Slow-moving action seen on the Euro, 4hr demand area still not proven.

Price action confirmation: simply means traders will likely wait for price action to confirm a level by consuming the opposing supply or demand area, then entering a trade on a possible retracement, this may occur on the lower timeframes also.

Pending orders: means pending orders are likely seen.

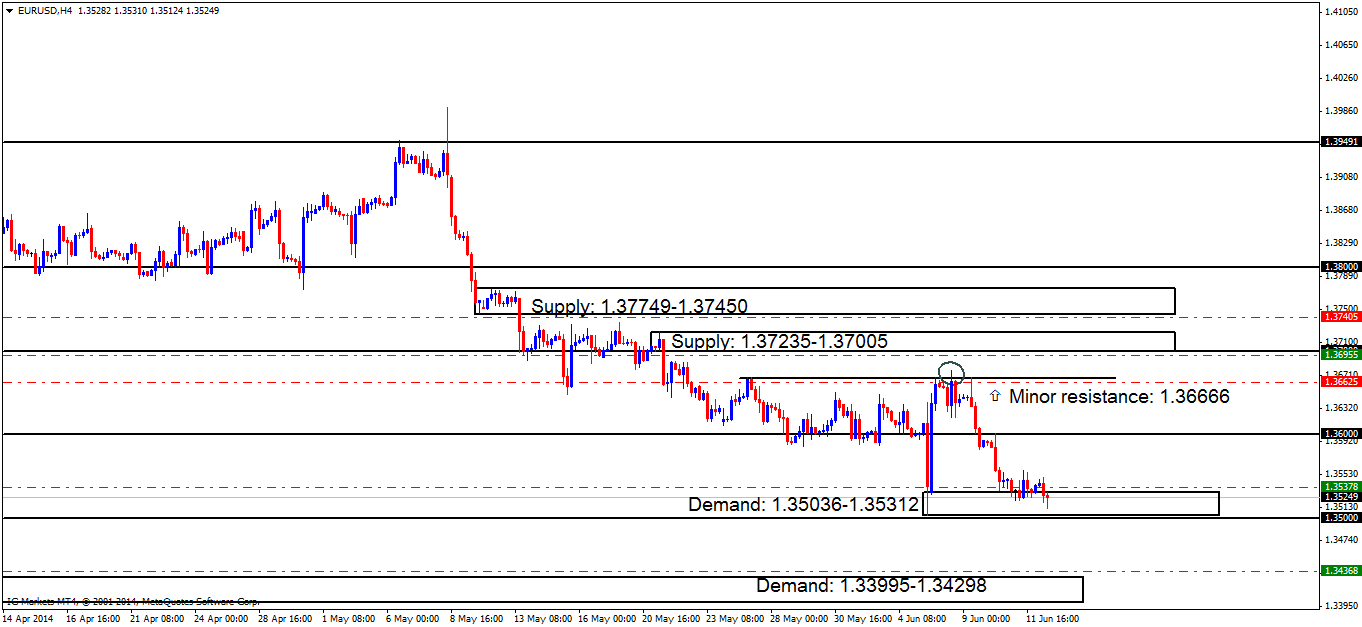

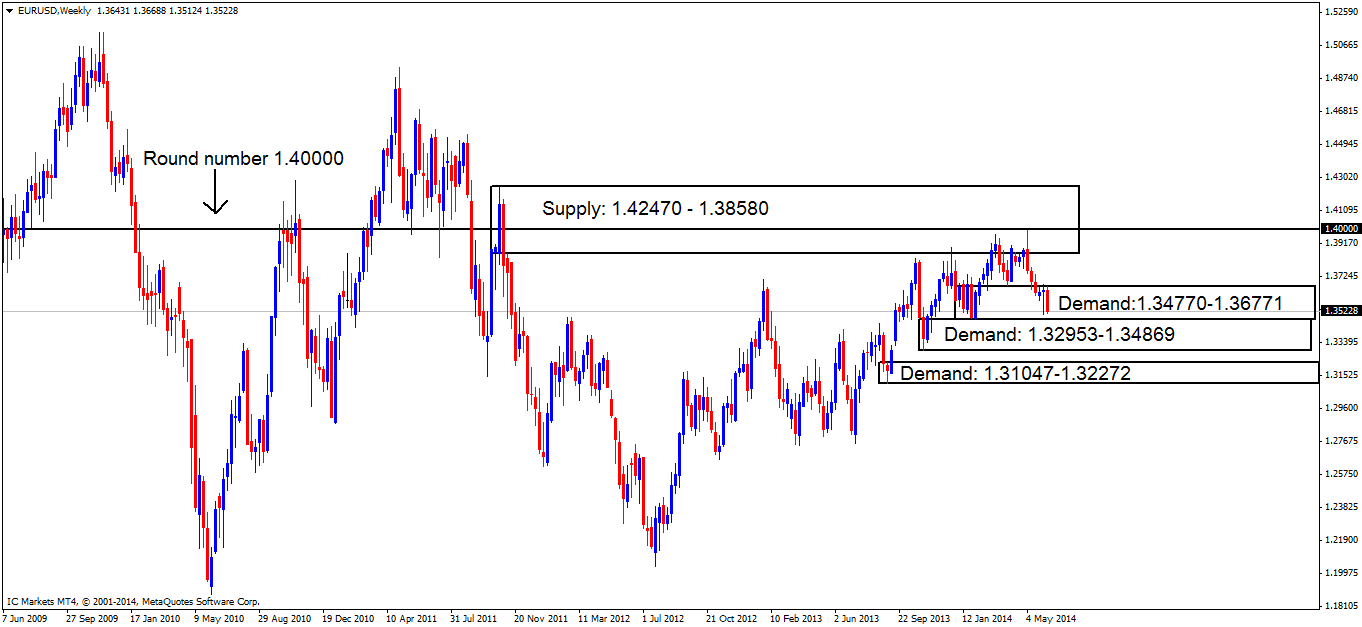

EUR/USD:

Weekly TF.

Weakness is being seen within the weekly demand area at 1.34770-1.36771, with buyers showing very little interest at the moment.

Daily TF.

The daily demand area seen at 1.34770-1.35557 is the last logical area on this timeframe left within the weekly demand area (shown above), if a break of this area is seen, expect buyers to come into the market around demand below at 1.33995-1.34385.

4hr TF.

Technically, not a lot has changed since the last analysis. The demand area at 1.35036-1.35312 is still holding, a break below here could be bad news for anyone who is currently long the market. If a break below is seen here, the next fresh demand area on this timeframe is seen at 1.33995-1.34298 where pending buy orders are likely sitting.

However, with all things considered, we should not totally rule out this demand area (1.35036-1.35312) just yet, as a spike below to the round number 1.35000 may likely happen, this could give pro money the liquidity they need for higher prices to be seen i.e. Buyers’ stops (sell orders), and breakout sellers’ orders for them to buy into.

Pending/P.A confirmation orders:

- The Pending buy order (Green line) seen at 1.35378 just above demand at 1.35036-1.35312 is currently active, so keep a close eye on the first target area (reported below).

