Australia inflation eases. Slow day ahead – Intraday analysis 25-04-2018

Intraday analysis 25-04-2018 – Daily Forex Market Preview

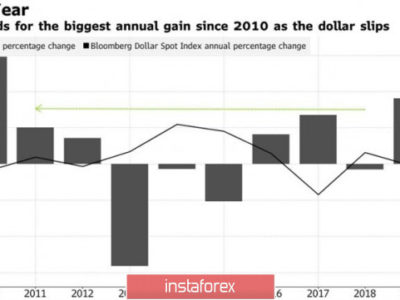

The U.S. dollar was seen managing to hold some of the gains following the strong rebound from Monday. However, the dollar was mixed with the USD mostly stronger against the Japanese yen.

Economic data showed that the Australian quarterly CPI data showed a 0.4% increase on the quarter. This was lower than the forecasts of 0.5% and down from 0.6% increase posted in the previous quarter of 2017. The trimmed mean CPI was slightly higher at 0.5% on the quarter, matching the estimates.

The German Ifo business climate data showed a decline as the index fell to 102.1 compared to 103.3 previously. The slower pace of data signaled that economic growth might have slowed down in Germany.

Data from the U.S. showed that the CB consumer confidence data came out at 128.7, beating estimates of 126.0. It was also higher compared to the 127.0 reading posted previously.

Looking ahead, the economic calendar is quiet today. The weekly crude oil inventory report is expected and the BoC’s Poloz is expected speak later in the day.

EURUSD intra-day analysis

EURUSD (1.2224): The EURUSD currency pair was seen posting a modest rebound following the declines from the past few days. After price action fell to an 8-week low. The rebound off the lows from 1.2203 sent prices briefly higher only to test the upper resistance level at 1.2250. In the near term, we expect the EURUSD to consolidate within the resistance and support levels of 1.2250 and 1.2200 region. A breakout from this range could most likely signal the next direction in the currency pair. We expect to see the EURUSD retesting the upper main resistance level of 1.2300.

GBPUSD intra-day analysis

GBPUSD (1.3981): The British pound was seen posting a modest recovery, but price action remains biased to the downside below the resistance level of 1.4000. If this resistance level holds, GBPUSD is expected to maintain the range within 1.4000 and 1.3900 region. In the near term, there is a potential for GBPUSD to retest the breakout from the rising trend line near 1.4070. Further gains could push the GBPUSD toward the resistance zone of 1.4162. To the downside, we expect the support level at 1.3900 likely to hold the declines for now.

XAUUSD intra-day analysis

XAUUSD (1328.15): Gold prices attempted to rebound yesterday but the gains were erased rather quickly. The current decline could see gold prices testing the support level at 1325.50 level. This could mark a short term lower high that could suggest a possible correction to the upside. The resistance level at 1344.00 remains a key level of interest which gold prices could test in the near term if the support level at 1325.50 holds. In the event of a break down below 1325.50, we expect to see a short term new low being posted.

Technical and Fundamental analysis is released all day on the Orbex website. Visit by clicking here to see more.