Trump withdraws from Iran deal. RBNZ meeting in focus – Intraday analysis 09-05-2018

Intraday analysis 09-05-2018 – Daily Forex Market Preview

The newswires were dominated by Trump’s decision on Iran nuclear deal which saw oil prices turning volatile on the day. The Trump administration announced that they would be pulling out the Iran nuclear deal. Oil prices reacted little to the news with price already pushing higher in anticipation of the outcome.

On the economic front, retail sales report from Australia showed a flat print and missed estimates of a 0.2% increase. Data from the Eurozone showed a modest improvement in German industrial orders which increased 1.0% compared to estimates of 0.8%. The German trade balance figures are ticked higher to 22 billion compared to estimates of 19.9 billion.

Looking ahead, the U.S. Producer prices index report will be coming out. Economists’ polled expect headline PPI to rise 0.2% on the month, a slower pace compared to 0.3% increase previously. Core PPI is also forecast to rise 0.2% on the month.

Later in the day, the RBNZ monetary policy meeting will be a key event to watch for. However, no change to monetary policy is expected at today’s meeting.

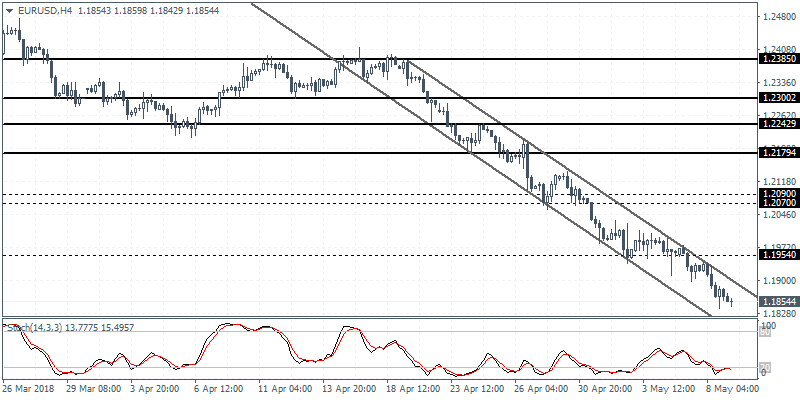

EURUSD intra-day analysis

EURUSD (1.1854): The EURUSD extended declines as price action closed below the support level of 1.1920. The declines below this level indicate further losses that could send the EURUSD lower toward the next main support level at 1.1730. Any rebound in prices are likely to be limited to the previous local highs although the main resistance level at 1.1954 will be a key level that could be tested in the near term. As long as the EURUSD remains below 1.1954, we expect to see the downside momentum prevailing.

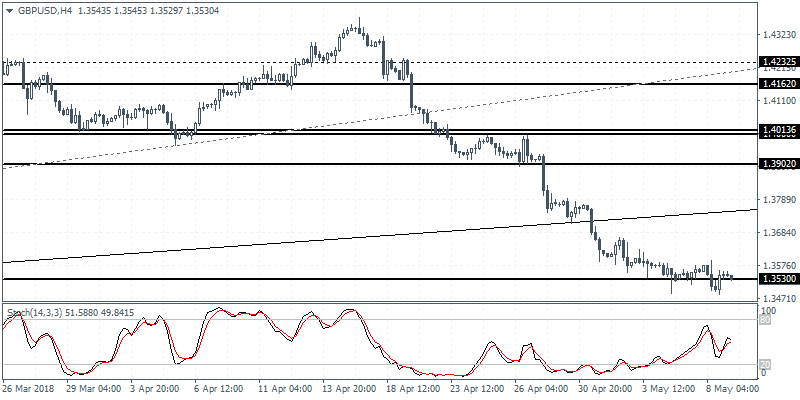

GBPUSD intra-day analysis

GBPUSD (1.3530): The British pound remained trading near the 1.3530 level with price action seen briefly slipping below this level only to recover back modestly. The consolidation at this level is expected to continue and it also indicates a potential rebound in price action in the near term. The British pound could be seen most likely to post a correction with the breached trend line likely to turn as resistance. To the downside, the round number support at 1.3500 remains the next target.

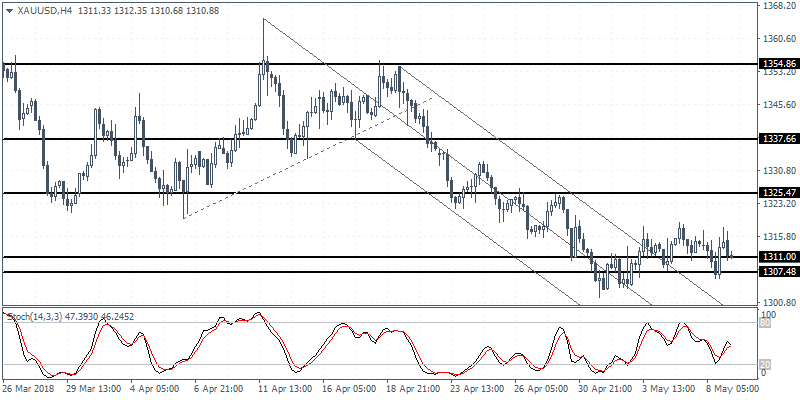

XAUUSD intra-day analysis

XAUUSD (1310.88): Gold prices continued to trade within the support level of 1311 and 1307. Price action remains range bound at this level but the consolidation could signal a possible correction. The resistance level at 1325 which remains untested could be the upside target on a rebound. To the downside, price action will need to break out below the support level strongly in order to test the next main support at 1300. However, in the near term, gold prices are likely to remain support with the potential for an upside correction.

Check out the Orbex website to see more analysis all through the day.