- New pending buy orders are seen around demand (1.33995-1.34298) at 1.34368. This demand area will more than likely see some sort of reaction due to its location seen to the left.

- Pending sell orders (Green line) seen at 1.36955 just below supply at 1.37235-1.37005 are set here since this level remains untouched, meaning unfilled orders are likely still set around this area.

- P.A confirmation sell orders (Red line) are seen higher up at 1.37405 just below supply at 1.37749-1.37450, this level requires confirmation because of how close the supply areas (levels above) are together, thus making a logical target area unavailable.

- P.A confirmation sell orders are visible below the minor resistance 1.36666 at 1.36625, this level has proved valid, but still needs to be confirmed due to a spike seen on Friday (circled) which may have consumed most of the sellers originally there. Do be on your guard with these sell orders; the higher-timeframes are indicating that higher prices may be seen this week.

- Areas to watch for buy orders: P.O: (Active) 1.35378 (SL: 1.34971 TP: [1] 1.36000 [2] 1.36666) 1.34368 (SL: 1.33926 TP: Dependent on how price action approaches the zone). P.A.C: No P.A confirmation buy orders are seen in the current market environment.

- Areas to watch for sell orders: P.O: 1.36955 (SL: 1.37270 TP: [1] 1.36666 [2] 1.36000) P.A.C: 1.37405 (SL: More than likely at 1.37791 TP: Dependent on where price ‘confirms’ the level) 1.36625 (SL: 1.36810 TP: Dependent on where price ‘confirms’ the level).

- Most likely scenario: The demand area at 1.35036-1.35312 will likely still see a bullish reaction, nevertheless, a spike lower may be seen to the round number at 1.35000 before higher prices are seen.

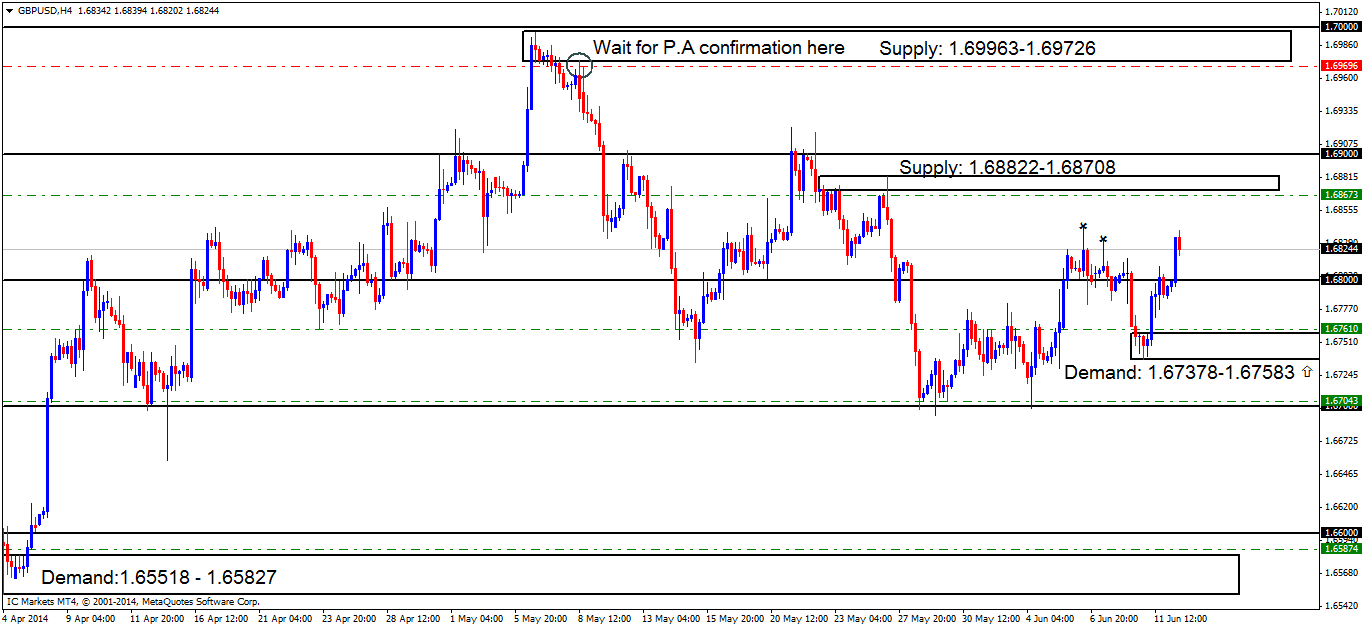

GBP/USD:

4hr TF.

The round number 1.68000 has been well and truly consumed; sellers did try to fight back around this price level, but were unable to cope with the onslaught of buying pressure thrown at them.

A new near-term demand area has been formed at 1.67378-1.67583. This demand area looks particularly tasty because price has likely consumed any selling pressure above at the highs (1.68324/1.68419) each marked with an x. So, if price does manage to retrace to our demand area, a nice reaction is likely to be seen.

Price is now currently capped between supply above at 1.68822-1.68708 and the demand area just mentioned above.

Pending/P.A confirmation orders:

- Pending buy orders (Green line) are seen below (1.65874) just above demand at 1.65518-1.65827. This area shows great potential as the momentum away from the base indicates unfilled orders may still be in play.

- The next set of pending buy orders (Green line) are seen just above the round number 1.67000 at 1.67043, this area will likely see a reaction due to the amount of credible touches this level has seen, making it an area to watch out for.

- Near –term pending buy orders are seen at 1.67610 just above demand at 1.67378-1.67583. A pending order is valid here since there is a likely possibility sellers have been consumed above at the highs (1.68324/1.68419) clearing the path for higher prices, therefore, if a retracement is seen to our demand area, buyers will likely be active here.

- Pending sell orders (Green line) are visible below supply (1.68822-1.68708) at 1.68673 due to strong momentum away from this area, indicating unfilled orders may still be hiding there.

- P.A confirmation sell orders (Red line) are seen at 1.69696 just below supply at 1.69963-1.69726. The reason this level requires confirmation is due to the wicks spiking the area as price left the base (circled) warning us sellers may have already been consumed.

- Areas to watch for buy orders: P.O: 1.65874 (SL: 1.65472 TP: Dependent on approaching price action nearer the time) 1.67043 (SL: 1.66527 TP: [1] 1.68000 [3] 1.68708) 1.67610 (SL: 1.67345 TP: [1] 1.68000 [2] 1.68708. P.A.C: No P.A confirmation buy orders are seen in the current market environment.

- Areas to watch for sell orders: P.O: 1.68673 (SL: 1.68846 1 TP: 1.68000 but may be subject to change). P.A.C: 1.69696 (SL: More than likely will be at 1.70030 TP: Dependent on where price ‘confirms’ the level).

- Most likely scenario: Price will likely see a decline in value, consuming the round number 1.68000 towards demand at 1.67378-1.67583 where a reaction will more than likely be seen.

