U.S. Q4 GDP revised higher. UK GDP in focus

Daily Forex Market Preview – Intraday analysis 29-03-2018

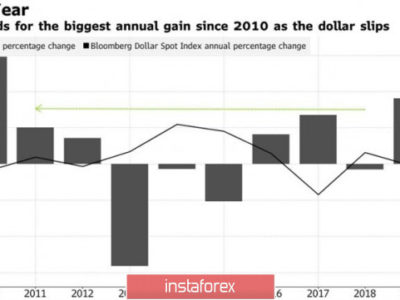

The U.S. dollar was seen holding on to the gains from Tuesday. The positive sentiment kicked in after the final revised GDP showed a 3.1% increase on the fourth quarter. This was higher than the expectations of an increase of 2.7%. Later in the day, the pending home sales data showed a 3.1% increase on the month which once again beat estimates of 2.1%. Previous month’s data was revised to show a 5.0% decline on the month.

Looking ahead, the economic calendar for the day will see the release of UK’s current account data followed by the GDP figures for the fourth quarter of 2017. Economists are forecasting that the UK’s GDP expanded at a pace of 0.4% on the quarter, unchanged from the previous estimates.

Canada will also be releasing its monthly GDP numbers with expectations pointing to a 0.1% increase on a month over month basis. Data from the U.S. will see the release of the core PCE price index data. Forecasts point to a slower pace of increase at just 0.2% on the month. Personal spending and income data is expected to show a 0.2% increase and 0.4% increase respectively.

EURUSD intra-day analysis

EURUSD (1.2326): The euro currency was seen giving up the gains for the second day as price fell to session lows of 1.2334 marking a three-day low. On the 4-hour chart, price action was seen slipping below 1.2363 which marked the breakout from the triangle pattern. Further declines could potentially invalidate the upside bias in price. In the near term, we expect a retest of 1.2363 level following which, if the resistance level holds, the euro could be seen posting stronger declines. Support is seen at 1.2180 which could be tested to the downside if the resistance level at 1.2363 holds up.

GBPUSD intra-day analysis

GBPUSD (1.4081): The British pound was seen giving up gains following the breakdown of prices below the 1.4162 level. The decline off the resistance level near 1.4162 has made price action post a consolidation into a bearish flag pattern. A close below 1.4115 could signal further declines to 1.4044 at the very least. The round number support at 1.4000 is likely to be tested in the near term however and we expect to see price posting a rebound in the short term.

XAUUSD intra-day analysis

XAUUSD (1327.59): Gold prices fell sharply yesterday testing the support level at 1328. With price now at support, we expect to see a modest rebound shaping up. The bullish divergence on the 4-hour chart signals a near term upside in price. Gold price will need to first retest the 1336 level where resistance could be formed. However, a breakout above this level will see gold prices testing the 1345 level once again. To the downside, a break below 1328 could signal a move lower to 1307.50.

For further technical and fundamental analysis visit our website by clicking here.