So What Gives with Crude (Part 2..)

When we had last written about this subject matter this past March we assumed that the OPEC oil cartel was looking to undermine the US domestic effort to produce its own oil without having to import crude from other nations. According to a June, 2015 article by Forbes magazine, the number of domestic oil rigs in the United States has decreased dramatically since last October when crude prices started to fall. According to the article the numbers of active rigs in the US dropped from 1,609 last October to 635 as of June, 2015. Don’t believe me? Check the article for yourself at: http://www.forbes.com/sites/greatspeculations/2015/06/15/where-is-the-u-s-oil-rig-count-headed/

Now as a consumer I can say that this is great news for domestic spending and reduced cost of living which is all well and true but as a trader I would have to say that this makes trading crude much more challenging than we seen in quite some time. We are faced with a crude oil glut in which we haven’t seen since the 1980’s and in effect caused many rigs to be capped. At Market Tea Leaves we teach principles of Market Correlation of which crude is a major component. This past year we’ve had to change our rules concerning Market Correlation as currently there is an inverse relationship between crude and the index futures. So currently if crude rises then the markets should fall and vice versa. Prior to last October the rule of thumb was if crude rises then the markets should rise as the primary thought was “increased crude prices means an expansionary economy”. The reason being that crude was thought to run the economies as all transports were run by crude. That isn’t the case any longer. Case-in-point as a homeowner and person of property, I recently purchased a battery operated lithium ion lawnmower that doesn’t require gas or oil to operate. Tesla and hybrid powered vehicles are making strong inroads on the fossil fuel market.

Another aspect that comes into play is Iran. Recently the US and Iran have consummated a proposed deal on nuclear power. If and when that deal is approved by the US Congress all economic sanctions against Iran will be lifted which means they’ll have the ability to sell their oil on the open market. This is in turn will drive the price crude even lower and recently the price of crude is no below $50 a barrel and decreasing.

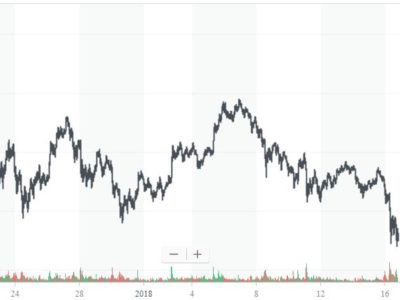

The above chart shows the price of the CL (crude) contract from October, 2014 to the present and as you can see it is decelerating rapidly. As of Friday, July 24th the September crude oil contract closed at 47.97 a barrel. The USD and crude is still reverse correlated as when the dollar rises, crude should drop and vice versa and when that doesn’t happen, it’s a sign that something’s not quite right.

So on one hand from a consumer’s perspective crude prices dropping is great on the pocketbook but from a trading point of view it makes life more challenging. Does this mean that there are no opportunities in crude? No, there are always opportunities if you’re looking for them.

Pingback: What is up with Opec?