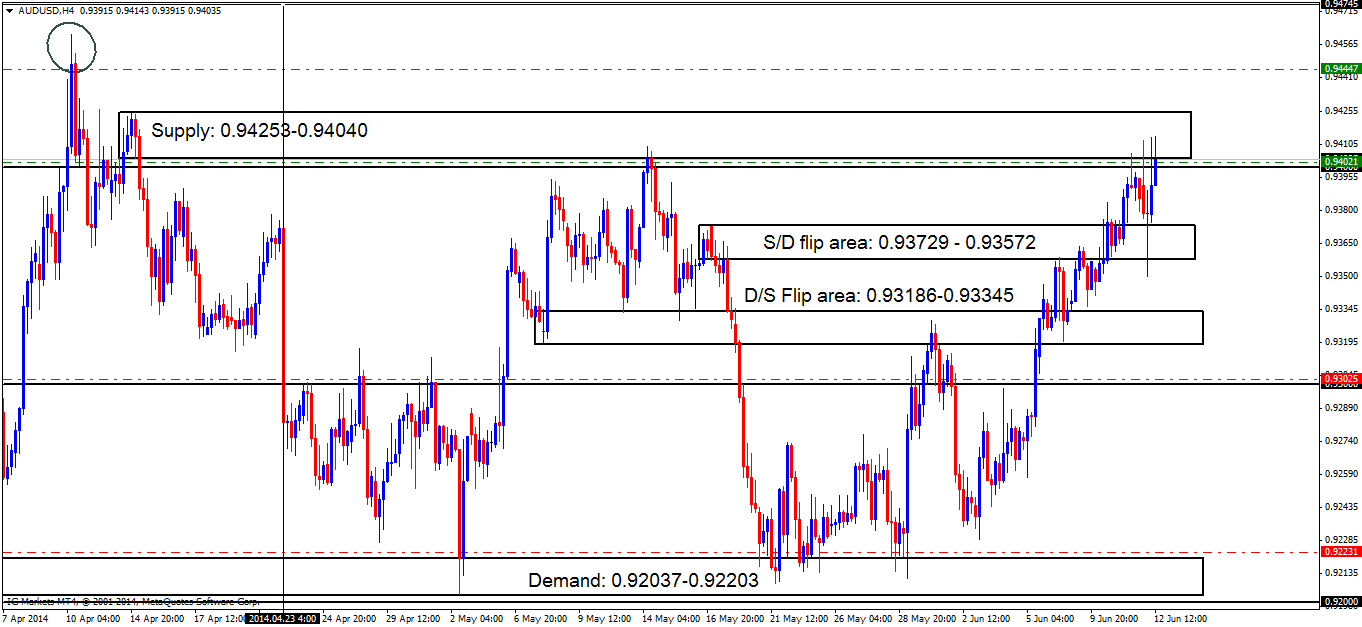

AUD/USD:

4hr TF.

Price, so far, has reacted fairly well to our supply area at 0.94253-0.94040, be that as it may, the round number seen just below at 0.94000 likely added extra resistance to the trade.

Price will likely still see lower prices from around this area, so do not go closing your positions just because the first target area has been hit (reported below), as do not forget we are currently trading in and around higher timeframe supply both on the weekly timeframe (0.93718) and on the daily timeframe (0.94468-0.93758).

Price is now currently capped between supply above at 0.94253-0.94040 and demand below (S/D flip area) at 0.93729-0.93572). A break above supply could force price to test the highs marked with a circle at around 0.94474, conversely, a break below could see price testing the D/S flip area at 0.93186-0.93345.

Pending/P.A confirmation orders:

- No pending buy orders are seen in the current market environment.

- P.A confirmation buy orders (Red line) are seen at 0.92231 just above demand at 0.92037-0.92203. It would be too risky to set a pending order around this area, since deep spikes into this demand zone have been seen (levels above) possibly consuming the majority of buyers in the process.

- The next set of P.A confirmation buy orders (Red line) are visible just above the round number 0.93000 at 0.93025. We require confirmation of this level because previous price action has warned us deep tests both north and south happen on a regular basis, hence the need to wait for confirmation rather than getting stopped out time after time through lack of patience.

- The pending sell order (Green line) set just below supply (0.94253-0.94040) at 0.94021 is now active; with our first target being hit at 0.93729. The trade will remain active with the stop-loss order set in its original position at 0.94277.

- New pending sell orders are seen at 0.94447, if price manages to get up to this level, active sellers are likely waiting because of how quickly price changed in direction, only pro money have the account size to do this, indicating unfilled sell orders may still be set there.

- No P.A confirmation sell orders are seen in the current market environment.

- Areas to watch for buy orders: P.O: No pending orders are seen with current price action. P.A.C: 0.92231 (SL: more than likely will be at 0.91984 TP: Decided if/when price ‘confirms’ the level) 0.93025 (SL: Dependent on where price ‘confirms’ the level TP: Dependent on where price ‘confirms’ the level).

- Areas to watch for sell orders: P.O: (Active – 1st target hit, trade still live) 0.94021 (SL: 0.94277 TP: [1] 0.93345 [2] 0.93000) 0.94447 (SL: 0.94667 TP: Dependent on how price action approaches the area). P.A.C: No P.A confirmation sell orders seen in the current market environment.

- Most likely scenario: Price will likely see more of a decline from supply at 0.94253-0.94040 to at least 0.93345. If price breaks the supply area just mentioned, look for sellers to come into the market around the highs at 0.94474.

USD/JPY:

4hr TF.

Overall, not much has changed since the last analysis, price still remains capped between supply above at 103.055-102.742 and demand below at 101.427-101.660.

The small area marked with an arrow at 102.367 is where pro money possibly made a decision to bring prices lower, consuming the minor S/R flip area (102.117) and the round number 102.000, so, this is a strong area of interest for us in the near-term future.

Pending/P.A confirmation orders:

- Pending buy orders (Green line) are seen just above demand (101.427-101.660) at 101.679, as this demand remains fresh and likely still holds unfilled orders.

- No P.A confirmation buy orders are seen in the current market environment.

- Pending sell orders (Green line) are visible at 102.980, deep within supply (103.055-102.742), this area may well appear to be weak now, but the way price reacted at the circled area within supply indicates pro money activity, meaning sell orders may be left unfilled there, so a pending order is permitted.

- New near-term pending sell orders are seen at 102.367. A pending order is valid here since this is the area where pro money made the ‘decision’ to take prices lower, unfilled sell orders were likely left there in the process.

- No P.A confirmation sell orders are seen in the current market environment.

- Areas to watch for buy orders: P.O:101.679 (SL: 101.404 TP: [1] 102.000 [2] 102.742 but may be subject to change) P.A.C: No P.A confirmation buy orders seen in the current market environment.

- Areas to watch for sell orders: P.O: 102.980 (SL: 103.108 TP: 102.117, but may well change if the market sees any developments) 102.367 (SL: 102.458 TP: Dependent on how price action approaches this area). P.A.C: No P.A confirmation sell orders seen in the current market environment.

- Most likely scenario: Price will likely see a rally towards the decision point marked with an arrow at 102.367 where active sellers are possibly waiting. Following this, price will likely drop to fresh demand at 101.427-101.660.

