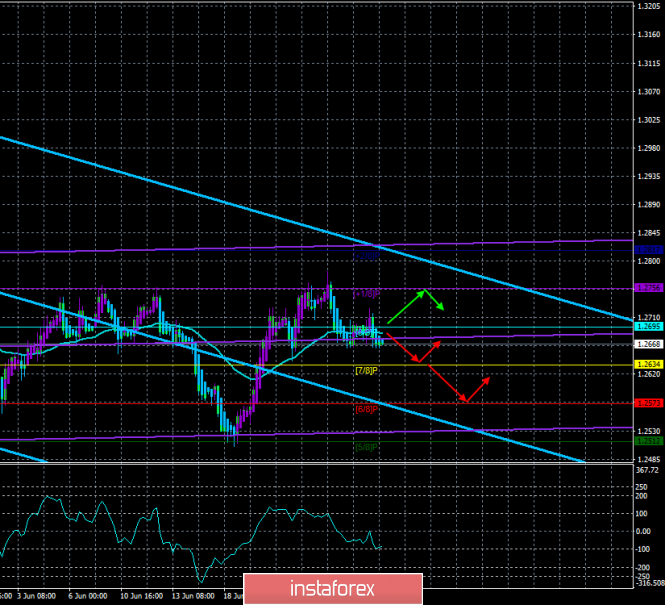

Overview of GBP/USD on June 28, 2019

4-hour timeframe

Technical data:

The upper linear regression channel: direction – down.

The lower linear regression channel: direction – sideways.

The moving average (20; smoothed) – sideways.

CCI: -85.8169

The currency pair pound/dollar could not overcome the Murray level of “+1/8” – 1.2756, thus, the bulls showed their strength at the moment, or rather the lack of it. And the pound sterling showed once again what is clear to almost any trader: with the unfinished Brexit process, without the Prime Minister and the leader of the ruling party, with complete uncertainty about the future of the country and future relations with the European Union, there is no question of any long-term strengthening. And we believe that this reaction of traders is absolutely logical. The British currency does not even particularly react to various kinds of information related to the candidates for the post of Prime Minister, who actively give interviews so that voters can better understand the vector of the direction of the foreign policy of everyone, Boris Johnson and Jeremy Hunt. What is the meaning of this information, if it is only the nature of promises, nothing more? Johnson has already promised to revise the current agreement with the EU, to which Brussels responded with a clear rejection of any new negotiations and revisions of the deal reached with Theresa May. At the weekend, there will be a meeting between the leaders of China and America, within the framework of which certain agreements can be reached on a trade deal. This information may affect the US dollar exchange rate, but for the GBP/USD pair, this information will be secondary. At the moment, the bears have already fixed the pair below the moving average, which is the first step in the direction of a new downward trend. The bulls failed to form even a short-term upward trend.

Nearest support levels:

S1 – 1.2634

S2 – 1.2573

S3 – 1.2512

Nearest resistance levels:

R1 – 1.2695

R2 – 1.2756

R3 – 1.2817

Trading recommendations:

The GBP/USD pair failed to overcome the level of 1.2756, which led to a consolidation below the moving average. We now recommend a cautious sale of the pound sterling with a target of 1.2634, as the bears have not yet confirmed their intention to a new campaign to the south.

It will be possible to buy the pound/dollar pair in small lots with targets of 1.2756 and 1.2817 after the price is fixed back above the moving average. In this case, the bulls will receive a new opportunity to form an upward trend, but they have little strength now.

In addition to the technical picture should also take into account the fundamental data and the time of their release.

Explanation of illustrations:

The upper linear regression channel – the blue line of the unidirectional movement.

The lower linear regression channel – the purple line of the unidirectional movement.

CCI – the blue line in the indicator regression window.

The moving average (20; smoothed) is the blue line on the price chart.

Murray levels – multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

The material has been provided by InstaForex Company – www.instaforex.com