Quiet Asian markets as Lunar New Year holidays begin, dollar bounces

The second week of February started quietly as many markets were closed in Asia. Hong Kong, China and Singapore markets were all shut for the Chinese new year holiday. The calendar is also light across Europe on Monday.

There will likely be some consolidation in currency pairs as markets digest last Friday’s all-important US nonfarm payrolls report.

There was a marked slowing in the rate of job creation in the US after the surge seen late last year. Despite the unemployment rate falling to an eight-year low of 4.9% , nonfarm payrolls showed the US economy added 151,000 jobs in January.

But despite the lower figure, this is still a robust rate of employment growth, and a trend strong enough to keep bringing unemployment down. Furthermore, December’s numbers had in part reflected stronger than usual construction sector hiring due to unseasonably warm weather.

The tightening labour market is expected by the Fed to drive a wage growth revival; and wages rose 0.5% during the month, though annual pay growth remains a somewhat disappointing 2.5%.

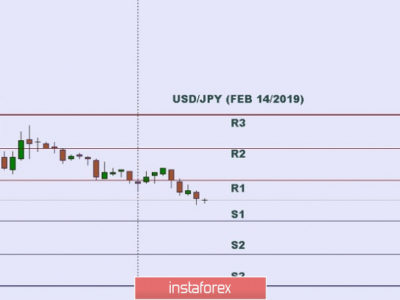

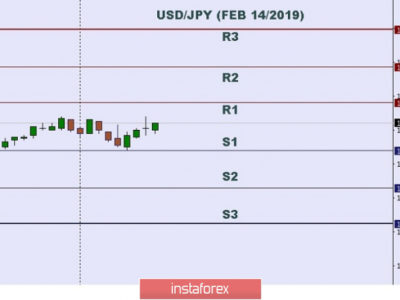

The uptick in wage growth however helped give the dollar a bounce. Today, the greenback was up against the yen. The Japanese currency is now 0.5 per cent weaker at Y117.44 per dollar, and has steadily been losing ground through the Asian trading session as the Tokyo Nikkei is up 1.5 per cent.

The post Quiet Asian markets as Lunar New Year holidays begin, dollar bounces appeared first on FXTM Blog.

Source:: Quiet Asian markets as Lunar New Year holidays begin, dollar bounces