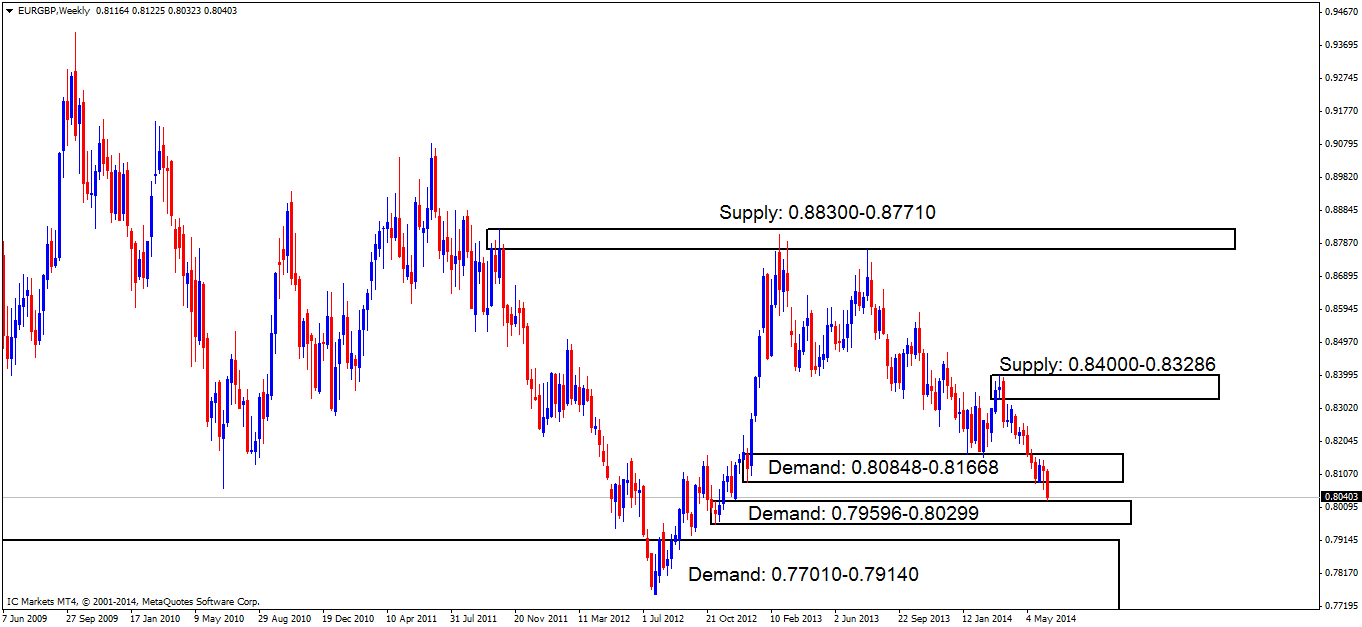

EUR/GBP:

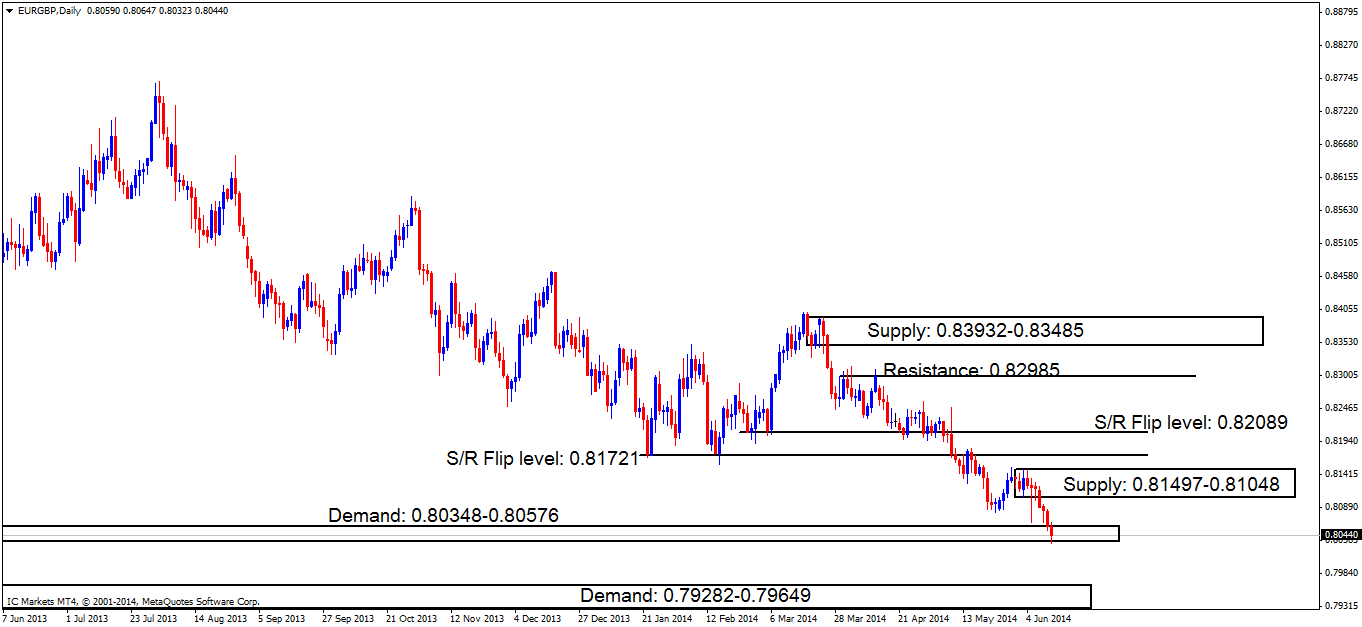

Weekly TF.

A quick update of the weekly timeframe shows that demand at 0.80848-0.81668 has well and truly been consumed. Price is now seen slightly reacting off of demand at 0.79596-0.80299.

Daily TF.

The daily timeframe shows price has spiked demand at 0.80348-0.80576, consuming most of the buyers in and around this area, if we see a positive close below here; the next demand area is seen at 0.79282-0.79649. But do keep in mind; we are currently touching weekly demand as shown above at 0.79596-0.80299, so higher prices are expected.

