A Review of the Fed Minutes and the CPI Numbers

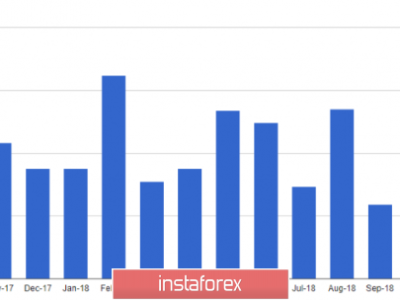

Yesterday, the Labor department released the consumer prices data for the month of March. The data showed that consumer prices eased during the month, with gasoline being the main contributor. The data showed that consumer prices dropped by 0.1%. This was the first and largest drop in consumer prices since May 2017. This was against what the 0.2% gain investors had expected. On an annualized basis, the consumer prices rose by 2.4% which was the largest annual gain in a year. It followed a 2.2% increase in February

On the other hand, core CPI rose by 0.2%. This CPI excludes food and energy components that are considered volatile. On an annualized basis, the core CPI rose by 2.1%, which was the largest gain since February 2017. This reading is now higher than the 1.8% increase of the past ten years. It had increased by 1.8% in February. The reading yesterday on the core CPI was in line with what investors were expecting.

While the CPI numbers are important, the Federal Reserve officials track a different number. They prefer the personal consumption expenditure price excluding food and energy. This figure has always been below the target 2.0% since 2012.

Meanwhile, the Fed released the minutes of the previous meeting yesterday. The minutes showed that there was consensus among the Fed officials about the pace of rate hikes. The officials had a consensus that the economy was improving, aided by increased consumer and business spending. The spending was brought about by a tightening labor force and increasing wages.

However, they were all cautious about the recent talk of tariffs and the impacts that a trade war would have. There were also some members who believed that the committee should wait before implementing further hikes. The committee also considered changing the language for the next committee meeting from the accommodative policies we have been used to, to a neutral or restraining tone. The change in tone / language would mean that the committee will be moving from its supporting role that happened after the crisis, to one checking on growth.

The minutes also showed the basis for the recent Fed rate hike. The consensus among economists is that the Fed could have two more hikes this year, one in March, and another one in September.

The committee also boosted the growth outlook for the economy from 2.7% in 2018 and 2.4% in 2019. In December, the committee’s projections for growth was 2.5% this year and 2.1% next year. The numbers announced yesterday were higher than those of the post-recession averages. The reasons for increased optimism were the tax reform package passed by the republicans and the recently-passed $1.3 trillion omnibus spending bill.

As mentioned above, they had issues with the administration’s stance on tariffs. They were concerned that the escalation with China would have some impacts on growth. However, they did not believe that the steel and aluminum tariffs announced earlier would have major impacts on the economy.

The post A Review of the Fed Minutes and the CPI Numbers appeared first on Forex.Info.