The pound fell below 1.5800

Euro

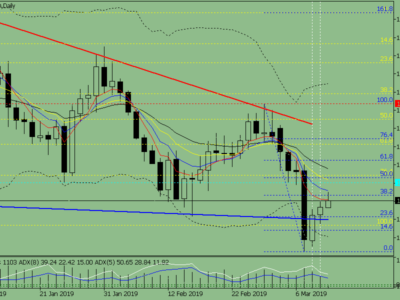

The European currency has fallen against the dollar. The German manufacturing sector indicators have grown and the services indicators have decreased, but the euro area business activity indicators recorded improvement in both areas – the PMI manufacturing index rose up to 50.8 from 50.1 while the service sector rose up to 51.9 after 51.1.

The euro continued to be sold off and this did not allow for it to consolidate above the resistance of 1.2500-1.2520. Being under pressure, it returned below this level, falling to the support near 1.2405-1.2425. This support was also broken and the pair tested the resistance level of 1.2330-1.2350.

The support levels are 1.2330-1.2350, and the resistance levels are 1.2425-1.2445.

MACD is in a neutral territory.

Trading recommendations

The current support breakthrough may lead to a decrease to 1.2440-1.2400. A rise above 1.2500-1.2520 will signal a “bottom” formation and the development of a potential upward correction.

Pound

The British pound fell against the dollar. The Bank of England financial stability report showed that the oil prices decrease is positive for the UK economy. The stress tests results of the largest UK banks have been assessed as satisfactory. The pair GBP/USD returned back to the support near 1.5630-1.5650 broke it through and fell below the level of 1.5580-1.5600 that significantly reduces the chances for a further upward correction.

The support levels are 1.5510-1.5530, and the resistance levels are 1.5580 – 1.5600.

MACD is in a neutral territory.

Trading recommendations

If the pound is able to consolidate above the current support, then we can expect the next 1.5710-1.5730 test. Its breakthrough will open the way to the resistance near 1.5800-1.5820. The support loss will increase to the level of 1.5460-1.5480 breakthrough risks.

Yen

Earlier the Japanese yen continued to strengthen against the dollar and other currencies amid the continuing desire to move away from risk. The Japan’s stock market showed the optimism decline – the Nikkei index has fallen by more than 2%. The dollar/yen fell to 116.05-116.25 and after its testing returned back to the resistance near 118.15-118.35.

The support levels: 115.95-116.15, and the resistance levels: 118.15-118.35.

The MACD indicator is in a negative territory.

Trading recommendations

The loss of 115.95-116.15 support will lead to a decrease to 114.00-114.20. The US inflation data and the FOMC/the Fed press conference results can greatly affect the pair dynamics.