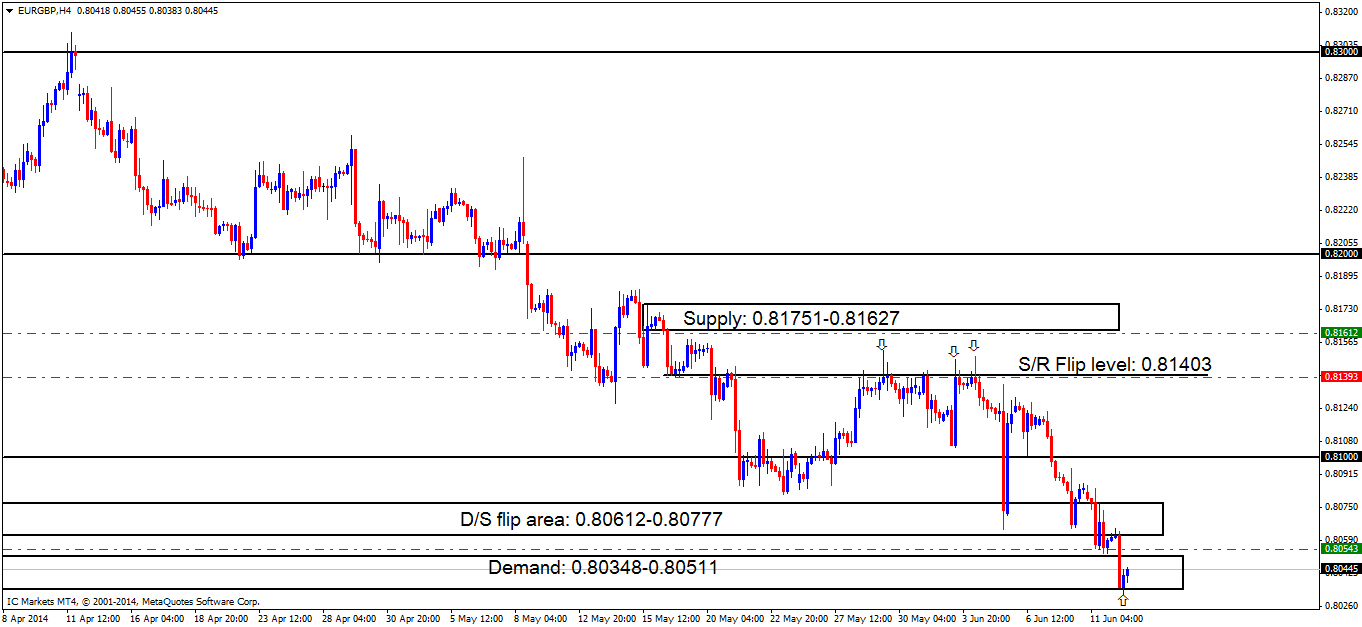

4hr TF.

Chart 1 below shows our pending buy order at 0.80543 was filled, but then very shortly after stopped out marked with an arrow. It seems the sellers at the D/S flip area (0.80612-0.80777) were too strong for buyers on this occasion.

Chart 1:

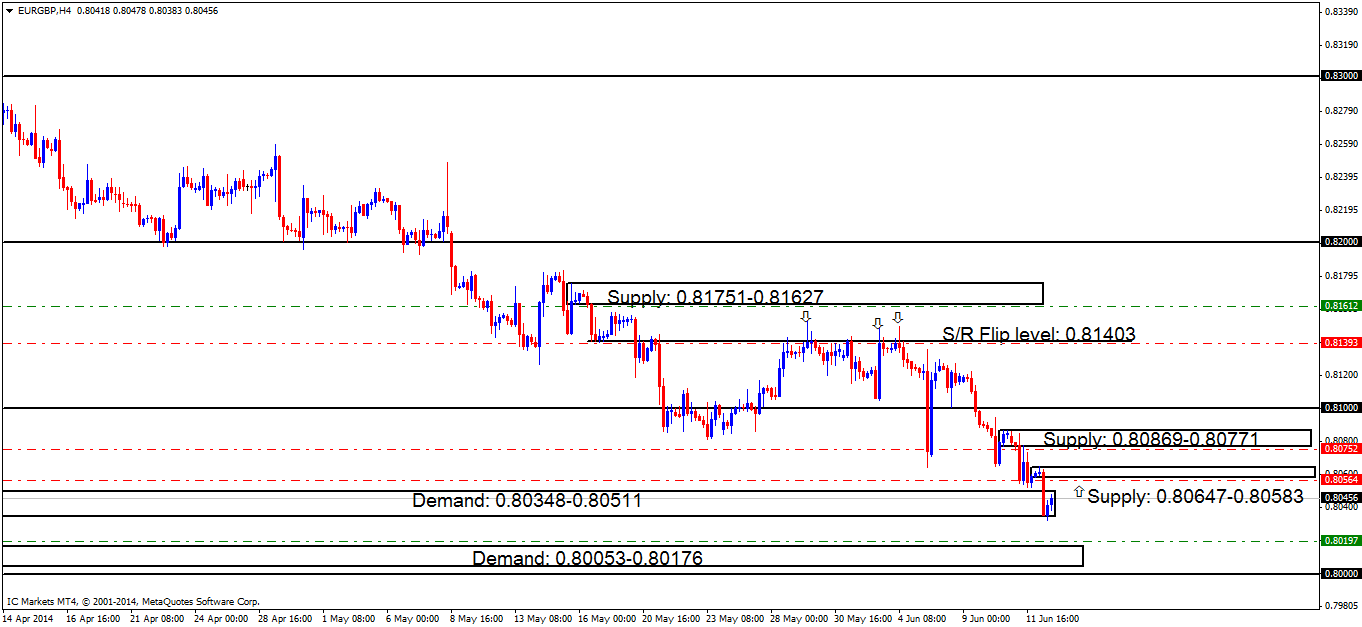

Chart 2 below shows two stacked supply areas with the highest being seen at 0.80869-0.80771, and the lowest seen at 0.80647-0.80583. Although these supply areas look quite good, we have to be very careful here as price could very easily consume these levels as we are currently trading at weekly demand (0.79596-0.80299) as shown above. If price does continue lower however, the next demand area is seen just above the huge round number 0.80000 at 0.80053-0.80176.

Pending/P.A confirmation orders:

- The pending buy order (Green line) set at 0.80543 just above demand (0.80348-0.80511) was filled and then stopped out within a pip! (Chart 1 shown with an arrow).

- New pending buy orders are seen just above demand (0.80053-0.80176) at 0.80197. A pending order is valid here due to price currently trading around the base of weekly demand at 0.79596-0.80299.

- No P.A confirmation buy orders are seen in the current market environment.

- Pending sell orders (Green line) are spotted just under fresh supply (0.81751-0.81627) at 0.81612 due to the area being fresh giving the impression orders may still remain unfilled there.

- P.A confirmation sell orders (Red line) under the S/R flip level 0.81403 at 081393 is an area where a reaction is likely, however there were too many wicks north seen marked with arrows, indicating sellers are drying up, thus, the need to wait for more confirmation.

- New P.A confirmation sell orders are seen just under supply (0.80647-0.80583) at 0.80564. The reason a pending order is not valid here is because price is trading around a weekly demand area (0.79596-0.80299), which means price could easily consume this supply level as the higher timeframes usually overrule the lower timeframes.

- New P.A confirmation sell orders are seen just under supply (0.80869-0.80771) at 0.80752. Confirmation orders were used here because price is trading around a weekly demand area (0.79596-0.80299), which means price could easily consume this supply level as the higher timeframes usually overrule the lower timeframes.

Chart 2:

- Areas to watch for buy orders: P.O:0.80197 (SL: 0.79959 TP: Dependent on how price action approaches the area) P.A.C: No P.A confirmation buy orders seen in the current market environment.

