4-hour Kumo. Price is showing reversal signs at the 38% Fibonacci retracement resistance. Support is at 91.70. A 4-hour close below that level will open the way for a move towards recent lows.

On a monthly basis price is testing the monthly Kumo. A strong bounce is justified from current levels. Dollar bears need to be very cautious. If a large scale upward bounce starts, our target will be between 96-97.The material has been provided by InstaForex Company – www.instaforex.com

Source:: Ichimoku indicator analysis of USDX for September 12, 2017