Overview of the GBP/USD pair Mar 20, 2020

4-hour timeframe

Technical details:

Higher linear regression channel: direction – downward.

Lower linear regression channel: direction – downward.

Moving average (20; smoothed) – downward.

CCI: -125.7083

The British pound at the auction on Thursday, March 19, suspended the collapse of the downward movement and even began to adjust slightly. This is evidenced by the “whole” two purple bars of the Heiken Ashi indicator. This event for the pound at this time is as rare as a solar eclipse. However, jokes are jokes, but even this upward correction threatens to be extremely weak. The position of the bulls is not weak, they are simply absent. None of the speculators wants to buy the British pound since it is the British currency that looks the least promising of all the currencies of the “main basket”. Thus, most likely, the downward movement will resume in the near future, as sad as it may sound for fans of the British pound.

Despite the fact that many countries around the world have already closed their borders, British foreign Secretary Dominic Raab said that the government does not yet plan to introduce a “full quarantine”. However, this decision is in the position of “permanent review”. “The advice of scientists is that this should not be done at the current stage. We are now very clear that it is not in the UK’s interests to take these measures. Closing the borders will not affect the spread of the disease,” Raab said. But British Prime Minister Boris Johnson believes that additional security measures will not prevent. “In light of recent events, we think we should strengthen measures to limit the growth of the epidemic by closing schools. Thus, I can state that after schools close on Friday, they will remain closed until further orders,” the Prime Minister of the Kingdom said.

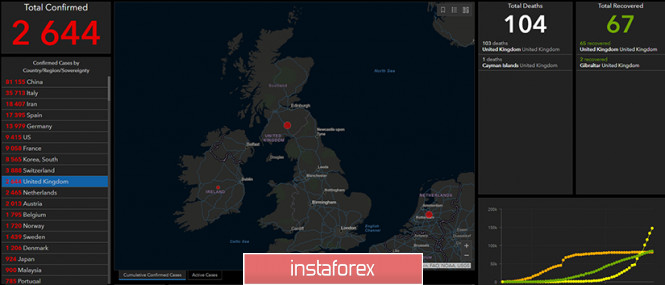

The number of cases of “coronavirus” is currently 2,644. Officially, 67 cases of complete recovery and 104 deaths are reported. However, unfortunately, as in many other countries, the epidemic continues to spread and this is very bad. Both for the economy and for the people of Great Britain. Moreover, there are a certain number of infected people who simply do not know about it yet, because they do not have any symptoms and have not passed the test.

Meanwhile, the Central Bank of England at an emergency meeting decided to reduce the key rate from 0.25% to 0.1%. It is noteworthy that the previous decline was just a few days ago and amounted to as much as 50 basis points. In addition, the British regulator decided to expand the program of quantitative easing in the amount of 200 billion pounds through the purchase of government bonds and corporate bonds. According to the Regulator, which is already under the leadership of Andrew Bailey, the economic shock caused by the spread of the “coronavirus” should be short-lived. However, the Bank of England recognizes the gravity of the situation. “In recent days, conditions in the UK government bond market have worsened, as investors have sought shorter-term assets that are alternatives to highly liquid assets of the Central Bank,” the Bank of England said in a statement. The new head of the Bank of England, Andrew Bailey, said that the Regulator is ready to pour any amount of money into the economy to mitigate the impact of the “coronavirus”. The Central Bank creates a commercial financing fund that will buy commercial bills for up to 1 year, thus financing the business. This will apply to companies that make a significant contribution to the British economy.

From a technical point of view, the pair has now started an upward correction. However, as we have said above, it is unlikely to be long-lasting. In any case, in order not to guess, it is recommended to carefully monitor the Heiken Ashi indicator, which clearly shows local reversals. Both linear regression channels turned downwards. The moving is also directed there. Thus, all trend indicators signal a downward trend. No one knows how long the collapse of the pound will continue. As we can see, no actions of the Bank of England can stop the fall yet. “Coronavirus” remains a key factor for the economy of each particular country.

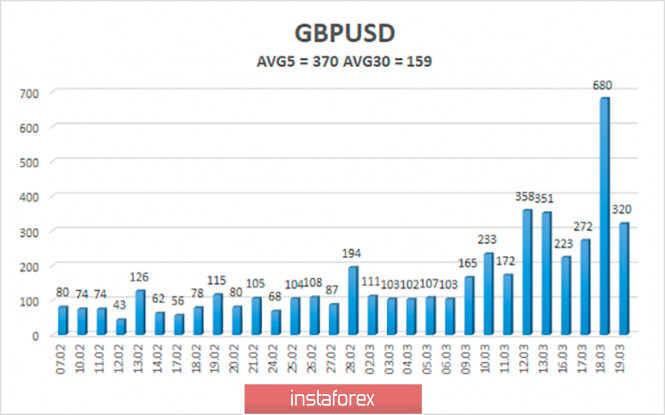

The average volatility of the pound/dollar pair over the past 5 days is already 370 points and continues to grow. The last two trading days were absolutely record-breaking for the pound – exactly 1000 points were passed in total… For two days… With that in one direction. On Friday, March 20, we expect the pair to move within the volatility channel of 1.1155-1.1895. This pair is likely to return to the lower border, but there are also small hopes for a correction.

Nearest support levels:

S1 – 1.1475

S2 – 1.1230

Nearest resistance levels:

R1 – 1.1719

R2 – 1.1963

R3 – 1.2207

Trading recommendations:

The GBP/USD pair has started a long-awaited correction. Thus, sales of the pound with the targets of 1.1230 and 1.1155 are still relevant, but it is recommended to open new sell positions after the Heiken Ashi indicator turns down. It is recommended to buy the British pound with the target of 1.2451, but not before fixing the price above the moving average line, which is not expected in the near future for obvious reasons (the price is too far from the moving average). We remind you that in the current conditions, opening any positions is associated with increased risks.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI – blue line in the indicator window.

Moving average (20; smoothed) – blue line on the price chart.

Murray levels – multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

The material has been provided by InstaForex Company – www.instaforex.com