- Areas to watch for sell orders: P.O: 0.81612 (SL: 0.81784 TP: [1] 0.81403 [2] 0.81000) P.A.C: 0.81393 (SL: Will be likely set at 0.81564 TP: Will be likely set at the round number 0.81000) 0.80752 (SL: likely to be set at 0.80900 TP: Dependent on where price ‘confirms’ the level) 0.80564 (SL: Dependent on where price ‘confirms’ the level TP: Dependent on where price ‘confirms’ the level).

- Most likely scenario: Price will likely trade in between supply at 0.80647-0.80583 and demand at 0.80053-0.80176 during the lower volume sessions. Once volatility picks up a break of supply is more likely than demand below as we are trading at weekly demand seen at 0.79596-0.80299.

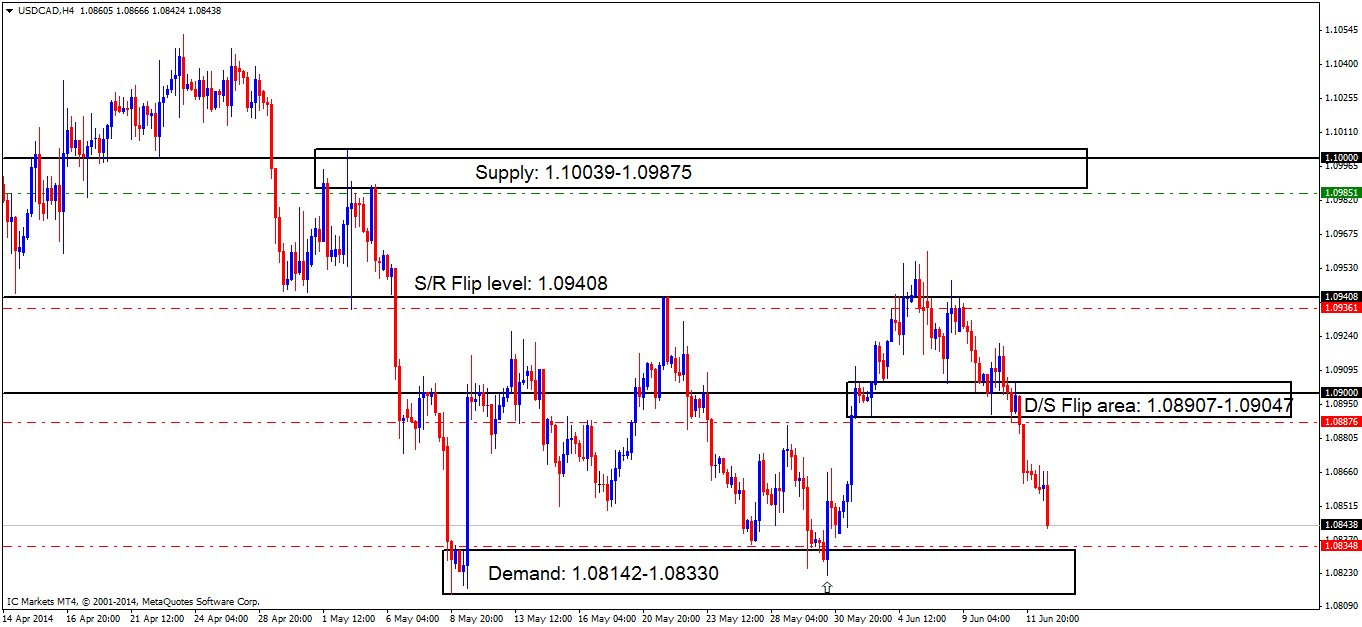

USD/CAD:

4hr TF.

In the last analysis it was reported that price would possibly continue declining until the buyers outweigh the sellers, which would likely be around the demand area at 1.08142-1.08330, where we currently have a confirmation order set at 1.08348. Sellers are certainly still in control with no sign of letting up seen yet.

Price is currently capped between supply at 1.08907-1.09047, and demand below at 1.08142-1.08330.

Pending/P.A confirmation orders:

- At the time of writing there are no pending buy orders seen.

- P.A confirmation buy orders (Red line) seen just above demand (1.08142-1.08330) at 1.08348. There may be orders left unfilled here, however, a pending order is not wise due to how deep price penetrated the level before (marked with an arrow).

- Pending sell orders (Green line) just below supply (1.10039-1.09875) at 1.09851 will very likely see a nice reaction. However, we should remain aware of the big figure number 1.10000 lurking within the top half of the supply area (levels above), so a bigger stop may be necessary.

- P.A confirmation sell orders are seen just below the S/R flip level (1.09408) at 1.09361. A P.A.C order was selected here because of the deep wicks seen in and around this area, possibly indicating sellers have been consumed, thus weakening the level on return.

- New P.A confirmation sell orders are seen just below the D/S flip area (1.08907-1.09047) at 1.08876. Pending orders are not logical here since price could very well spike north, deep into the zone, attempting to penetrate the round number 1.09000 which could possibly stop us out if we had pending orders set.

- Areas to watch for buy orders: P.O: There are no pending buy orders seen in the current market environment. P.A.C: 1.08348 (SL: Likely to be set at 1.08127 TP: Decided if/when price ‘confirms’ the level).

- Areas to watch for sell orders: P.O: 1.09851 (SL: 1.10114 TP: [1] 1.09408 [2] 1.09047) P.A.C: 1.09361 (SL likely to be set at 1.09513 TP Decided if/when price ‘confirms’ the level) 0.08876 (SL: Decided if/when price ‘confirms’ the level TP: Decided if/when price ‘confirms’ the level).

- Most likely scenario: Price will likely continue Dropping towards demand at 1.08142-1.08330, where a bullish reaction is expected to be seen.

