Intraday technical levels and trading recommendations for EUR/USD for May 9, 2017

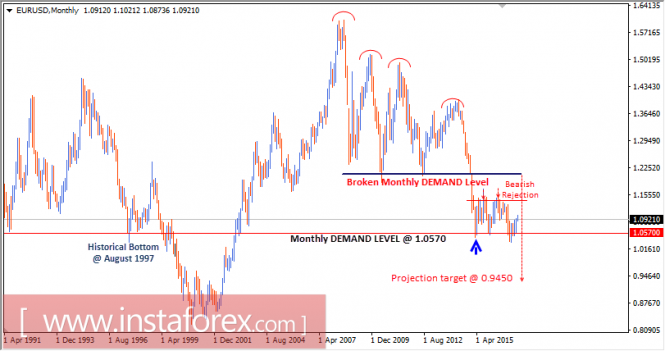

In January 2015, the EUR/USD pair moved below the major demand levels near 1.2100 where historical bottoms were previously set in July 2012 and June 2010.

Hence, a long-term bearish target was projected toward 0.9450.

In March 2015, EUR/USD bears challenged the monthly demand level around 1.0570, which had been previously reached in August 1997.

Later in April 2015, a strong bullish recovery was observed around the mentioned demand level.

However, next monthly candlesticks (September, October, and November) reflected a strong bearish rejection around the area of 1.1400-1.1500.

In the longer term, the level of 0.9450 remains a projected target if any monthly candlestick achieves bearish closure below the depicted monthly demand level of 1.0570.

Otherwise, the EUR/USD pair remains trapped within the depicted consolidation range (1.0570-1.1400).

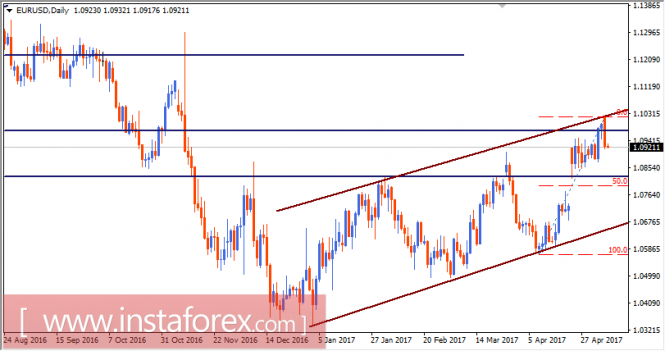

Since January, the EUR/USD pair has been trending-up within the depicted ascending channel.

This week, the market opened on a weekly bullish gap. A bearish engulfing daily candlestick came after testing the upper limit of the depicted channel near 1.1020.

That’s why, a bearish pullback is expected towards 1.0870, 1.0820 and 1.0790.

The technical outlook for the pair remains bullish. That’s why, the current bearish pullback towards 1.0790 (50% Fibonacci level) should be watched for bullish rejection and a possible BUY entry.

The material has been provided by InstaForex Company – www.instaforex.com

Source:: Intraday technical levels and trading recommendations for EUR/USD for May 9, 2017