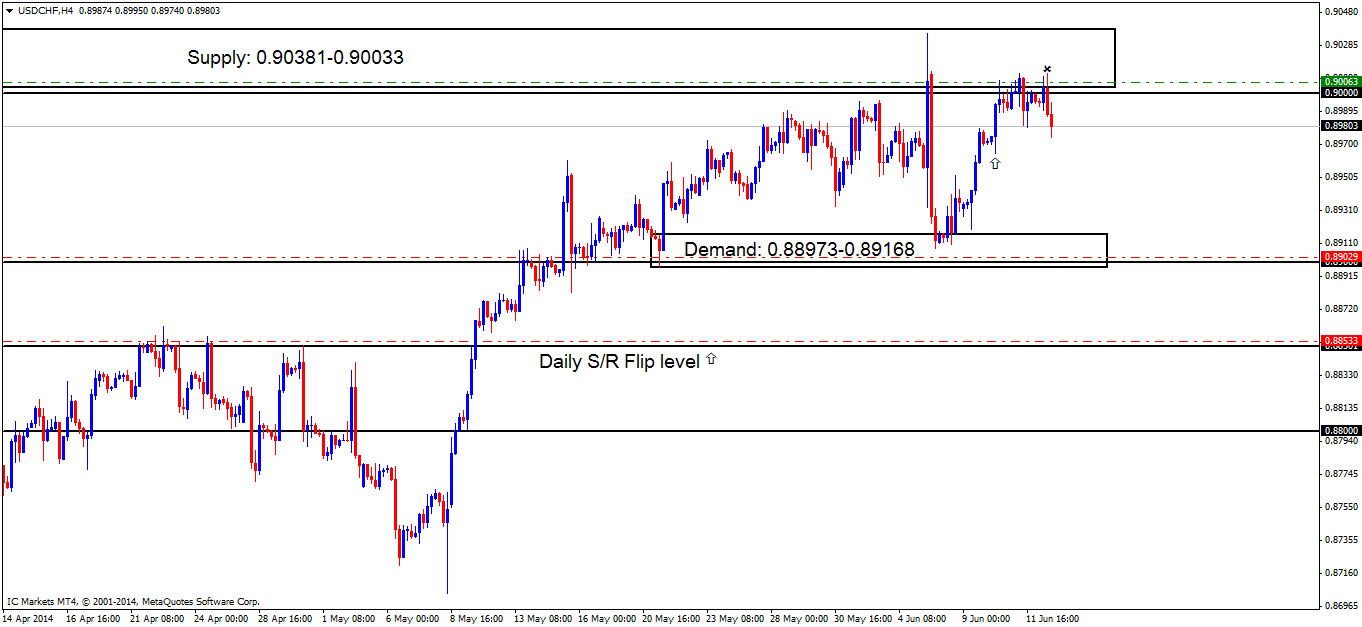

USD/CHF:

4hr TF.

Sellers are beginning to show some energy around supply at 0.90381-0.90033. A bearish engulfing candle marked with an x has been seen given us some possible indication price may be south soon. However, sellers still have to deal with temporary buyers around a trouble point at 0.89747 marked with an arrow before lower prices can be seen.

At the time of writing price seems to be temporarily capped between the trouble point below at 0.89747 and supply above at 0.90381-0.90033. A break above this supply could force price to test supply at 0.91339-0.91116 (not visible on the chart below).

Pending/P.A confirmation orders:

- There are no safe pending buy orders seen at the time of writing.

- P.A confirmation buy orders (Red line) are seen just above the daily S/R flip level (0.88501) at 0.88533. This level needs to see some confirming price action before any entry is placed in the market, due to their being no logical area for a stop loss order.

- Near-term P.A confirmation buy orders are seen within demand (0.88973-0.89168) at 0.89029, just above the round number 0.89000, as price may retrace to demand to collect unfilled orders.

- The pending sell order (Green line) visible at the base of supply (0.90381-0.90033) just above the round number 0.90000 at 0.90063 still remains active, so keep a close eye on the first target area.

- No P.A confirmation sell orders are seen in the current market environment.

- Areas to watch for buy orders: P.O: There are no pending buy orders seen in the current market environment. P.A.C: 0.88533 (SL: Decided if/when price ‘confirms’ the level TP: Decided if/when price ‘confirms’ the level) 0.89029 (SL: Likely to be set at 0.88784 TP: Decided if/when price ‘confirms’ the level).

- Areas to watch for sell orders: P.O: (Active) 0.90063 (SL: 0.90412 TP: [1] 0.89168 [2] 0.88501) P.A.C: There are currently no P.A confirmation orders seen in the current market environment.

- Most likely scenario: Sellers will likely attempt to consume the small demand area seen at 0.89747, if this happens there is very little stopping price from dropping to demand at 0.88973-0.89168.

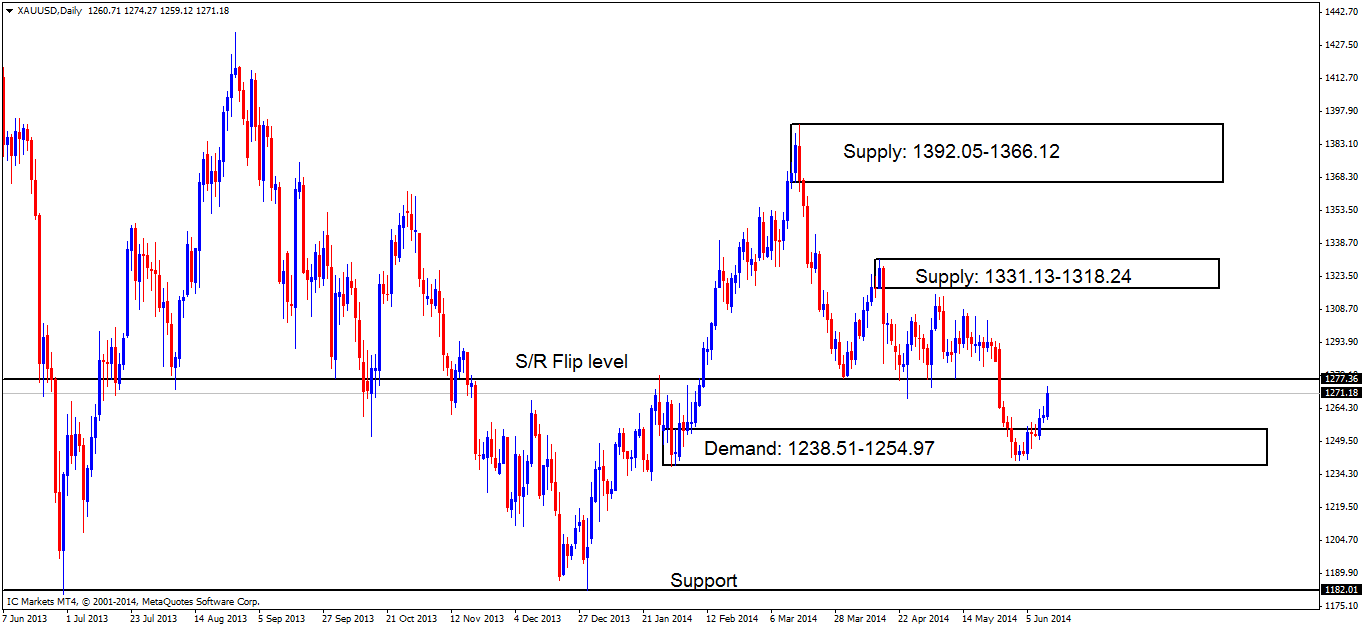

XAU/USD (GOLD)

Daily TF.

Demand has been confirmed at 1238.51-1254.97 with price rallying up to the S/R flip level seen at 1277.36.

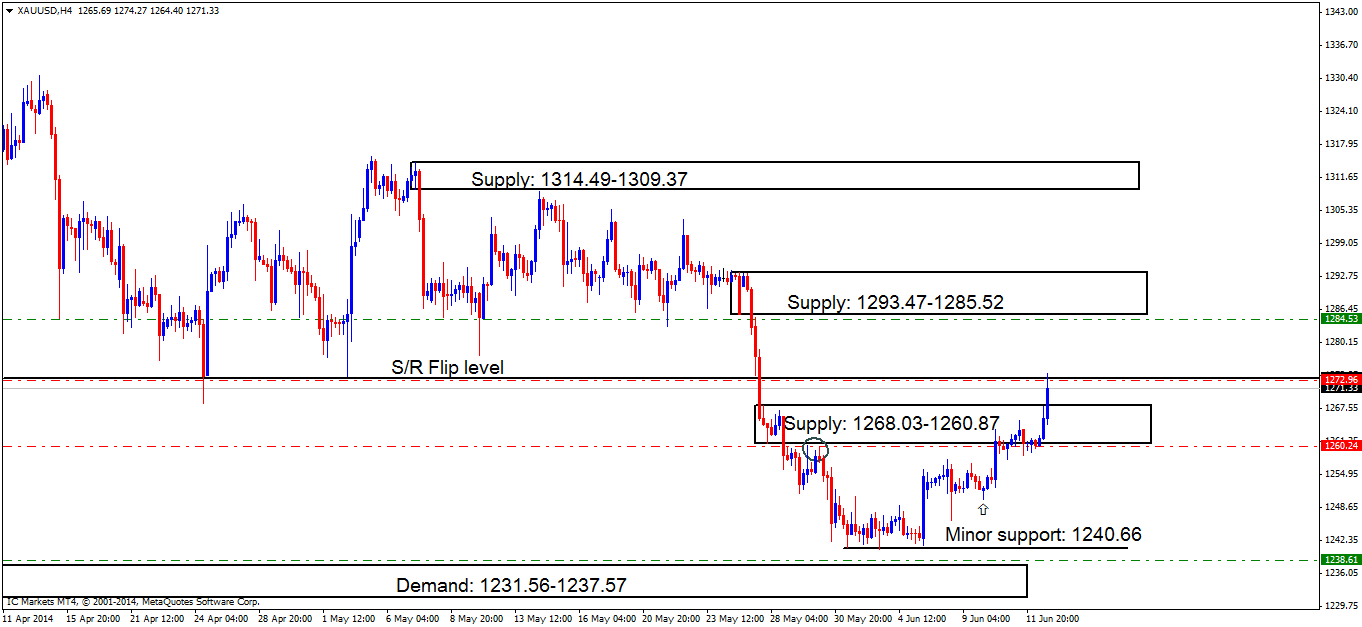

4hr TF.

Chart 1 below shows supply at 1268.03-1260.87 has been consumed which was reported may happen in yesterday’s analysis.

Chart 1:

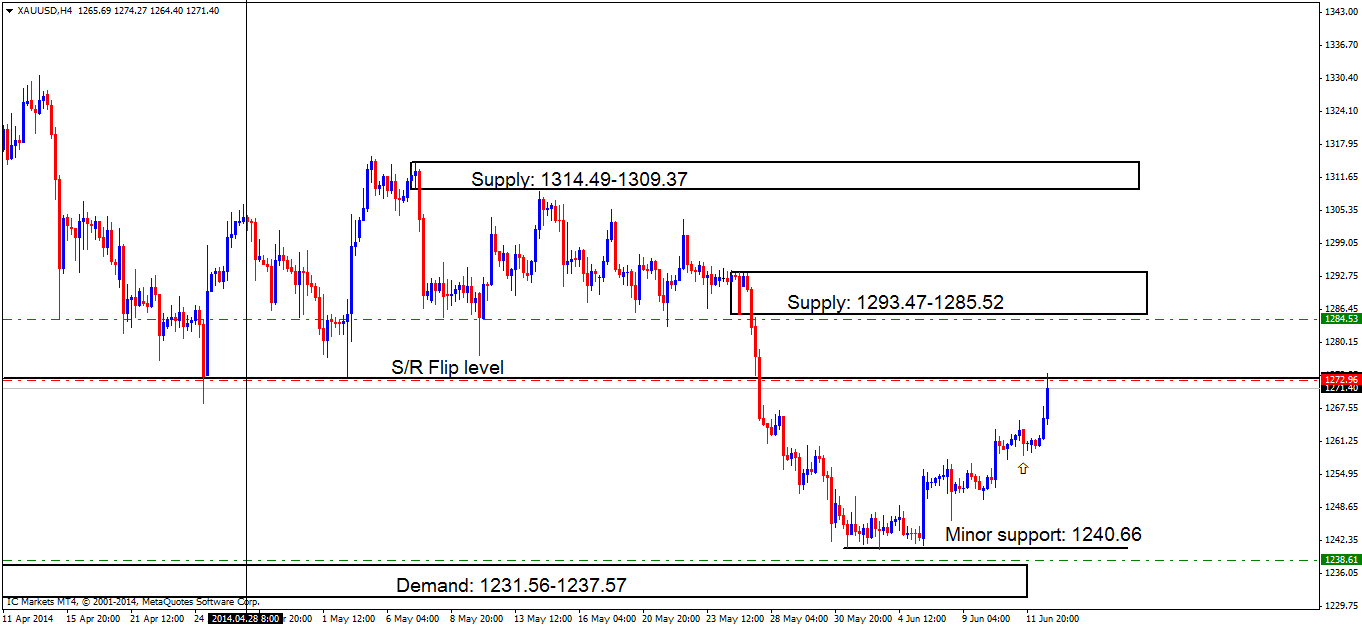

Chart 2 below shows price is slightly reacting bearishly off of the S/R flip level at 1272.96. This level will need to be confirmed by consuming the low marked with an arrow at 1258.57, before any pending order or even market order is entered into the market.

Pending/P.A confirmation orders:

- Pending buy orders (Green line) are seen above demand (1231.56-1237.57) at 1238.61 as pro money will likely fake the minor support level at 1240.66 into demand below (levels above).

- No P.A confirmation buy orders are seen in the current market environment.

- Pending sell orders (Green line) are seen just below supply (1293.47-1285.52) at 1284.53, as this level will likely see a reaction due to a supply/demand imbalance around this area indicating the possibility of unfilled sell orders there.

- The P.A confirmation sell order just under the S/R flip area (1273.34) at 1272.96 is now active. Sellers will need to confirm this level by consuming the low at 1258.57 marked with an arrow (chart 2), a pending order can then be set at 1272.96 awaiting a possible return.

- The P.A confirmation sell order (Red line) set just below supply (1268.03-1260.87) at 1260.24 has been cancelled. Price rallied too far from the confirmation level, and no attempt was made on consuming the low 1250.17 marked with an arrow as shown on chart 1.

Chart 2:

- Areas to watch for buy orders: P.O: 1238.61 (SL: 1230.64 TP: 1260.87 P.A.C: There are currently no P.A confirmation buy orders seen in the current market environment.

- Areas to watch for sell orders: P.O: 1284.53 (SL: 1294.70 TP: [1] 1273.34 [2] 1268.03) P.A.C: (Active-awaiting confirmation) 1272.96 (SL: Decided if/when price ‘confirms’ the level TP: Decided if/when price ‘confirms’ the level).

- Most likely scenario: Price will likely trade around the S/R flip level 1272.96 during the low-volume sessions, once volatility picks up a drop from this area may be seen to around the lows at 1258.57.

Source: Friday 13th June: Slow-moving action seen on the Euro, 4hr demand area still not proven.